Bitcoin’s (BTC) transient surge to $66,000 has attracted a surge in bullish predictions, with merchants betting on a rise that would see the value surpass its all-time excessive. Though Bitcoin hasn’t but set a brand new report, its Open Curiosity (OI) has reached a peak, signaling that curiosity within the main cryptocurrency is at its highest stage in a substantial time.

The surge in OI, alongside the value spike to $66,000, alerts rising dealer confidence in a possible breakout. How excessive can BTC go?

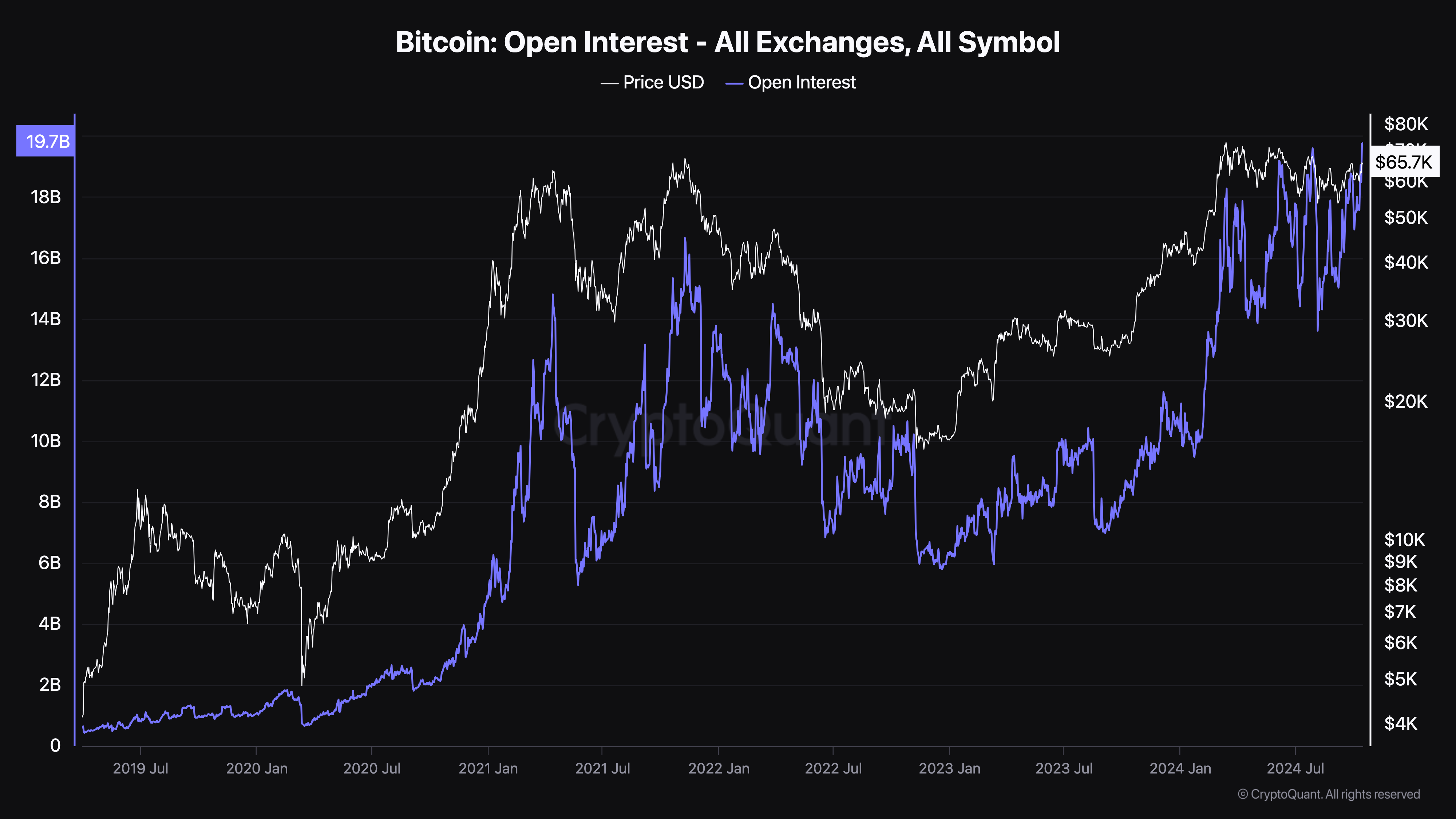

Bitcoin Open Curiosity Reaches New All-Time Excessive

Sometimes, OI displays the variety of open contracts available in the market. When it rises, it signifies that merchants are actively coming into positions, typically in anticipation of great value actions. A lower, then again, signifies lowered publicity to the coin.

In accordance with CryptoQuant, Bitcoin’s Open Curiosity has reached a new all-time excessive of $19.80 billion. The final time the metric went this excessive was in July. Throughout that interval, the coin’s value virtually retested $68,000.

Given the present market sentiment, it’s not unreasonable to contemplate that Bitcoin might problem its all-time excessive of round $73,750. However that may solely occur if rising curiosity within the asset persists.

Learn extra: The place to Commerce Bitcoin Futures: A Complete Information

Relating to this growth, crypto analyst EgyHashX opined that the rising liquidity might positively have an effect on Bitcoin’s value within the brief time period.

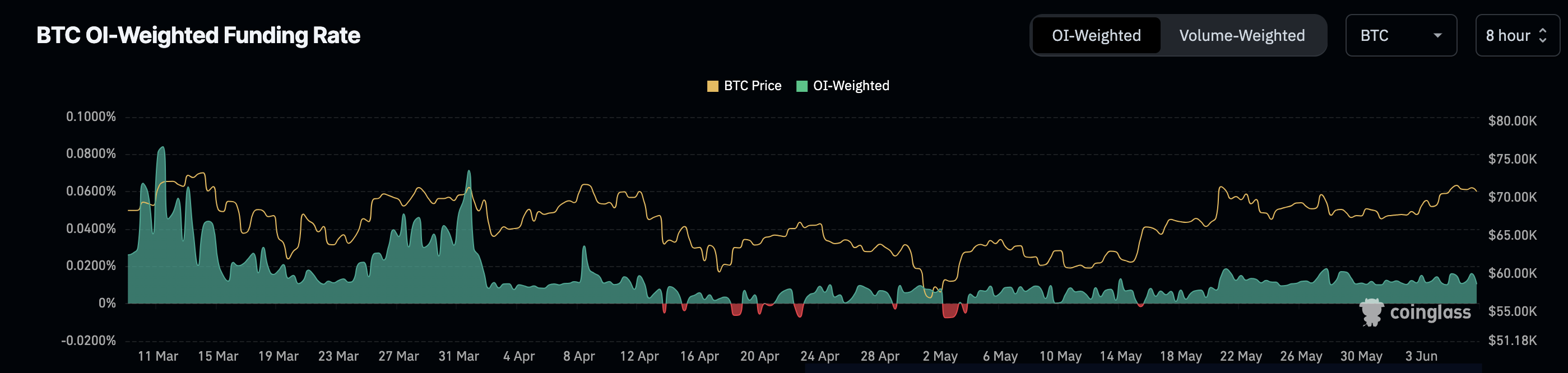

“This upward trend in the derivatives market indicates a growing influx of liquidity and increased attention in the cryptocurrency space. The rise in funding rates further points to a bullish sentiment among traders,” EgyHashX highlighted by way of CryptoQuant.

As well as, the latest surge in Bitcoin’s Funding Price reinforces bullish sentiment available in the market. The Funding Price measures the price of holding lengthy versus brief positions in futures contracts. When optimistic, it means that extra merchants are leaning towards lengthy positions, anticipating an upward value motion.

A damaging Funding Price would point out a bearish outlook, with extra merchants favoring brief positions. Because the Funding Price has been at its highest stage since August and stays optimistic, it alerts that merchants are anticipating Bitcoin’s value to rally, with information exhibiting anticipation towards $75,000.

BTC Value Prediction: 14% Improve to Begin With

For the previous few months, Bitcoin’s value has been buying and selling inside a descending channel. This channel ensured that the coin remained range-bound and located it difficult to interrupt out.

However yesterday, October 14, BTC lastly rose previous that resistance at $65,234. Within the course of, the coin climbed to $66,474 earlier than just lately pulling again. Regardless of that, BTC has shunned re-entering the descending channel, indicating that the bullish thesis might nonetheless be sturdy.

If this stays the case, Bitcoin might break the overhead resistance at $70,738. Ought to that occur, the coin would possibly climb to $75,002 earlier than the top of this quarter.

Learn extra: 4 Finest Crypto Brokers for Shopping for and Promoting Bitcoin in 2024

On the flip aspect, the lack of ability to leap above $66,009 once more might invalidate the bias. In that circumstance, Bitcoin might decline to $60,272. Brian Quinlivan, Lead Analyst at Santiment, urged warning, saying that Bitcoin might need hit a neighborhood high.

“One thing that is still slightly concerning is how bullish the crowd is currently at this BTC rally. The ratio of positive vs. negative comments over the past 2 days is the highest we’ve seen all year long, which can often align with short-term top signals,” Quinlivan informed BeInCrypto.

Disclaimer

In step with the Belief Venture tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.