Jupiter (JUP) value not too long ago surged over 10% following information that Grayscale added the coin to its listing of 35 altcoins into consideration for funding. This optimistic improvement has pushed renewed curiosity in JUP, sparking an uptrend out there.

Whereas some metrics level to continued power, others recommend that the uptrend might face challenges forward. Let’s discover these indicators to know what may be subsequent for JUP.

JUP Present Uptrend Is Very Sturdy

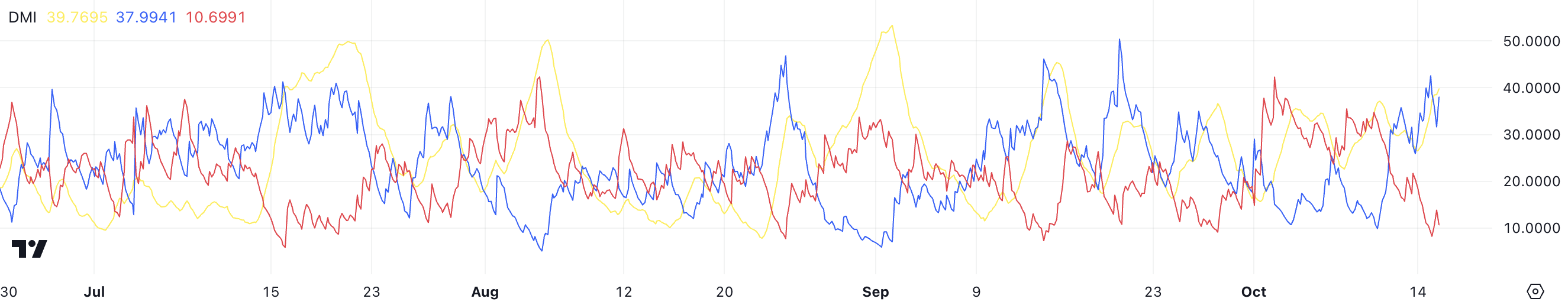

The latest information from Grayscale has resulted in JUP’s Common Directional Index (ADX) leaping to 39.76. The ADX is a measure of development power, with values above 25 sometimes indicating a powerful development out there.

On this case, a worth close to 40 is substantial and signifies that the present value development has important momentum. Importantly, ADX itself doesn’t point out the route of the development — it merely reveals how robust it’s.

Given the latest upward value motion and the ADX worth, it’s clear that the development pushing JUP larger is gathering power. Such an ADX studying offers merchants confidence that the development just isn’t weakening, suggesting that the latest surge might proceed.

Learn extra: 11 Prime Solana Meme Cash to Watch in October 2024

When analyzing the Directional Motion Index (DMI) chart for JUP, the D+ line stands at 37.99, whereas the D- is at 10.69. The DMI consists of two elements, the optimistic directional indicator (D+) and the unfavourable directional indicator (D-), which assist in figuring out whether or not patrons or sellers have the higher hand.

In JUP’s case, a D+ of 37.99 in comparison with a D- of 10.69 reveals that patrons are dominating the market. The next D+ implies that upward strain considerably outweighs downward strain, reflecting robust bullish sentiment. The mix of a excessive ADX worth and the appreciable distinction between D+ and D- means that the present uptrend is robust and more likely to persist.

This setup signifies that JUP has the potential for additional value progress, as patrons keep a strong benefit over sellers, driving continued optimistic momentum.

This Metric Exhibits The Social gathering Might Be Over Quickly

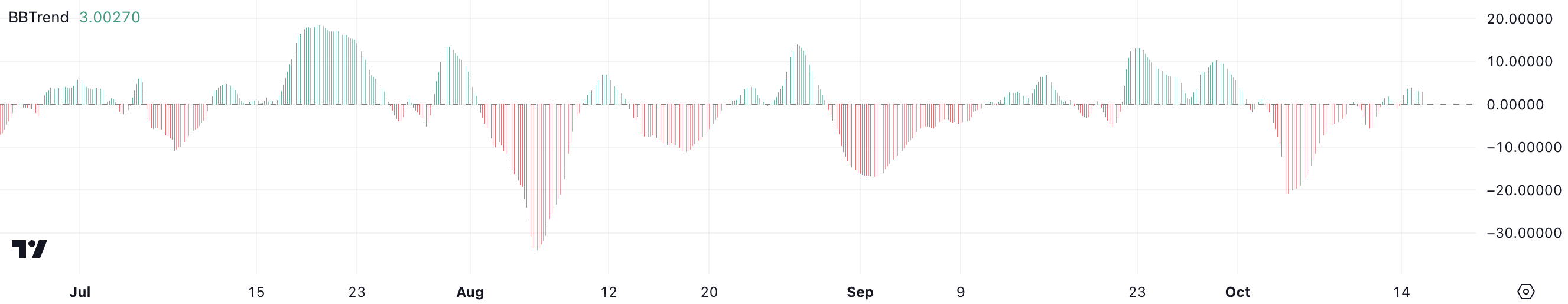

Then again, JUP’s BBTrend is at present at 3.38, reflecting a comparatively subdued stage of momentum in comparison with latest highs. The BBTrend indicator has been hovering round this worth for the previous few days, exhibiting a big drop from the extent of 13 that it reached on the finish of September when JUP skilled a value spike.

This decline means that whereas the present value motion is optimistic, it could lack the depth seen in the course of the earlier rally. The distinction between the present BBTrend studying and the height in late September reveals that momentum has considerably cooled off for the reason that earlier spike, indicating a possible weakening in bullish power.

BBTrend, or Bollinger Bands Pattern, is a metric used to gauge the power and route of value actions in relation to the Bollinger Bands. It basically measures the value’s place relative to the band and may point out whether or not an asset is experiencing a powerful development or volatility.

The next BBTrend worth means that the value is actively transferring towards the outer bands, implying robust momentum and important value volatility.

Though the Directional Motion Index (DMI) and ADX point out that the present uptrend is robust for JUP, the comparatively low BBTrend worth raises questions in regards to the sustainability of this development. It hints that whereas the value route is decisively upward, the amount and general market enthusiasm is probably not adequate to take care of the identical stage of power going ahead.

This divergence between robust development indicators and a average BBTrend means that the present development may face challenges, particularly if the shopping for quantity doesn’t decide up.

JUP Value Prediction: Is It Set To Be Again to $1.22 Quickly?

JUP’s shorter Exponential Shifting Common (EMA) traces have not too long ago crossed above the longer-term EMA traces, which is usually thought-about a bullish sign. This sort of crossover signifies a shift in momentum the place latest value actions are outpacing the typical value over an extended interval, suggesting that patrons are stepping in and gaining power.

Nevertheless, one short-term EMA line continues to be trying to cross above the longer-term ones, indicating that whereas the bullish development is forming, it has not but totally matured. The complete crossover of all short-term EMA traces above the longer-term ones would additional solidify the bullish sentiment and ensure the presence of a powerful upward development.

Learn extra: Solana ETF Defined: What It Is and How It Works

EMA traces are a kind of transferring common that provides extra weight to latest value knowledge, making them notably attentive to the most recent value adjustments. Merchants typically use EMA crossovers to establish shifts in market tendencies. When shorter EMAs cross above longer ones, it’s sometimes interpreted as a sign that momentum is popping optimistic and a possible rally could possibly be on the best way.

If JUP’s remaining short-term EMA line additionally crosses above the long-term traces, it will doubtless strengthen the present uptrend, paving the best way for JUP to check key resistance ranges at $0.96 and $1. Ought to the momentum be robust sufficient, JUP value may doubtlessly goal $1.22, which might characterize a considerable 38% value surge.

Disclaimer

Consistent with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.