The crypto market sentiment is seeing a serious shift as main digital belongings proceed their bullish momentum.

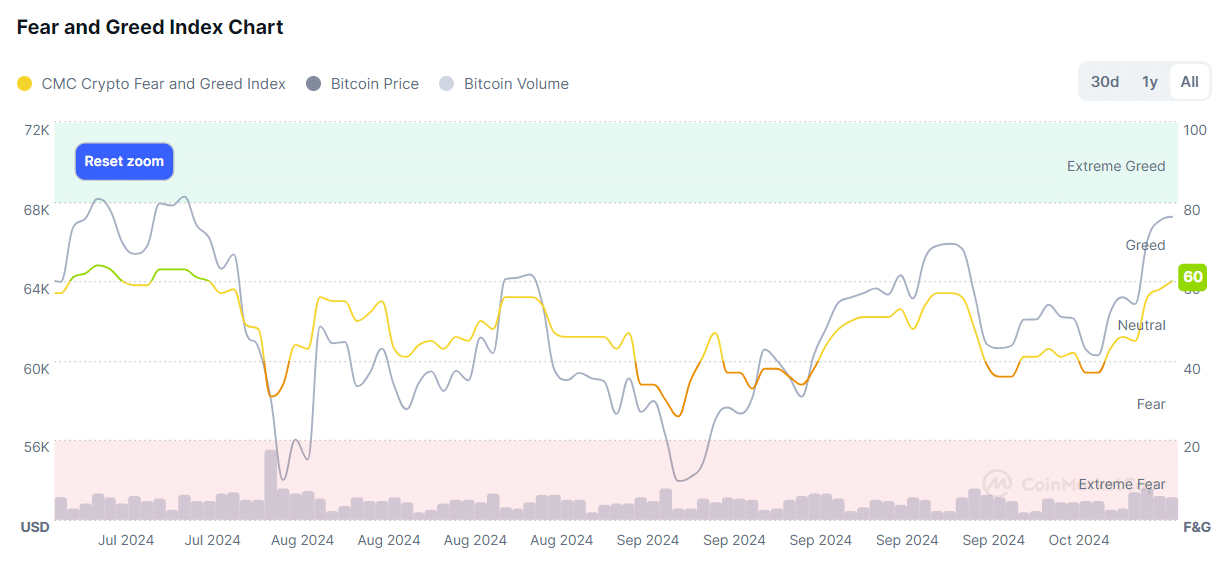

Based on knowledge supplied by CoinMarketCap, the crypto concern and greed index entered the 60 zone as we speak, signaling barely grasping market situations.

That is the primary time the crypto market has hit the greed zone in six weeks—final seen on July 31. The key drop occurred in early August because the Bitcoin (BTC) value plunged beneath the $54,000 mark.

The current market-wide rebound got here on the again of Bitcoin’s bullish momentum. The BTC value has always risen since Oct. 10, recording a 12% surge over the previous week—Bitcoin briefly touched a two-month excessive of $68,375 on Oct. 16.

Regardless of a slight correction, Bitcoin remains to be up 0.3% previously 24 hours and is buying and selling at $67,350 on the time of writing.

Based on knowledge from IntoTheBlock, 95% of the Bitcoin holders are at present in revenue, 3% are near their preliminary funding and a pair of% are seeing losses.

At this level, short-term profit-taking can be regular, as a result of elevated variety of holders in revenue.

However, the variety of every day energetic addresses in revenue declined from 112,780 to 91,160 distinctive wallets between Oct. 15 and 16. The downshift reveals that some traders may be aiming at an extra value hike as a substitute of taking income straight away.

One of many principal causes behind Bitcoin’s bullish momentum is the elevated demand for the spot BTC exchange-traded funds within the U.S. Per a crypto.information report, these funding merchandise recorded a web influx of over $1.6 billion over the previous 4 days—seeing $458.5 million in inflows on Oct. 16 alone.