Solana (SOL) has been on a tear, recording a 12% worth surge previously week. The altcoin presently trades at $170.16, slightly below the essential $171 resistance stage. If it maintains its momentum, Solana’s worth could break by means of this resistance in the course of the present buying and selling session.

A profitable breach would open the door for an additional rally, with the following main hurdle at $186.32. If SOL can overcome this resistance, it may attain the $200 mark. However how quickly can this occur?

Solana Sees Spike in Exercise

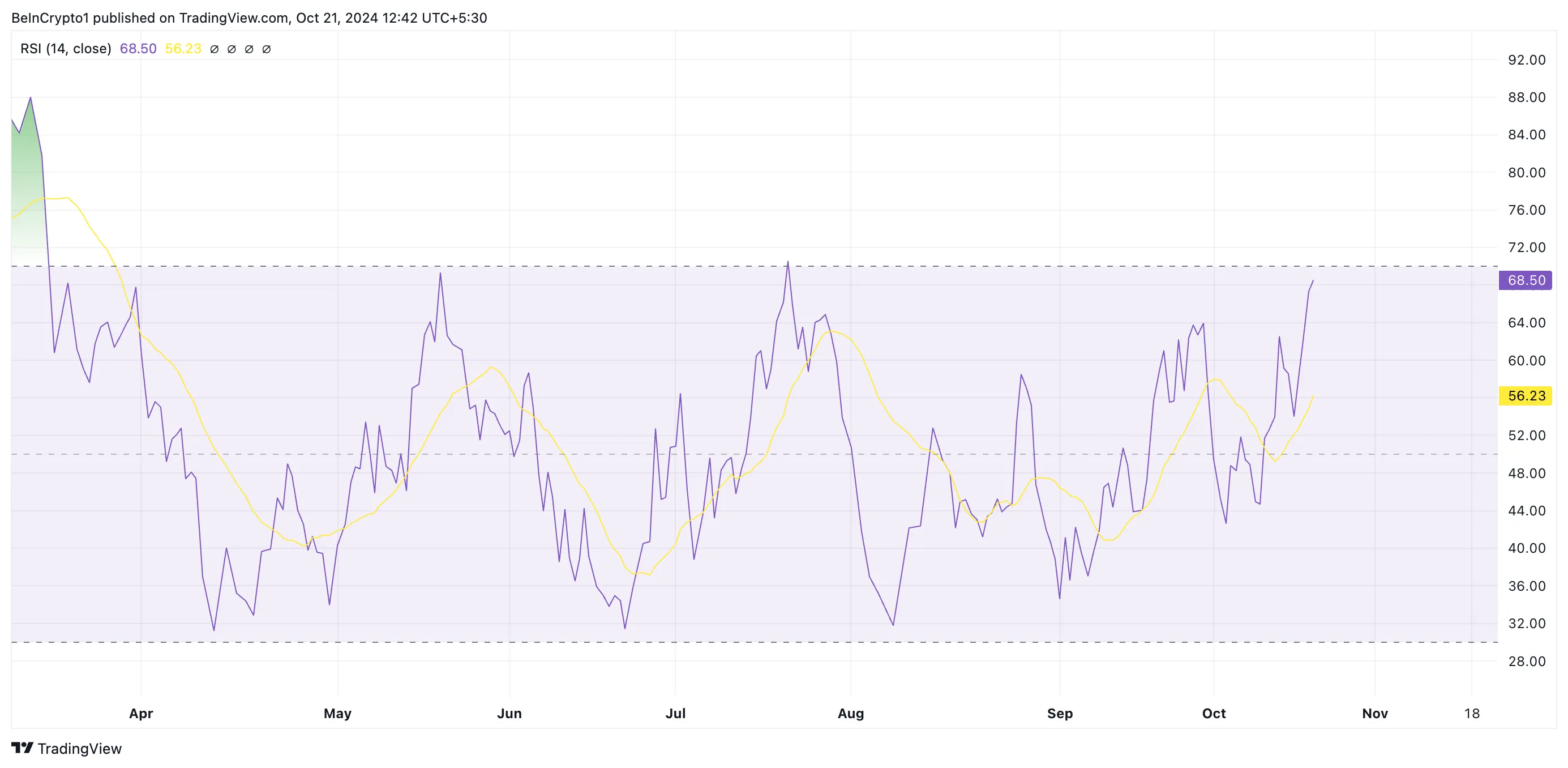

Solana’s key momentum indicators, assessed on a one-day chart, verify the current surge within the demand for altcoin. For instance, its Relative Energy Index (RSI), which tracks its overbought and oversold market circumstances, is in an uptrend at 68.50.

This indicator’s values vary between 0 and 100, with values above 70 suggesting that the asset is overbought and should quickly witness a correction. Values beneath 30 point out an oversold situation and trace at a potential rebound.

Learn extra: 13 Greatest Solana (SOL) Wallets To Take into account in October 2024

SOL’s present RSI alerts that the market has seen sustained shopping for stress, which is driving the worth increased. Nevertheless, whereas not technically in overbought territory, the asset is shut, which may imply that the worth may face promoting stress quickly.

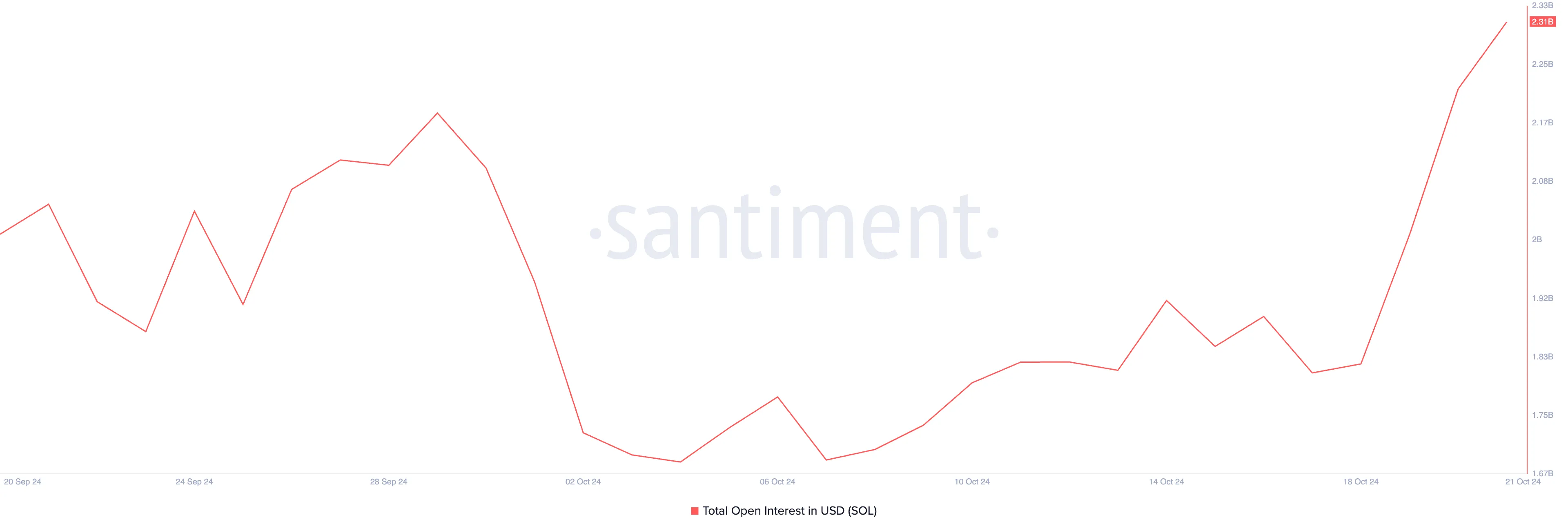

However, over the previous few days, Solana’s Open Curiosity has skyrocketed. As of this writing, it sits at $2.31 billion, having risen 29% since October 18. It presently sits at its highest stage since August 1.

An asset’s open curiosity measures the variety of excellent by-product contracts (futures or choices) which are presently energetic and haven’t been settled or closed. When it rises together with an asset’s worth, it alerts that the uptrend is robust and backed by vital market participation.

SOL Worth Prediction: Coin Could Surpass $200 Or Fall To $131

If a big portion of rising open curiosity consists of brief positions (bets in opposition to the worth), and the worth continues to climb, it may set off a brief squeeze. Nevertheless, this hasn’t been the case for Solana. As an alternative, the demand for lengthy positions stays sturdy, as proven by its constructive funding fee of 0.012% at press time.

Funding charges, that are periodic charges, assist hold an asset’s contract worth aligned with its spot worth. A constructive funding fee signifies that extra merchants are betting on a worth rally reasonably than a decline.

Learn extra: Purchase Solana (SOL) and Every little thing You Want To Know

If this pattern continues, Solana may break by means of the $171.74 resistance. Ought to momentum persist, the following vital stage to look at is $186.32. A decisive transfer previous this level may push the worth towards $209.90, a stage final seen in March.

Nevertheless, profit-taking may dampen this bullish momentum, presumably pulling the worth again towards $131.38.

Disclaimer

Consistent with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.