Worldcoin’s (WLD) value has confronted vital value stress just lately, failing to bounce off the $2.00 assist stage. The altcoin is presently buying and selling at $1.65, with consolidation showing to be the following doubtless transfer.

Traders are actually assessing whether or not Worldcoin is an effective addition to their portfolio this October, as market sentiment across the token stays cautious.

Worldcoin Might Not Be the Greatest Alternative

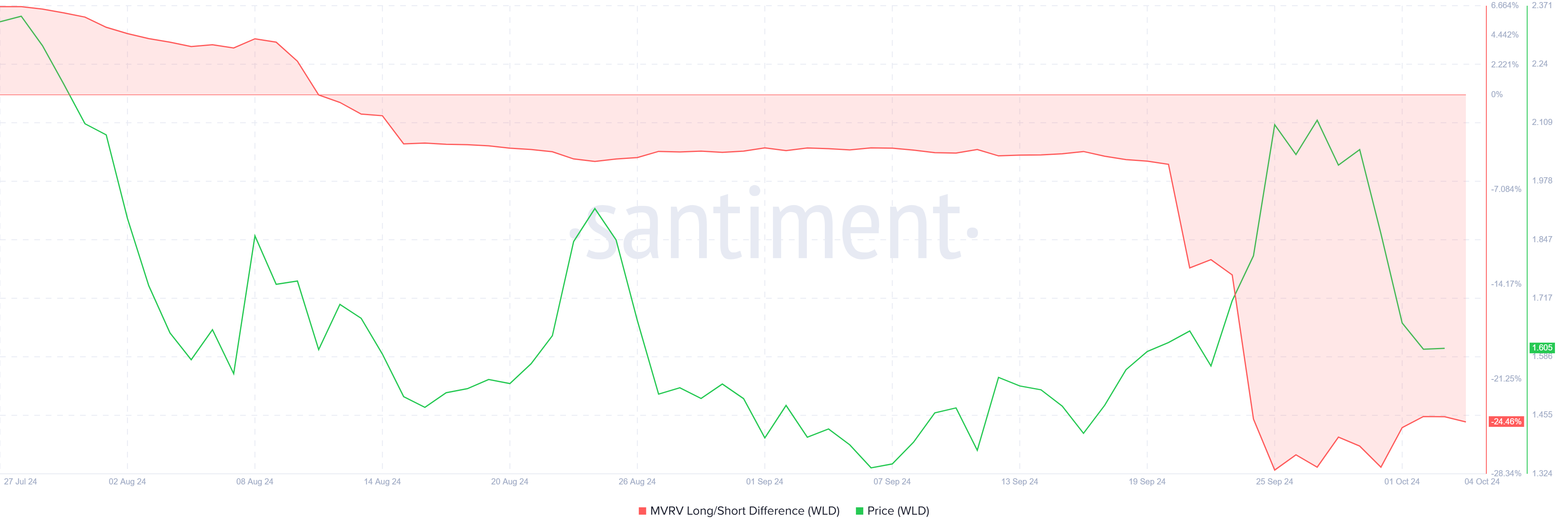

The MVRV (Market Worth to Realized Worth) Lengthy/Brief Distinction indicator for Worldcoin is presently signaling a bearish outlook. Extremely constructive values usually counsel that long-term holders are in revenue, an indication of stability. However, deeply unfavourable values point out that short-term holders are profiting, which tends to extend promoting stress.

At the moment, the indicator is at -24%, exhibiting that short-term holders are seeing income. These buyers’ income are a bearish signal, as short-term buyers are sometimes vulnerable to promoting rapidly, growing the chance of a value decline.

This shift in market sentiment, pushed by short-term profit-taking, means that Worldcoin could battle to regain upward momentum within the close to time period. The bearish indicators are prompting many buyers to stay cautious about including WLD to their portfolios.

Learn Extra: Find out how to Purchase Worldcoin (WLD) and All the things You Must Know

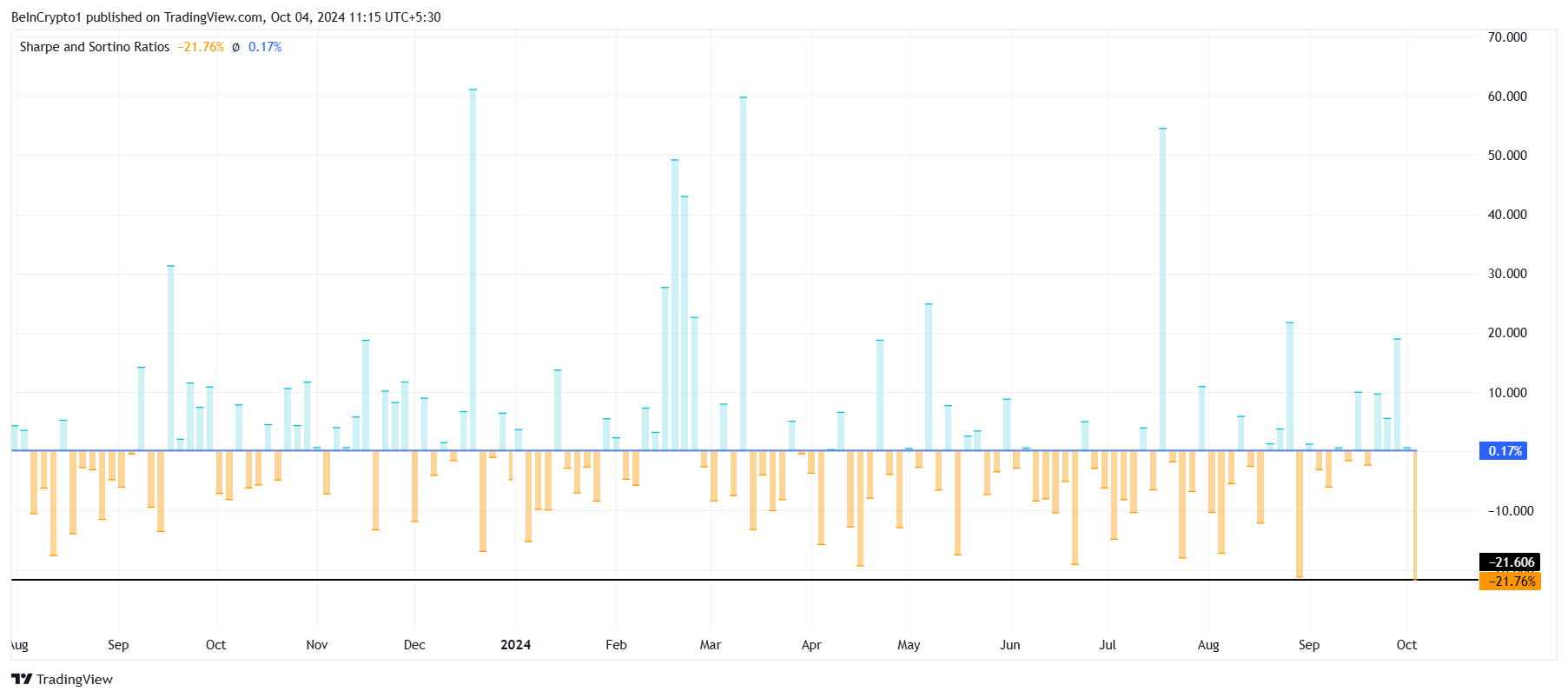

Moreover, the broader macro momentum for Worldcoin isn’t faring significantly better. WLD’s Sharpe Ratio, an indicator that measures the risk-adjusted returns of an asset, is at its lowest level because the altcoin’s inception. This means that the danger related to investing in WLD presently outweighs the potential rewards, making it a much less enticing possibility for buyers.

The low Sharpe Ratio means that Worldcoin will not be the very best wager in the mean time. It is because the present danger surroundings might result in additional losses. Traders are suggested to be cautious of coming into the market underneath these situations, as WLD could proceed its downtrend except vital bullish catalysts emerge.

WLD Value Prediction: Limitations Forward

Worldcoin’s value has declined by 24% in latest days, now buying and selling at $1.65. Given the present market sentiment and macro indicators, it’s doubtless that WLD will stay underneath the $2.00 barrier for the foreseeable future.

The altcoin can be going through resistance at $1.74, which can not current a major hurdle, however failure to breach it might result in additional declines. A drop in direction of $1.34, the decrease restrict of the consolidation vary between $2.00 and $1.34, is feasible if bearish situations persist. This chance excludes Worldcoin from the “must-have altcoins for your portfolio in October” checklist.

Learn Extra: Worldcoin (WLD) Value Prediction 2024/2025/2030

Nonetheless, a change in market traits and a profitable breach of $1.74 might allow Worldcoin to rise past $2.00. If this happens, it’s going to invalidate the present bearish-neutral outlook, probably pushing WLD’s value towards $2.50.

Disclaimer

In step with the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary selections. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.