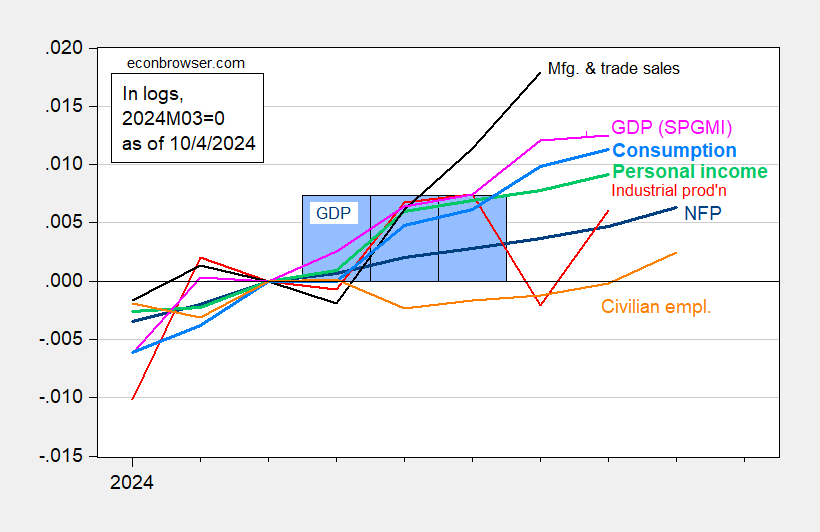

From FoxNews. Right here’s an image of indicators adopted by the NBER’s BCDC over the previous yr. Word that August numbers are principally up.

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), civilian employment (orange), industrial manufacturing (pink), private earnings excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q2 third launch/annual replace, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (10/1/2024 launch), and writer’s calculations.

It’s attainable that NBER will backdate the recession to beginning in July. Up to now we now have preliminary information for August for consumption, private earnings ex-transfers, and industrial manufacturing, and don’t have Q3 GDP (though all nowcasts for Q3 point out progress). Nonetheless, NBER peak in July does appear just a little unlikely to me.

By the best way, Dr. Antoni additionally declared a recession just a little greater than two years in the past.