The Fantom (FTM) value has lately proven promising progress, however questions stay about how lengthy this uptrend can final. Regardless of the preliminary surge, key indicators are beginning to trace at a possible weakening of momentum. ADX values have declined, suggesting that the robust bullish development could also be dropping steam.

Moreover, whereas the current drop in change provide supplied a lift, subsequent stability on this metric raises doubts about continued upward strain. The approaching days can be essential in figuring out whether or not FTM can maintain its beneficial properties or face a reversal in direction of decrease assist ranges.

Fantom Worth Present Pattern Could Not Final

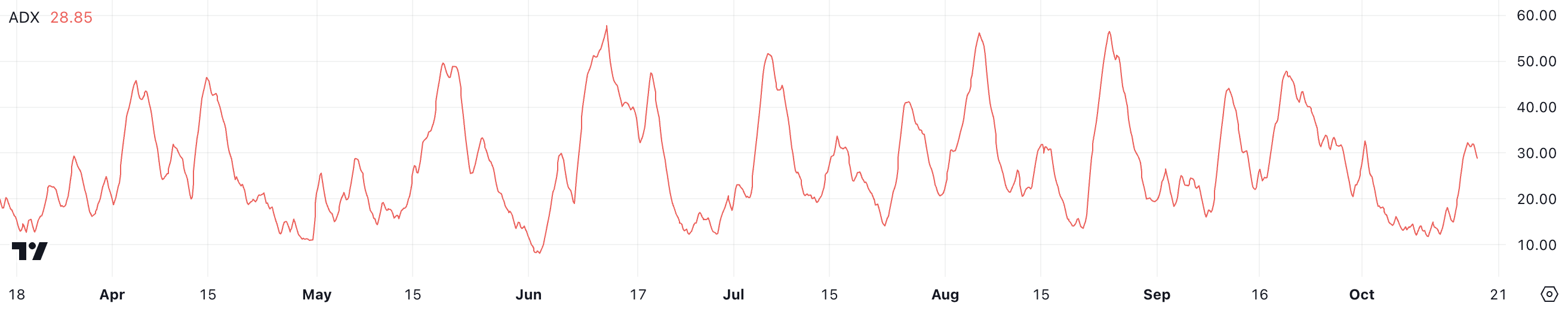

FTM’s ADX is presently at 28.85, down from 32 only a day in the past. This comes after a speedy surge the place the ADX rose from 15 to 32 in simply two days, reflecting a powerful and swift enhance in development energy.

Nonetheless, the current decline signifies that the momentum could also be dropping a few of its pressure, and merchants are paying shut consideration to see if this development continues downward.

Learn extra: Fantom (FTM) Worth Prediction 2024/2025/2030

The ADX, or Common Directional Index, measures the energy of a development, no matter whether or not it’s bullish or bearish. It ranges from 0 to 100, with values above 20 indicating a trending market and something above 30 signifying a powerful development. FTM’s value surged by 14% up to now seven days, pushed by this robust uptrend.

Nonetheless, the truth that the ADX has decreased from above the 30 threshold means that the present upward momentum is likely to be weakening. If the ADX continues to fall, it might suggest that the development is dropping energy, doubtlessly signaling an finish to the current bullish rally.

FTM Provide On Exchanges Dropped Closely Earlier than the Current Surge

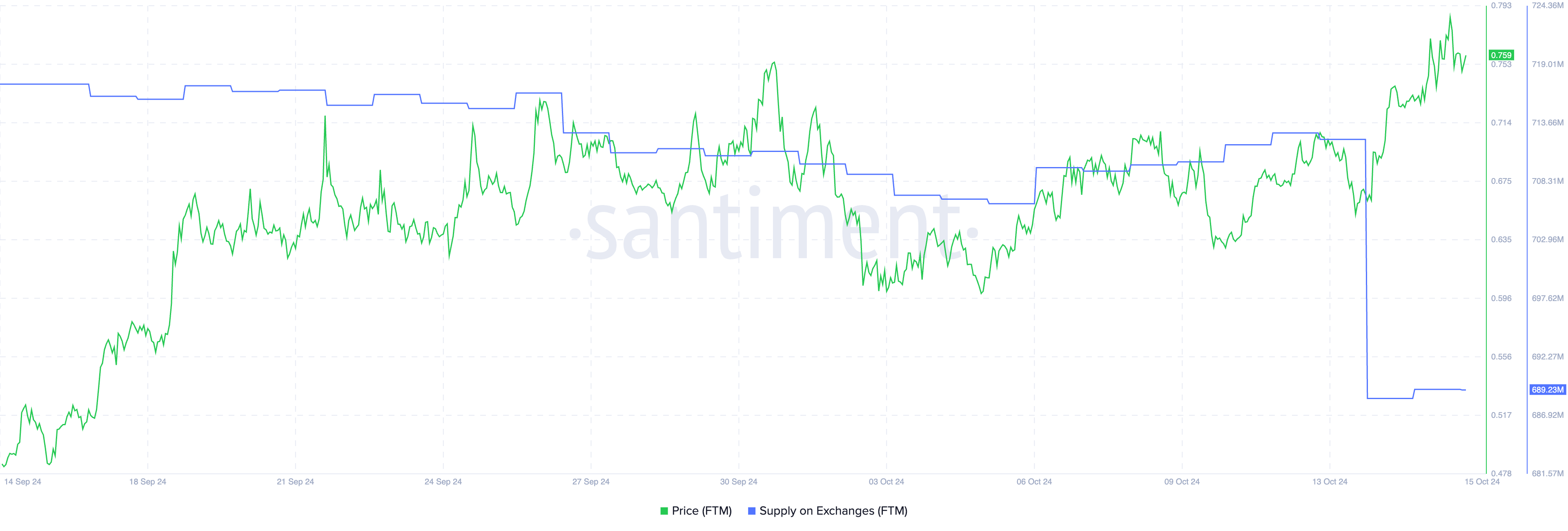

Between October 13 and October 14, FTM’s provide on exchanges dropped from 712 million to 688 million. This coincided with a value enhance, with FTM rising from $0.66 on October 13 to $0.78 by October 15.

The discount in change provide means that fewer tokens had been available for promoting, aligning with the following value surge.

Usually, when customers switch cash to exchanges, it’s thought-about a bearish sign, as they might be making ready to promote. Conversely, when cash are withdrawn from exchanges, it typically alerts bullish sentiment, indicating that holders are usually not planning to promote quickly and is likely to be anticipating a value enhance.

After the preliminary drop in FTM’s change provide, the quantity has since stabilized, but it surely stays essential to maintain monitoring this metric. Adjustments in provide on exchanges can present useful perception into potential shifts in market sentiment.

Fantom Worth Prediction: Can It Rise Again To $0.96 In October?

FTM’s EMA (Exponential Transferring Averages) strains are presently bullish, with a wholesome hole between the short-term and long-term strains. This means robust upward momentum, as the worth has maintained a transparent lead within the current development.

When short-term EMAs are positioned nicely above the long-term ones, it signifies that current value motion is extra favorable in comparison with the longer common, reflecting bullish sentiment out there.

EMA strains are used to easy out value information by giving extra weight to current costs. This helps merchants determine the route of a development and spot adjustments in momentum earlier.

Learn extra: 9 Greatest Fantom (FTM) Wallets in 2024

Nonetheless, after the current value surge, FTM’s short-term EMAs have began to curve downwards. In the event that they cross under the long-term EMAs, it should kind a “death cross,” a bearish sign that implies a possible reversal in development and additional draw back.

If such a state of affairs occurs, FTM’s value might take a look at assist ranges at $0.65 and $0.59. Then again, if the uptrend regains energy, FTM might proceed its rise, difficult resistance at $0.76 — a stage it lately didn’t surpass. Breaking previous that might push FTM again in direction of $0.85 and even $0.96, its highest value since Could.

Disclaimer

In keeping with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.