Helium (HNT) value has been on the rise regardless of the broader market downturn. What could possibly be behind this? Though HNT is at present in an uptrend, a number of indicators counsel the power of this pattern might not be as strong because it appears.

The ADX reveals a weakening pattern, and whereas the RSI signifies there could possibly be room for additional development, the low momentum raises questions on whether or not the uptrend can maintain itself.

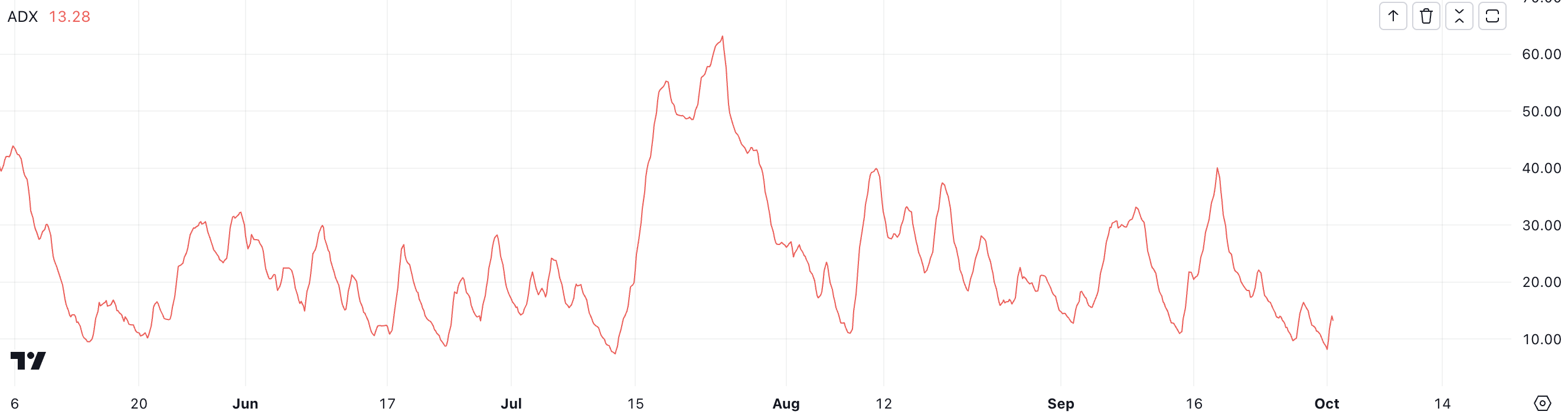

HNT ADX Reveals The Present Development Isn’t Sturdy

HNT’s ADX has dropped considerably to 13.28, down from a robust studying of 40 on September 18, signaling a serious weakening within the power of the present pattern.

The ADX (Common Directional Index) is a technical indicator that helps decide the power of a pattern, no matter its course. When the ADX is above 25, it usually signifies that the pattern is robust and more likely to proceed. Values under 20 counsel a weak or non-existent pattern.

Learn extra: Helium (HNT) Worth Prediction 2024/2025/2030

With HNT’s ADX now properly under the 20 threshold, this factors to an absence of momentum behind the present value motion. Though HNT continues to be in an uptrend, the low ADX means that the pattern lacks the required power to maintain itself.

This weak point may end result within the pattern reversing within the close to future because it turns into extra inclined to promoting stress or a shift in market sentiment. A declining ADX on this vary signifies that merchants needs to be cautious, because the uptrend might not final for much longer if momentum continues to fade.

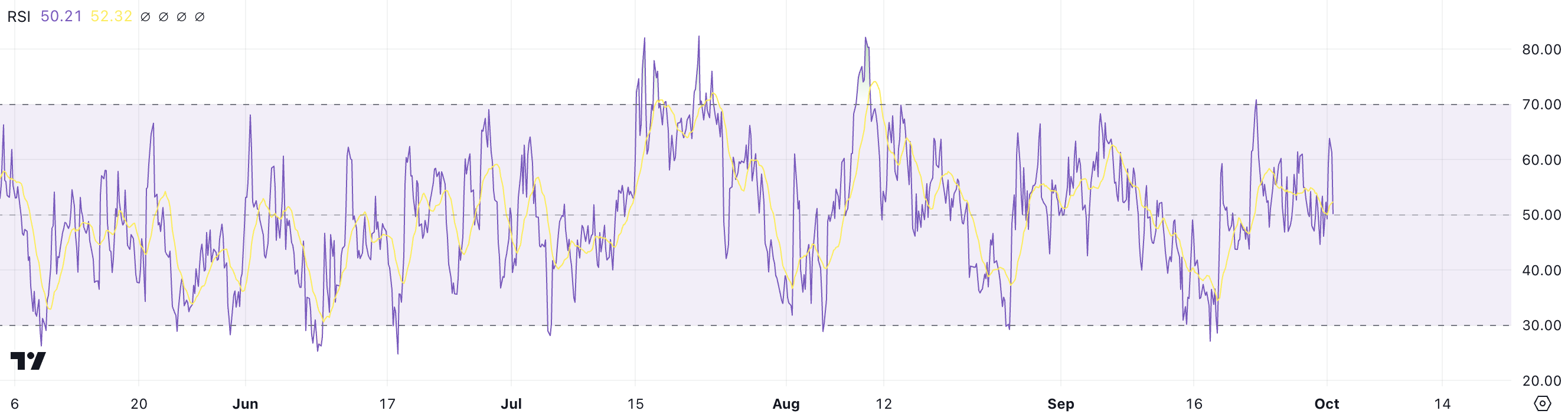

Helium RSI Reveals A Worth Enhance Potential

HNT’s RSI is at present at 50.21, which displays a impartial stance by way of market momentum. That signifies that the value is neither overbought nor oversold. The RSI (Relative Power Index) is a technical indicator that helps merchants gauge the pace and alter of value actions by measuring the magnitude of latest beneficial properties towards latest losses.

It oscillates between 0 and 100, with readings above 70 suggesting overbought circumstances — the place a value correction could be imminent. Then again, readings under 30 point out oversold circumstances — the place a rebound could also be anticipated.

With HNT’s RSI at simply over 50, the token finds itself in a balanced zone, that means there isn’t extreme stress from both consumers or sellers for the time being. This positioning leaves the door open for additional value development. That occurs as a result of the RSI has not but reached ranges that may sign an overheated market.

Provided that HNT has already proven an upward pattern with a 3.05% acquire over the past 7 days, the largest winner among the many largest DePin cash, the present RSI means that there may nonetheless be room for added value appreciation.

Then again, ADX reveals that the present pattern shouldn’t be sturdy sufficient. The stability between these two ought to is prime to trace the following steps for HNT value.

HNT Worth Prediction: Key Resistance at $8

HNT’s EMA traces are at present positioned in a bullish formation, having fashioned a golden cross on September 23. This golden cross happens when a short-term EMA crosses above a long-term EMA. That alerts the potential for a sustained upward pattern.

Nonetheless, regardless of this constructive formation, the gap between the EMA traces stays comparatively slim. That means that the pattern isn’t absolutely established or sturdy but.

The Exponential Shifting Common (EMA) is a technical indicator that tracks the typical value of an asset over time however offers extra weight to latest value actions. That makes it extra responsive to cost fluctuations than a easy transferring common.

Learn extra: What Is DePIN (Decentralized Bodily Infrastructure Networks)?

Whereas the present EMA setup factors to bullish potential, HNT has been going through resistance on the $8.00 degree, struggling to interrupt by this key barrier. If it manages to clear this resistance, it may rise to $8.70, providing a possible 10% acquire.

Nonetheless, with the ADX indicating a weak pattern, there’s an actual risk that the momentum might fade. Which means the uptrend may reverse. If this occurs, HNT’s value may drop as little as $6.30, a considerable 20% decline.

Disclaimer

In keeping with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. At all times conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.