On October 18, the US Securities and Change Fee (SEC) accredited a rule change that enables the New York Inventory Change (NYSE) and the Chicago Board Choices Change (CBOE) to supply choices buying and selling for a number of spot Bitcoin exchange-traded funds (ETFs).

This choice comes throughout a interval of sturdy weekly inflows for Bitcoin ETFs, marking their greatest efficiency in round seven months.

SEC Greenlights Choices Buying and selling

The SEC’s filings revealed that each exchanges have been licensed to checklist choices for spot ETF merchandise. Nonetheless, whereas the NYSE has full approval for all merchandise, CBOE’s itemizing excludes Grayscale’s Bitcoin Mini Belief.

“The Commission finds that the proposed rule change is consistent with Section 6(b)(5) of the Act,76 which requires that an exchange have rules designed to prevent fraudulent and manipulative acts and practices, to remove impediments to and perfect the mechanism of a free and open market, and to protect investors and the public interest,” the SEC said within the two filings.

Learn extra: An Introduction to Crypto Choices Buying and selling

The precise launch date for these choices has not been confirmed. Nonetheless, ETF specialists anticipate the approval to broaden entry to crypto-related monetary merchandise on main US exchanges. This transfer will possible enhance liquidity round Bitcoin ETFs, draw extra individuals to the market, and finally strengthen the trade.

Jeff Park, head of alpha methods at Bitwise, highlighted the benefits of ETF choices over current BTC choices on platforms like Deribit. He identified that ETF choices provide cross-margining, which permits integration with a number of belongings equivalent to GLD.

Park emphasised that derivatives don’t straight have an effect on Bitcoin provide however enable USD holders to hedge in opposition to Bitcoin publicity, which may cut back volatility. He additionally highlighted that ETF choices can allow market circumstances to considerably affect massive belongings like BTC.

“ETF options are the tightropes accelerating flows that convert Bitcoin’s potential energy into kinetic energy, all leading in one direction: higher,” Park concluded.

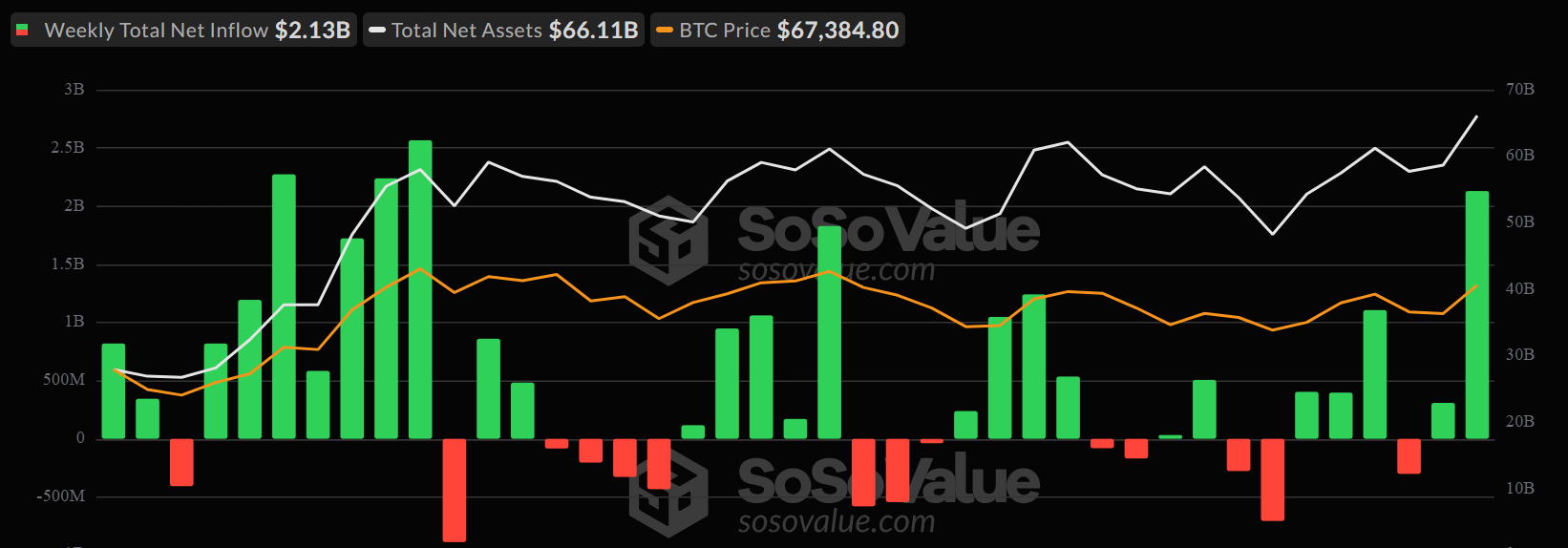

The SEC’s approval coincides with the ETFs experiencing a exceptional week of inflows. Knowledge from SoSoValue revealed that Bitcoin ETFs collectively pulled in over $2 billion, extending their successful streak to 6 consecutive days. In consequence, the ETFs have now reached $21 billion in whole internet inflows, pushed by sturdy investor demand.

Learn extra: How To Commerce a Bitcoin ETF: A Step-by-Step Strategy

Nate Geraci, president of the ETF Retailer, believes this sustained momentum displays the sturdy retail and institutional curiosity in Bitcoin ETFs. At this tempo, he predicts that BTC ETFs may surpass Gold ETFs in market dimension throughout the subsequent two years.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any selections based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.