On Thursday, Visa launched the Visa Tokenized Asset Platform (VTAP) by way of a partnership with a Spanish financial institution. VTAP is a software for banks to launch real-world property (RWAs), connecting them to the crypto ecosystem.

The RWA market is rising, and Visa hopes to reap the rewards of plugging banks in.

VTAP’s Early Levels

Bank card big Visa declared this information through a press launch, describing its new product because the Visa Tokenized Asset Platform (VTAP). Visa known as it a product for conventional finance (TradFi) to bridge fiat currencies with blockchains and deliberate a wide-release reside pilot with Ethereum in early 2025.

Learn Extra: Actual World Asset (RWA) Backed Tokens Defined

The press launch could describe VTAP as a very new product, however this isn’t its first public look. Visa started a partnership with Spanish financial institution Banco Bilbao Vizcaya Argentaria (BBVA) in late September, intending to hold out a small “sandbox” check of VTAP. BBVA will proceed to play this main function in VTAP’s gradual rollout.

“We are proud to continue spearheading the exploration of tokenized solutions with Visa through its VTAP platform. This collaboration marks a significant milestone… and will ultimately help enable us to broaden our banking services and expand the market,” stated Francisco Maroto, Head of Blockchain and Digital Property at BBVA.

Visa’s press launch targeted on VTAP’s capability to plug conventional finance into crypto by creating RWAs, particularly stablecoins. This big-picture evaluation, nonetheless, is much less helpful at describing VTAP’s affect in common financial institution operations. A Fortune interview with Maroto helps elucidate the image on the bottom.

Visa, Actual-World Property and Stablecoins

The interview described BBVA’s partnership with Visa as extra of a stablecoin launch than the event of a brand new monetary software. Maroto didn’t point out VTAP by identify, claiming as an alternative that BBVA is constructing a brand new stablecoin for the crypto settlements. BBVA’s European space of operations is an enormous asset to Visa resulting from latest EU stablecoin rules.

Learn Extra: What Is Markets in Crypto-Property (MiCA)?

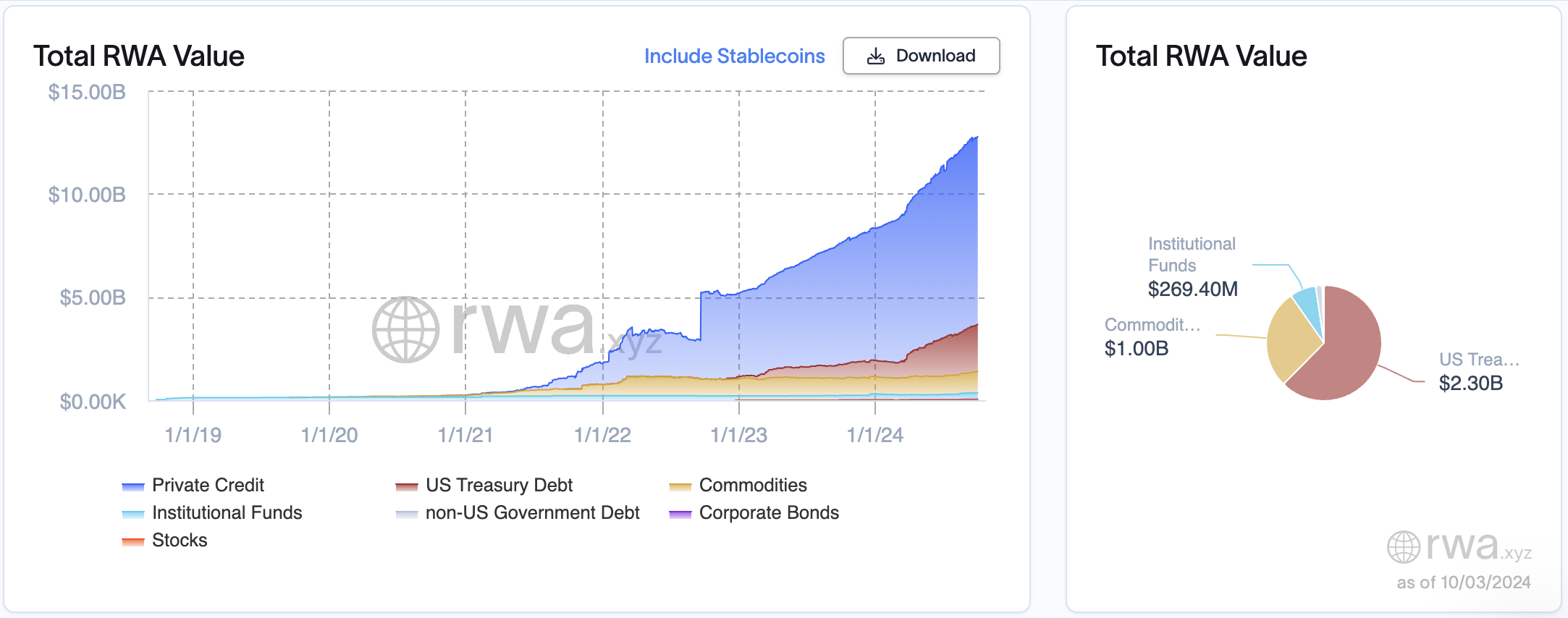

In different phrases, VTAP isn’t only a platform to attach TradFi to the blockchain world; it’s a technique to join Visa to the rising RWA market. Visa has carried out experiments with RWAs, resembling tokenized deposits in a number of jurisdictions this 12 months, and VTAP goals to take it worldwide. RWAs are a rising market, and VTAP seems like Visa’s ticket in.

Contemplating the sheer pace of development within the RWA market, Visa’s undertaking will likely be fairly fascinating. If different banks observe BBVA’s lead and use VTAP to enter the stablecoins sector, Visa will reap big rewards. Nevertheless, if income are tempting sufficient, different establishments will certainly develop their very own RWA platforms.

In the end, VTAP remains to be within the early levels. Visa will give attention to the precise partnership with BBVA for at the least a number of months, and the outcomes will decide the broader rollout. Nonetheless, if circumstances are proper, VTAP may show a formidable software for TradFi establishments sooner or later.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.