The attract of anonymity has all the time been a major draw within the blockchain ecosystem. Early adopters touted the flexibility to conduct transactions in secrecy, removed from the prying eyes of centralized establishments and regulators.

Nevertheless, as blockchain evolves, the business faces a crucial query – Is anonymity nonetheless paramount, or is it a fading side amidst rising calls for for transparency?

Why Blockchain Transparency is Necessary?

The blockchain sector is present process a metamorphosis. Enhanced regulatory scrutiny and developments in blockchain analytics are slowly demystifying the once-opaque crypto ecosystem.

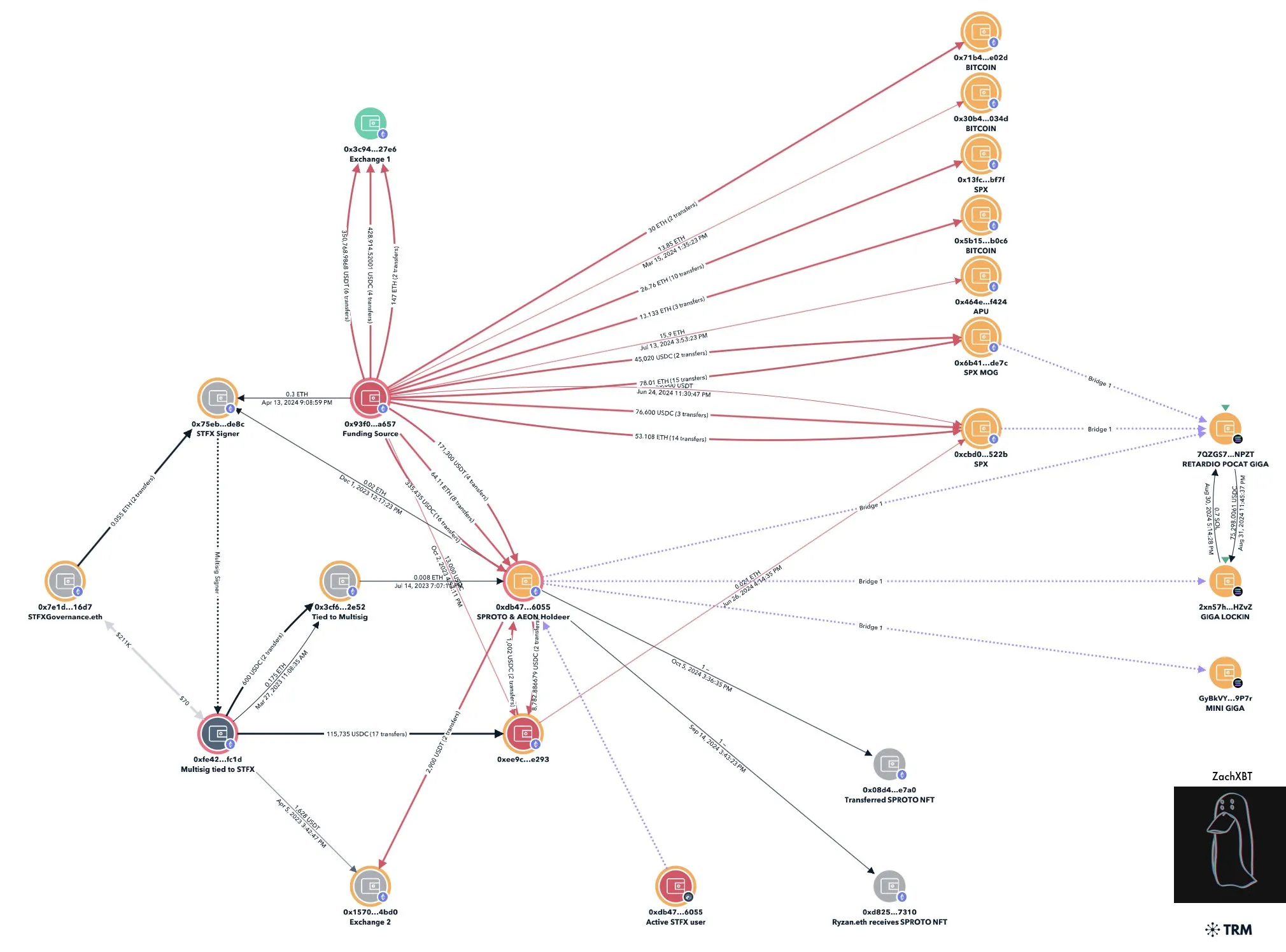

A revelation by the on-chain detective ZachXBT, who uncovered the crypto holdings of a meme coin dealer, Murad, highlights this shift. This publicity ignited debates concerning the ethics of showing such data and whether or not such acts undermine the foundational privateness promised by blockchain.

Learn extra: Who Is ZachXBT, the Crypto Sleuth Exposing Scams?

Regardless of issues, many argue that transparency is essential for combating fraud, cash laundering, and different illicit actions throughout the crypto area.

The decision for larger oversight is partly pushed by the rising incidents of crypto-related frauds and hacks. In line with an Immunefi report, over $412 million was misplaced to such incidents within the third quarter of 2024 alone. Furthermore, year-to-date, the overall reached $1.3 billion throughout 169 incidents by September 2024.

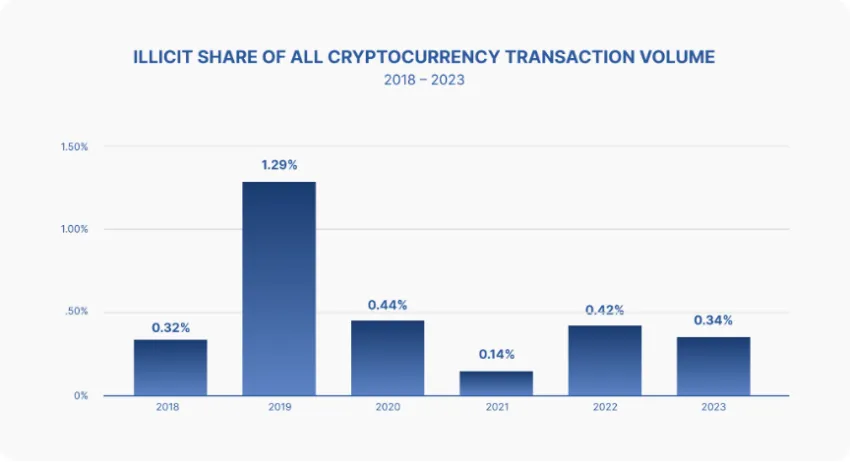

These safety breaches and the utilization of cryptocurrency in unlawful actions gasoline the controversy over blockchain’s twin nature—providing freedom but probably facilitating illegal acts.

Want For a Balanced Strategy

In an interview with BeInCrypto, Alex Pruden, Govt Director at Aleo Basis, countered this angle. He highlighted the misuse of conventional monetary programs in crimes.

“The traditional financial system is used for illegal activities all the time. 99% of money laundering and sanctions evasion actually happens through large financial institutions (who don’t catch it until after the crime has been perpetrated). Does that mean we should ban banks and payment processors? Of course not, because these institutions provide benefits to everyone else. The key is finding the right balance,” Pruden informed BeInCrypto.

Supporting this, a Crypto Info Sharing and Evaluation Middle (ISAC) report notes that money is used way more often than crypto in unlawful actions. The report challenged the notion that crypto is predominantly the foreign money of criminals.

Learn extra: Anonymity vs. Pseudonymity: Understanding the Key Variations

Furthermore, purists and privateness advocates contend that an excessive transfer in direction of openness erodes the core values of blockchain. Pruden emphasised the significance of privateness.

“Real-world financial transactions between parties are often predicated on a notion of confidentiality. And this confidentiality/privacy is essential for businesses to function. For example, businesses transacting with one another may not want the contents of that transaction public to competitors. Likewise, individual financial transactions on public blockchains are at risk from surveillance, data mining, and cyberattacks,” Pruden acknowledged.

Opposite to Pruden’s view, Adrian Brink, co-founder of Namada, argues that blockchain was by no means actually about privateness.

“I don’t think that blockchain was built on the promise of privacy at all. Bitcoin doesn’t offer any privacy guarantees. The potential for de-anonymization was there from the beginning,” Brink informed BeInCrypto.

Learn extra: Prime 7 Privateness Cash in 2024

Consultants Declare Zero Information Proof is the Answer

This pressure between privateness and transparency raises pivotal questions on the way forward for blockchain. Can it stay decentralized and safe whereas compromising on anonymity? Or is privateness nonetheless important to guard customers and uphold the expertise’s rules?

William Wendt, Head of Ecosystem at Oasis, informed BeInCrypto that privateness isn’t a binary selection.

“Often, this issue of privacy vs. transparency is looked at through a binary lens. Either a blockchain is fully transparent or fully anonymous. However, this is not the case. Privacy is a spectrum, and different dApps and users will have different preferences for what level of privacy/transparency they will need,” Wendt mentioned.

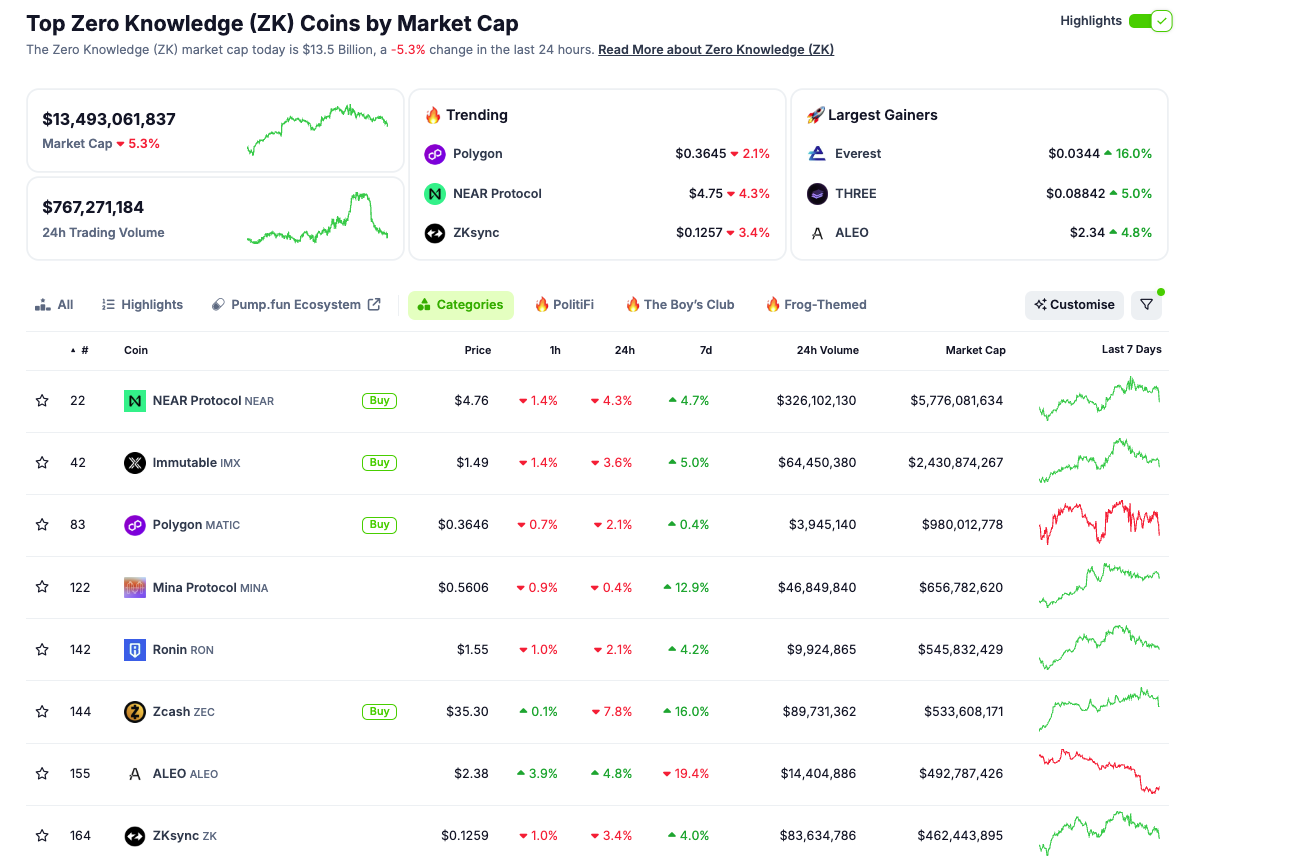

In line with all three consultants, a promising answer lies in zero-knowledge expertise, which presents a means for transparency and privateness to coexist. Zero-knowledge proofs (ZKPs) enable for the verification of transactions with out revealing underlying knowledge, thus sustaining consumer privateness whereas making certain compliance with legal guidelines.

“Historically, transparency was seen as a mechanism to enforce compliance, but it doesn’t have to come at the cost of user privacy. Cryptographic solutions like ZK proofs (ZKP) enable a system where transactions can be “correct by construction” when it comes to the legislation, with out revealing the underlying knowledge. This protects consumer privateness and creates a consumer interface nearer to a checking account/cost app than most Web3 functions in the present day,” Pruden famous.

Brink additionally helps this nuanced strategy, emphasizing that the necessity for privateness varies by context.

“What you need to share with your local government is going to be different from what you want to share with the world. The key issue is primarily self-sovereignty. We’re moving towards a world where technologies like zero-knowledge cryptography empower users with the choice of what to share. Privacy can coexist with transparency, but the architecture must be thoughtfully designed,” Brink informed BeInCrypto.

Learn extra: What are Zero-Information Proofs? Securing Progress for Web3 Apps

Zero-knowledge cryptography addresses privateness issues and likewise meets regulatory necessities, providing a balanced answer that protects particular person privateness and fulfills transparency obligations. This expertise proves compliance with anti-money laundering (AML) and Know Your Buyer (KYC) laws with out disclosing private data, offering a win-win situation for all stakeholders.

Because of heightened curiosity, the zero-knowledge sector is rising. In line with knowledge from CoinGecko, the overall market capitalization of zero-knowledge cash stands at almost $13.5 billion.

In conclusion, whereas blockchain was initially celebrated for its privateness options, the altering atmosphere means that each transparency and privateness are vital for its future. The continuing growth of zero-knowledge cryptography and related applied sciences could maintain the important thing to sustaining blockchain’s founding rules whereas adapting to new regulatory environments.

Disclaimer

Following the Belief Venture tips, this function article presents opinions and views from business consultants or people. BeInCrypto is devoted to clear reporting, however the views expressed on this article don’t essentially mirror these of BeInCrypto or its employees. Readers ought to confirm data independently and seek the advice of with an expert earlier than making selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.