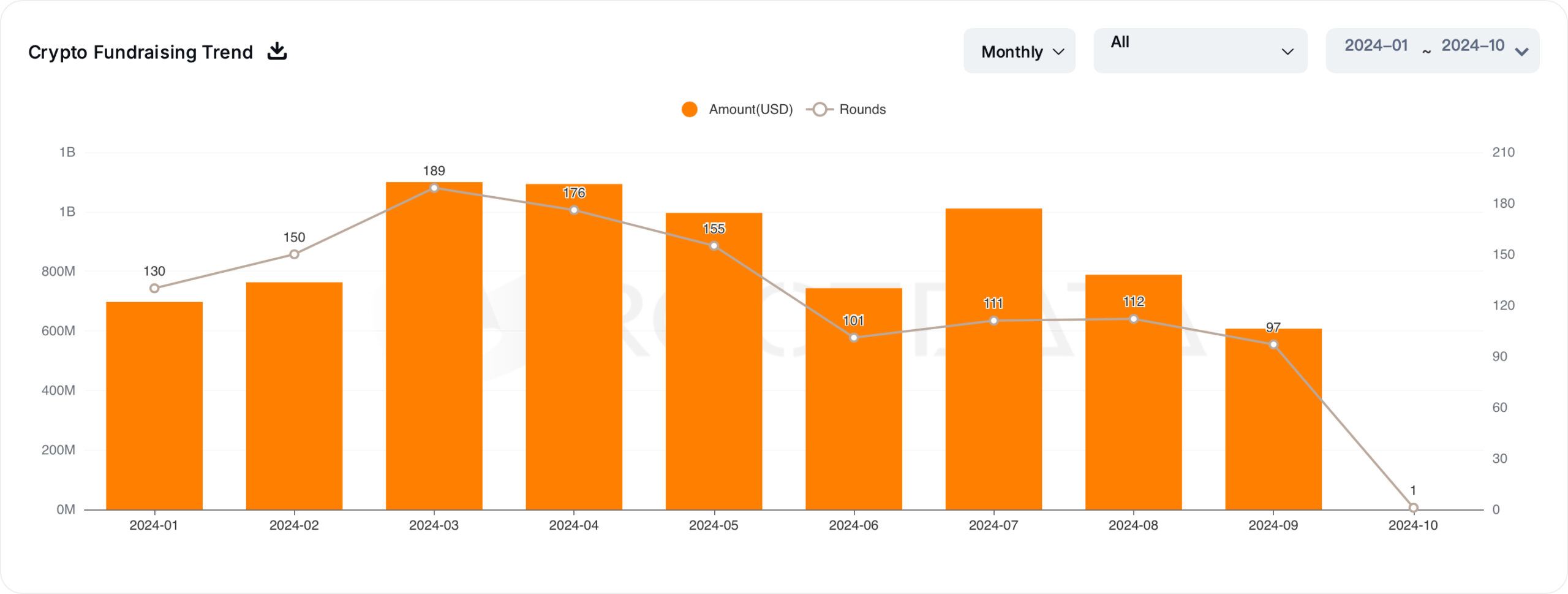

In response to RootData statistics, 97 publicly disclosed crypto VC investments occurred in September, representing a 12.6% lower from August’s 111 rounds.

September’s whole fundraising quantity reached $607 million, a 22% drop from the $785 million raised in August.

Notable Decline in Crypto VC Investments

Enterprise capital exercise serves as a key indicator of main buyers’ curiosity within the crypto market. September marked the bottom level in 2024, with solely 97 publicly disclosed crypto VC rounds, down from 111 in August.

The overall quantity raised additionally fell sharply, dropping from $785 million in August to $607 million in September, making it the worst month of the yr for each the variety of rounds closed and the quantity of funding.

The declining funding quantity displays a cautious method amid financial and geopolitical uncertainties. Apparently, the allocation of funds throughout sectors shifted as effectively.

Learn extra: Greatest Funding Apps in 2024

In August, decentralized finance (DeFi) captured practically 25% of whole investments, with synthetic intelligence (AI) following at 15%. In September, infrastructure and DeFi dominated, securing greater than half of the general funding worth.

Celestia Takes the Middle Stage

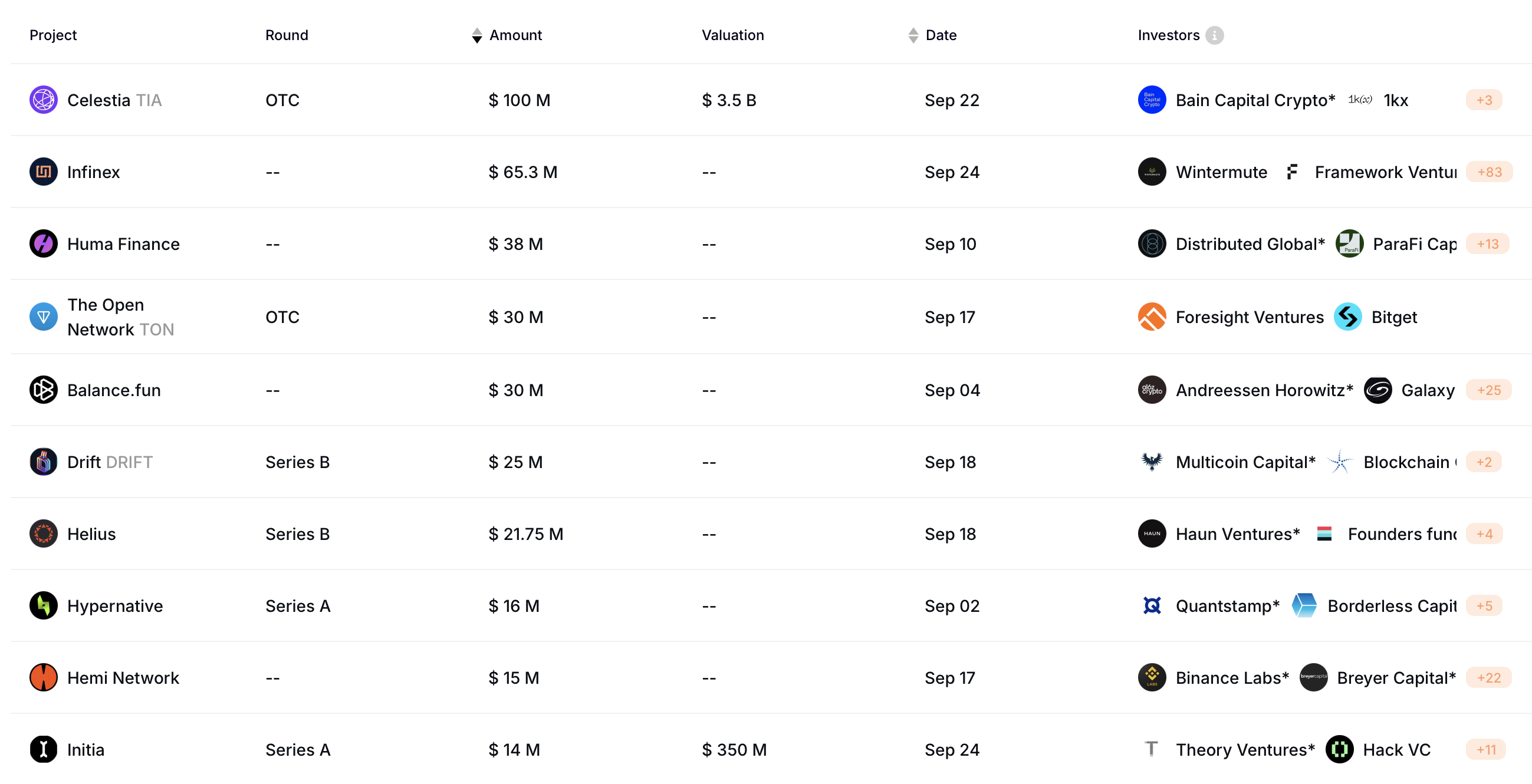

The biggest occasion in September was Celestia’s $100 million funding spherical led by Bain Capital, with further contributions from Syncracy Capital, Robotic Ventures, and Placeholder.

This spherical brings Celestia’s whole fundraising to $155 million, following its current launch as one of many first modular information availability layer protocols. The startup goals to handle a essential problem in blockchain networks: scalability and information availability.

Learn extra: High Blockchain Firms in 2024

Decentralized perpetuals buying and selling platform Infinex raised over $65 million utilizing a brand new patronage fundraising mannequin. Kain Warwick, Infinex’s founder, launched the “Patronage” mannequin, designed to supply equal funding alternatives via Patron NFTs, shifting away from the standard enterprise capital method.

Infinex held 4 rounds of its Patron Sale, attracting each retail contributors and main crypto entities, together with Wintermute and Solana Ventures.

Huma Finance raised $38 million, includeing $10 million in fairness funding and $28 million in yield-bearing RWAs on the platform. Distributed World led the fairness funding, with contributions from Hashkey Capital, Folius Ventures, and Stellar Growth. For the RWA portion, Stellar Growth Basis was the biggest participant, committing $10 million.

The Open Community and AI-powered blockchain platform Stability.enjoyable tied for 4th place in September by funding measurement. Crypto trade Bitget and Foresight Ventures invested $30 million in TON, whereas Stability.enjoyable raised an equal quantity from buyers together with a16z, Galaxy, and others.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.