Bitcoin and Ethereum ETFs (exchange-traded funds) recorded the best multi-week inflows within the session ending Friday, September 27. This comes amid ongoing chatter concerning the crypto market’s restoration.

With a monitor document of less-than-desirable returns in September, given it has traditionally been Bitcoin’s worst-performing month, markets anticipate higher fortunes in October because the month nears its finish.

Crypto ETFs Inflows At Multi-Week Highs

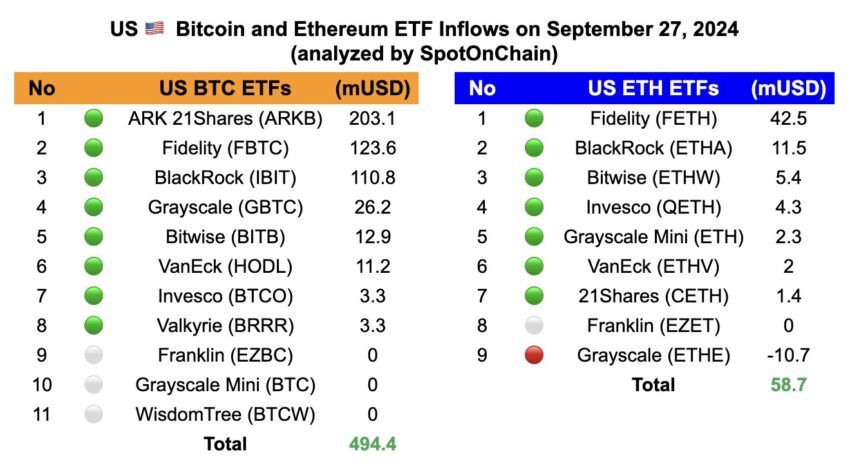

Crypto buyers purchased 7,526 Bitcoin (BTC) and 22,310 Ethereum (ETH) on Friday, leading to web inflows of $494.4 million and $58.7 million for Bitcoin and Ethereum ETFs, respectively.

Spotonchain, an on-chain insights software, reported that these inflows catapulted whole weekly flows to ranges final seen weeks in the past. Particularly, Bitcoin (BTC) ETFs recorded a complete of $1.11 billion in constructive flows, marking the biggest weekly influx since July 19.

Alternatively, Ethereum (ETH) ETFs had as much as $84.6 million in whole inflows between Monday and Friday, the biggest weekly influx since August 9.

Learn extra: How To Commerce a Bitcoin ETF: A Step-by-Step Strategy

Information from Farside Buyers corroborates the report. It reveals BlackRock’s IBIT ETF led the inflows day by day, save for Monday, the place it recorded $11.5 million, in opposition to Constancy’s FBTC, which recorded $24.9 million in constructive flows.

Since their debut within the US market in January 2024, spot Bitcoin ETFs have been a magnet for institutional buyers. They provide direct portfolio inclusion of Bitcoin, bypassing the challenges of direct buy and safe storage.

As BeInCrypto reported, greater than 1,000 institutional buyers signed on inside simply two 13F submitting durations. This highlights how the market’s response to BTC ETFs has been overwhelmingly constructive.

In the meantime, within the ETH ETF market, all issuers are struggling because the monetary instrument continues to underperform. Nonetheless, mustering constructive flows for each markets will not be simple.

It comes as buyers proceed to guess on crypto market restoration, with Bitcoin holding effectively above $65,500.

Bitcoin value energy is carefully tied to broader financial indicators that recommend an increase in liquidity. Such a turnout typically advantages Bitcoin as a consequence of its sensitivity to liquidity adjustments. For starters, China is contemplating fiscal support for its citizenry amidst a struggling financial system. Equally, the US Federal Reserve just lately reduce rates of interest, which frequently bodes effectively for risk-on belongings.

Varied economists have commented on the rising liquidity, together with macro researcher Julien Bittel.

“Liquidity is on the rise again, and Bitcoin – being extremely sensitive to changes in liquidity conditions – has the potential to move explosively as fresh liquidity flows into the system. The macro environment is shifting. A major liquidity wave is now on the horizon, and when it hits, Bitcoin looks primed for a strong push higher in Q4,” Bittel stated.

Equally, the World Cash Index (GMI) additionally reveals rising liquidity. This metric measures the quantity of cash in circulation amongst shoppers and banks.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

A rise within the GMI sometimes indicators extra funds circulating and prepared for spending. This might result in elevated Bitcoin purchases.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.