The Toncoin token remained in a bear market and was liable to forming the dreaded dying cross sample, regardless of robust on-chain metrics.

Toncoin (TON) was buying and selling at $5.81 on Monday, Sep. 30, down by over 30% from the year-to-date excessive.

Sturdy on-chain metrics

Further knowledge confirmed that the variety of on-chain activated wallets has risen to over 20.8 million, a big improve from January’s low of 1.1 million.

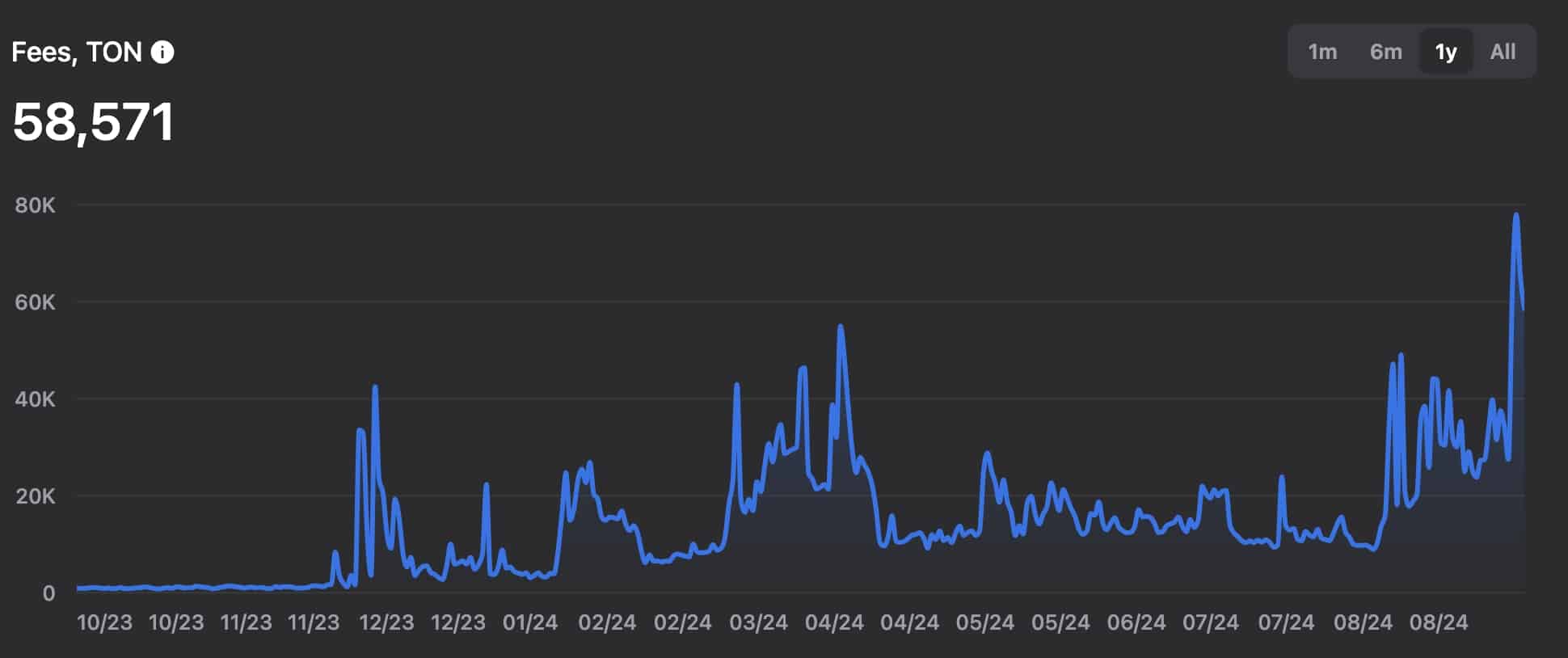

Furthermore, the variety of Toncoins burned day by day has continued to rise, reaching the year-to-date excessive of virtually 39,000. These burns have coincided with a pointy decline within the variety of minted Toncoins, which has dropped to 39,000 from this month’s excessive of over 50,000.

Function in DeFi is fading

Toncoin’s worth has doubtless retreated because of its waning position within the decentralized finance business, the place the full worth locked within the community has dropped from over $765 million in July to $427 million.

TON has moved from being a prime ten participant within the DeFi business to turning into the Twentieth-biggest chain. Smaller chains reminiscent of Core, Mode, Mantle, and Linea have surpassed it in current weeks.

Toncoin has additionally dropped due to Pavel Durov’s current arrest in France and the efficiency of its tap-to-earn tokens. Hamster Kombat, which launched its airdrop final week, has dropped by nearly 60% from its highest degree.

Equally, Notcoin (NOT) dropped by 71%, whereas Catizen (CATI) has fallen by 50% from their all-time highs. Most of all of the lately launched Telegram’s tap-to-earn tokens have dropped to document lows.

In the meantime, Toncoin’s futures open curiosity dropped to $260 million on Sep. 30, down from the year-to-date excessive of over $360 million. This determine has reached its lowest level since Sep. 12, indicating waning demand.

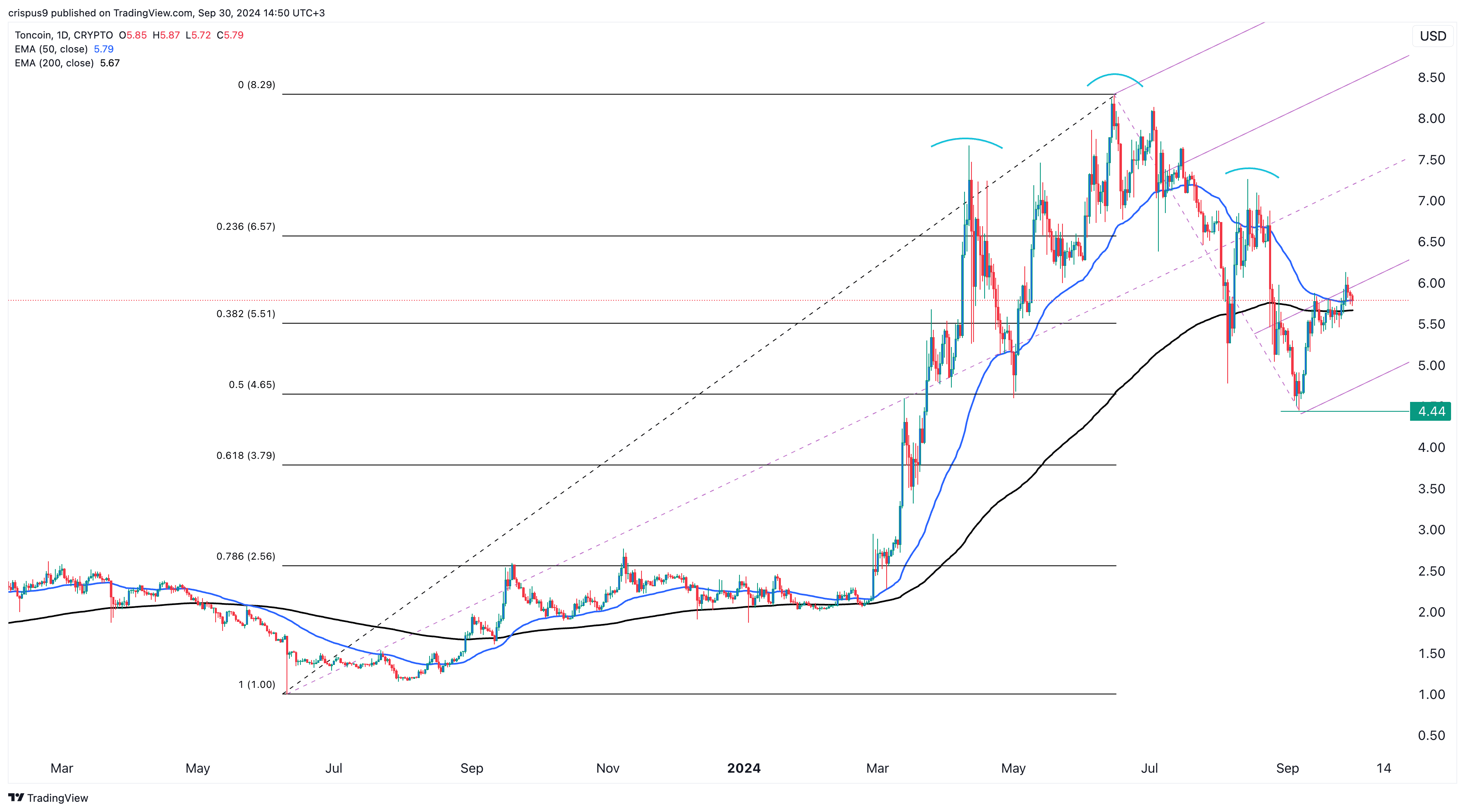

Toncoin worth evaluation

Toncoin’s token has dropped by over 30% from its year-to-date excessive, and the 50-day and 200-day Exponential Transferring Averages are near forming a dying cross sample. The final time it shaped this sample in Might of final 12 months, it resulted in a drop of over 50%.

TON has additionally shaped a head and shoulders and a rounded prime sample. It stays under the primary assist degree of the Andrew’s pitchfork instrument and the 23.6% Fibonacci Retracement degree.

Subsequently, Toncoin might have a bearish breakout to the subsequent key assist at $4.45, its lowest level in September, except it strikes above the 50-day and 200-day transferring averages.