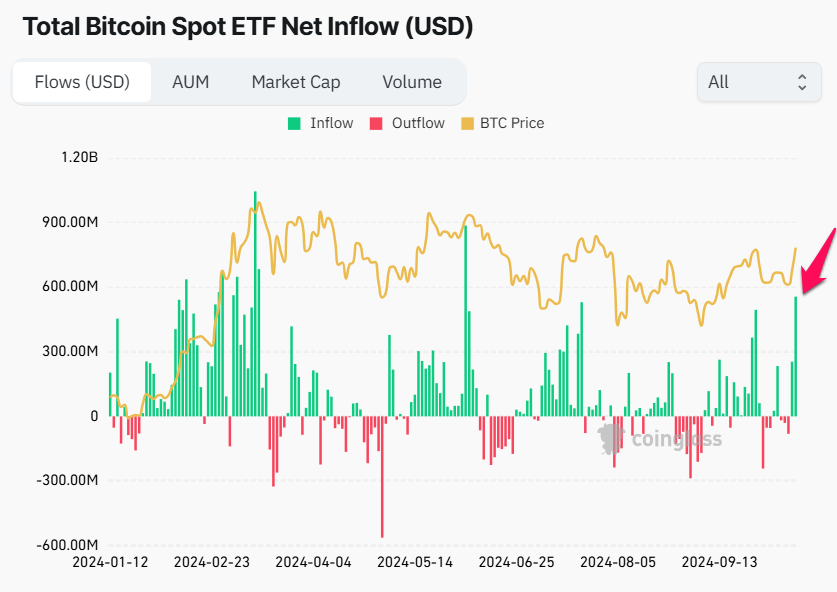

Spot Bitcoin ETFs within the US have simply recorded a major web influx, surpassing $555 million on Monday.

This marks the best web influx since June 5, signaling a robust resurgence in investor demand for Bitcoin. Concurrently, the value of Bitcoin additionally surged.

Bitcoin Surpasses $66,000

Based on information from Coinglass, on October 14, all spot Bitcoin ETFs recorded an influx of $555.90 million. Moreover, the overall buying and selling quantity of Bitcoin ETFs reached $2.78 billion, the best since August 25.

Alongside this, Bitcoin’s worth rose by greater than 6.3% in the course of the day, climbing again above $66,000 after a worth correction earlier in October. Nonetheless, as of writing, Bitcoin’s worth has retraced, presently buying and selling round $65,500.

Learn Extra: What Is a Bitcoin ETF?

Farside information revealed that the majority Bitcoin ETFs noticed constructive netflow throughout Monday’s buying and selling session, aside from Wisdomtree’s BTCW, which had zero netflow. Constancy’s FBTC led the shopping for exercise with $239.3 million, adopted by Bitwise’s BITB with $100.2 million. Even Grayscale’s GBTC, which normally experiences sell-offs, recorded a purchase order of $37.8 million.

Constructive Sentiment Surges as US Election Nears Closing Phases

Bloomberg evaluation means that the latest Bitcoin worth rally is pushed by investor optimism that the newly elected president will assist bolster the crypto trade by improved regulatory insurance policies. Whereas presidential candidate Trump has vowed to change SEC Chairman Gary Gensler, candidate Kalama Harris has pledged to help a regulatory framework for cryptocurrencies.

Nonetheless, Blackrock CEO Laurence Fink expressed that the end result of the election won’t considerably impression the sector.

“Well, first, I’m not sure if either President or other candidate would make a difference. I do believe the utilization of digital assets are going to become more and more of a reality worldwide. Conversations we’re having with institutions worldwide, conversations about how should they think about digital assets, what type of asset allocation there should be. I mean, we believe Bitcoin is an asset class in itself.” – Laurence Fink stated.

Learn extra: Bitcoin (BTC) Worth Prediction 2024/2025/2030

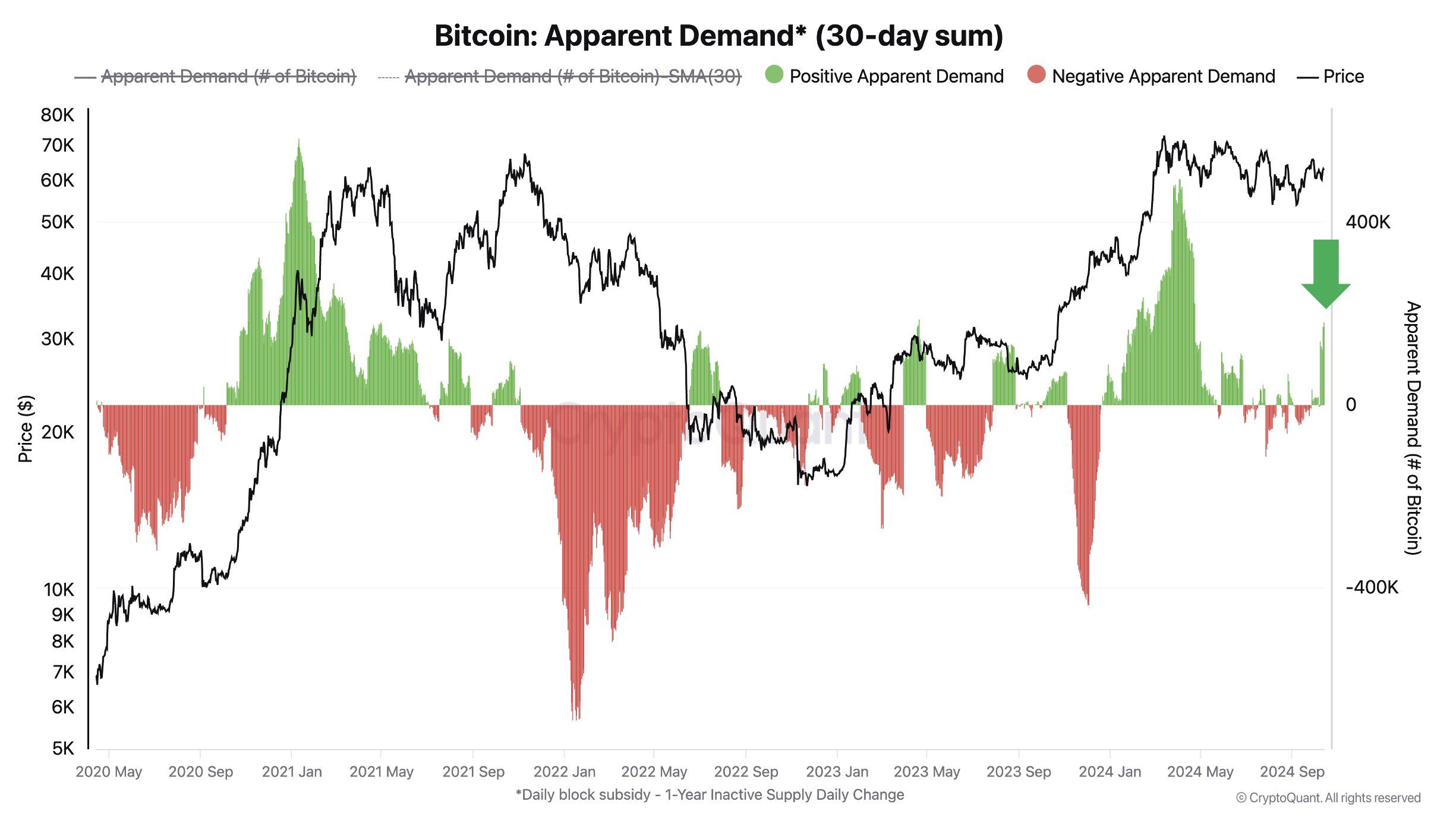

CryptoQuant’s Bitcoin Obvious Demand indicator reveals that Bitcoin demand is making a robust comeback. This metric gauges investor demand by evaluating newly mined Bitcoin and the provision that has remained inactive for over a 12 months.

The chart reveals that the final main spike in Bitcoin Obvious Demand occurred in early 2024 when Bitcoin’s worth surged from $40,000 to over $72,000.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.