The Aptos (APT) value has surged by 24% over the past seven days, elevating questions on whether or not this uptrend could be sustained. Whereas latest beneficial properties have been spectacular, the technical indicators are beginning to present blended alerts.

Whether or not APT can push increased or face a correction will rely upon how these traits unfold within the coming days.

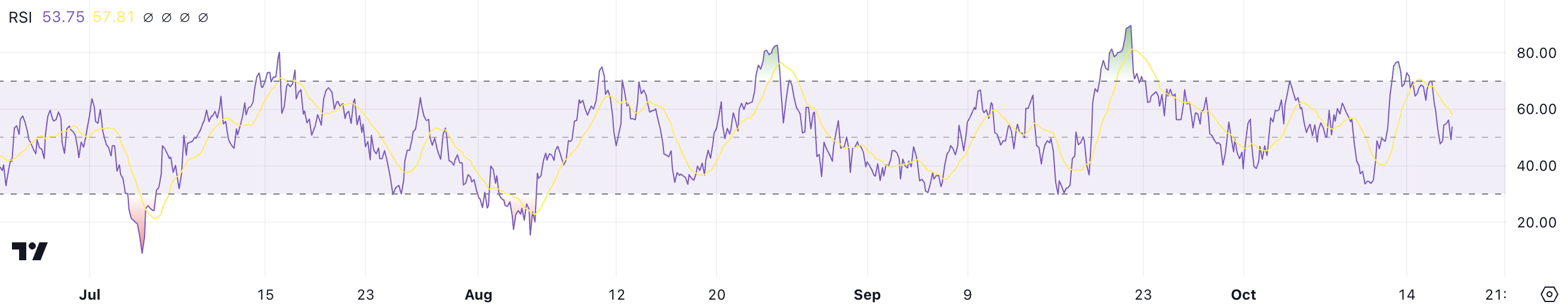

APT RSI Is Far From Overbought

Aptos (APT) RSI is presently at 53.75, dropping from 76 simply 4 days in the past. This decline suggests a discount in shopping for strain in comparison with latest peaks, signaling a possible cooling interval in market exercise. Nonetheless, the present RSI stage nonetheless exhibits a impartial to mildly bullish outlook.

RSI, or Relative Power Index, is a momentum indicator that measures the velocity and alter of value actions. It ranges from 0 to 100, with values above 70 indicating overbought circumstances and under 30 suggesting oversold circumstances. An RSI round 50 displays a balanced state, the place shopping for and promoting pressures are almost equal.

Learn extra: Aptos (APT) Value Prediction 2024/2025/2030

APT’s RSI at 53.75 factors to a market that isn’t but overextended regardless of latest beneficial properties, which noticed APT value rise by 24% in only one week. This stage means that the uptrend should have room to develop because the RSI stays under the overbought threshold of 70.

If bullish momentum resumes, APT’s value might proceed climbing, probably pushing the RSI increased with out instantly risking a reversal. This positioning permits for additional progress earlier than reaching a stage that sometimes alerts warning.

Ichimoku Cloud Reveals Aptos Surge Might Be Over For Now

The Ichimoku Cloud chart for Aptos suggests a typically bullish pattern, as indicated by value ranges presently buying and selling above the inexperienced cloud (kumo). This configuration implies that market sentiment is constructive and patrons are in management. The cloud acts as a assist zone, and with costs above it, APT is demonstrating resilience and energy in its latest value motion.

Moreover, the main span A (inexperienced) is above main span B (purple), which reinforces the bullish sentiment and factors to potential assist within the occasion of any short-term value dips.

The Tenkan-sen (blue line) and Kijun-sen (purple line) are additionally displaying blended alerts. Whereas the Tenkan-sen stays barely above the Kijun-sen, indicating that the momentum continues to be bullish, their latest convergence suggests a lack of momentum. If the Tenkan-sen crosses under the Kijun-sen, it might sign a possible pattern reversal or at the very least a weakening of the present uptrend.

Moreover, the inexperienced Chikou span (lagging line) is above the worth, which helps a continued bullish outlook, however merchants ought to look ahead to any modifications that might sign a pullback. General, the Ichimoku chart alerts that APT stays in a bullish place, however the narrowing hole between key traces signifies that momentum may very well be wavering.

APT Value Prediction: The Coin Can Surge 76% If This Occurs

APT EMA traces are presently bullish, with short-term traces positioned above long-term ones. Nonetheless, the gap between these traces has considerably narrowed, indicating that bullish momentum may be weakening. When the hole between short-term and long-term EMAs shrinks, it usually alerts that the pattern may very well be dropping energy and would possibly quickly reverse.

EMA traces, or Exponential Shifting Averages, assist establish the path and momentum of value traits by giving extra weight to latest information factors. In APT’s case, the present EMA setup displays an ongoing uptrend, however the diminishing separation means that the market’s energy could also be faltering.

Learn extra: 5 Finest Aptos (APT) Wallets in 2024

If the present uptrend holds, APT might surge to $14.42, and breaking that resistance would possibly propel the worth to $17.89 — its highest stage since April 1. Such a transfer would characterize a 76% acquire for APT value, displaying the bullish potential if momentum stays robust.

Nonetheless, as indicated by each the Ichimoku Cloud and EMA traces, the uptrend may very well be getting weaker. If the pattern reverses, APT value would possibly check assist ranges at $8.45 and even fall to $7.86.

Disclaimer

In step with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.