The crypto markets are gearing up for a news-packed week, with a number of key occasions on the horizon.

In the meantime, Bitcoin (BTC) flipped inexperienced after climbing above $63,000, signaling that “Uptober” is likely to be in play once more.

FTX Court docket Listening to

The deadline for the courtroom listening to associated to FTX creditor repayments is on October 7, amid chatter that the trade will start distributing $16 billion to its collectors someday this month. BeInCrypto reported on the controversy, with collectors offended concerning the abysmal compensation coming their method.

FTX creditor activist Sunil Kavuri defined expectations in a latest submit on X. He mentioned that if the courtroom approves the compensation plan, claimants anticipating quantities under $50,000 may begin receiving funds by late 2024. Nevertheless, these owed bigger sums could have to attend till mid-2025.

Learn extra: FTX Collapse Defined: How Sam Bankman-Fried’s Empire Fell

Nevertheless, FTX token FTT recorded important volatility amidst buzz concerning the upcoming listening to. Token deposits elevated as merchants positioned for potential exits amid volatility forward of an important listening to.

OKX Delists These 5 Tokens

OKX trade additionally makes it to the highest crypto information this week, with 5 tokens up for delisting, in accordance with a late September announcement. On October 8, the trade will delist spot buying and selling for REN, TAKI, LEASH, ORB, and KINE tokens.

“We advise users to cancel orders on these trading pairs (REN/USDT, REN/USDC, TAKI/USDT, LEASH/USDT, ORB/USDT, and KINE/USDT) before the delisting. Otherwise, the system will automatically cancel these orders. The cancellation may take 1-3 working days,” the trade mentioned.

Token delisting sometimes causes a drop in buying and selling quantity and liquidity, making it tougher for holders to promote at truthful costs. It typically results in sharp worth declines as buyers panic promote or lose confidence within the token. Consequently, holders could face important losses within the worth of their property.

EIGEN and APT Token Unlocks

EIGEN token holders ought to brace for volatility forward of a $35.75 million value of unlocks on Tuesday. An official announcement from the Eigen Basis mentioned this unlock occasion would carry new alternatives for participation throughout the EigenLayer ecosystem. Notably, it will mark the community’s first cliff unlock occasion.

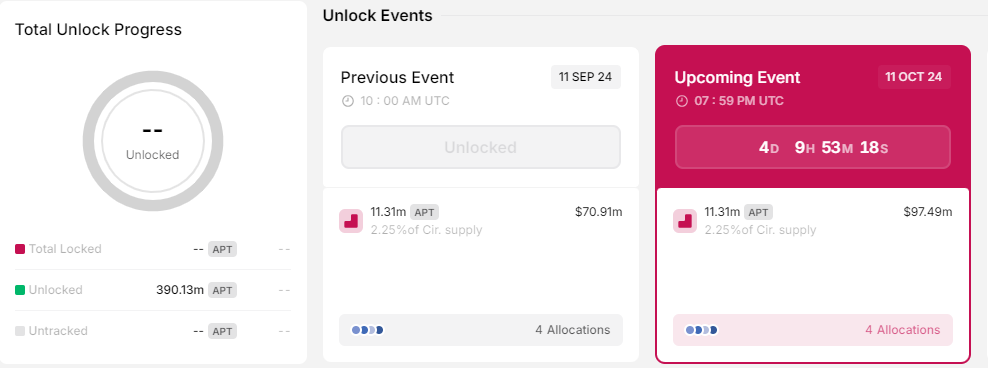

On Friday, October 11, the Aptos ecosystem is about to unlock 11.31 million APT tokens, valued at $97 million primarily based on present costs. These tokens might be distributed among the many basis, group, core contributors, and buyers.

Tokens allotted to the group and buyers could enter the market shortly as holders money in for short-term income. This inflow may probably affect APT’s worth, creating downward stress.

HBO’s Large Satoshi Nakamoto Reveal

Satoshi Nakamoto’s identification could turn into public data this week, with American tv community HBO because of premiere its much-awaited documentary on Tuesday. Opinion polls on Polymarket recommend Len Sassaman stands out as the creator of Bitcoin.

Sassaman, now late, was an American technologist, cryptographer, and privateness advocate, a befitting profile for the pseudonymous Satoshi Nakamoto. He’s mentioned to be the most important crypto billionaire ever, holding 1.1 million BTC tokens value virtually $67.5 billion at present charges.

“Len Sassaman’s wife had direct communication with the “creator” of Bitcoin After he died she was “thinking about” basically altering Bitcoin She nonetheless has entry to his “old hard drives” which suggests she has entry to 1 million Bitcoin (5% of all Bitcoin, value almost$65 billion),” one X person commented.

Stacks Nakamoto Arduous Fork

Nakamoto is making headlines twice in crypto information this week, with the second being the upcoming Stacks exhausting fork on October 9. It’s a main improve on the Stacks community designed to carry a number of advantages, the principle ones being elevated transaction throughput and 100% Bitcoin finality.

With this improve, the Stacks blockchain would understand new capabilities and enhancements, specializing in key developments. These embody improved transaction velocity, enhanced finality ensures for transactions, mitigated Bitcoin miner MEV (miner extractable worth) alternatives that have an effect on PoX, and enhanced robustness towards chain reorganizations.

PEPPER Airdrop Snapshot

After the primary snapshot on September 30, fan engagement Web3 mission Chiliz (CHZ) has one other airdrop of its PepperChain (PEPPER) token to CHZ holders on October 10 throughout main exchanges exterior the US.

PEPPER airdrop is a part of a continued technique to increase and diversify the Chiliz ecosystem. The ecosystem is in style for its fan token platform and is deeply concerned within the sports activities and leisure industries.

Learn extra: What are Crypto Airdrops?

The addition of PepperChain positions Chiliz for community-centric initiatives that may reward lively participation and engagement.

Upbit Suspends MKR and DAI Buying and selling

Korea’s largest trade, Upbit, will droop buying and selling pairs for MKR/BTC and DAI/BTC from 14:00 native time on October 11, 2024. It will assist model reshaping as Maker transitions to Sky Protocol and its MKR token adjustments to Sky.

Equally, Dai stablecoin will change to USDS. The suspension will final till the rebranding and token trade is accomplished.

The DeFi group has its reservations concerning the rebranding. Some laud the transfer as a mandatory evolution in response to market calls for. In the meantime, others are involved that it shifts away from the decentralized ideas that initially outlined MakerDAO.

“MakerDAO was an OG DeFi protocol aiming to build an autonomous, decentralized stablecoin with low volatility against fiat currency, backed by ETH. DAI is now migrating to USDS, a stablecoin that goes against its original vision,” Lumberg, one of many distinguished DeFi group members, commented.

Nonetheless, others say the change may have long-term results on the DeFi sector, as introducing USDS and SKY may result in a centralization pattern throughout the house.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections primarily based on this content material. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.