Ryan Cummings and Ernie Tedeschi have a really fascinating article in BriefingBook at the moment which casts new mild on the disjuncture between measured sentiment and standard macroeconomic indicators. Cummings and Tedeschi doc how the transfer to on-line sampling has altered the traits of the College of Michigan Financial Sentiment collection.

…we consider on-line respondents are ensuing within the degree of the general sentiment and present situations indices being meaningfully decrease, making more moderen UMich information factors inconsistent with pre-April 2024 information factors. Particularly, we use a easy statistical mannequin to estimate that the impact of the methodological swap from cellphone to on-line is at present leading to sentiment being 8.9 index factors –or greater than 11 %–decrease than it might be if interviews have been nonetheless collected by means of the cellphone.

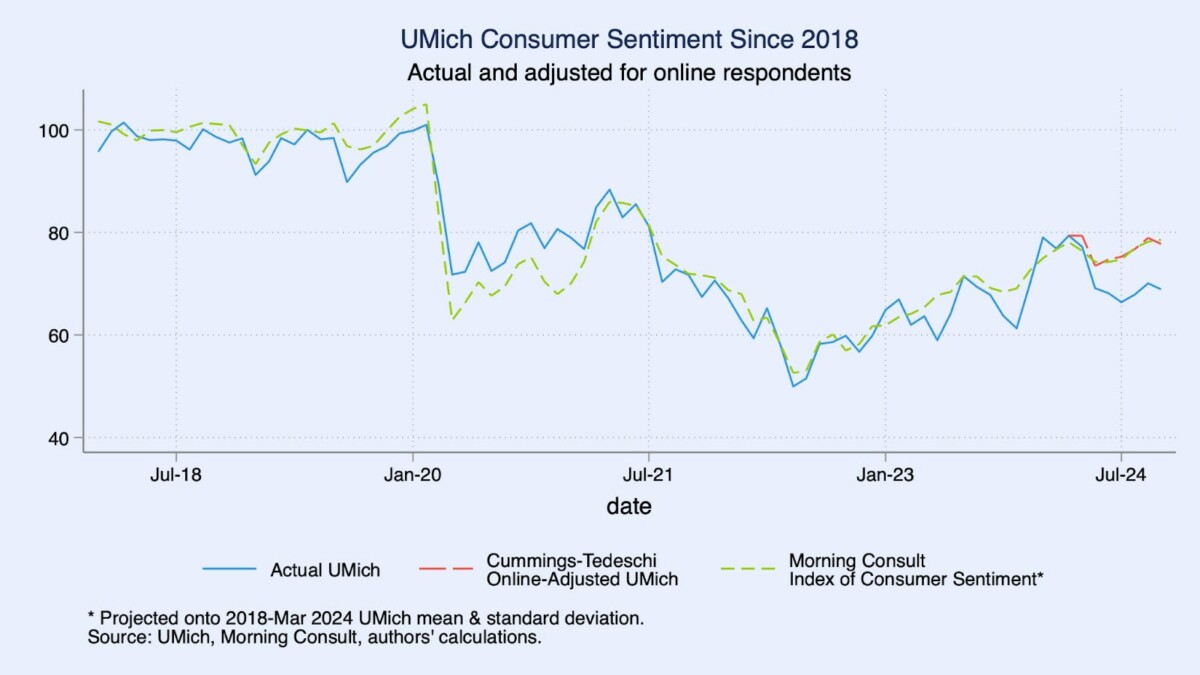

To show that the swap to on-line surveying has imparted a structural break within the UMich collection, they evaluate towards the Morning Seek the advice of collection.

Supply: Cummings and Tedeschi (2024).

The Morning Seek the advice of survey has been on-line, so it serves as a management. Therefore, the important thing cause for the shift in measured sentiment.

A cursory take a look at the weighted age distribution of cellphone and on-line assignments means that, no, they weren’t random in follow. For instance, on-line respondents have been extra more likely to be older in these transition months, which could have an effect on their sentiment responses. …

A extra formal multilevel logit mannequin–which measures the chance of a person being in a sure age cohort after accounting for different demographic elements–confirms this distinction. Respondents 65+ for instance had a 52 % probability of being within the on-line group in April-June, which is greater than twice as seemingly as respondents 18-24, and this distinction is statistically important …

I don’t understand how the larger presence of older respondents interacts with the partisan divide examined in this put up (are Republican/lean Republican voters older than corresponding Democratic/lean Democratic respondents?)

What I can say is that the adjusted Cummings-Tedeschi collection reveals much less proof of a structural break than the official UMichigan collection, when utilizing as regressors unemployment, y/y CPI inflation and the SF Fed information sentiment index.

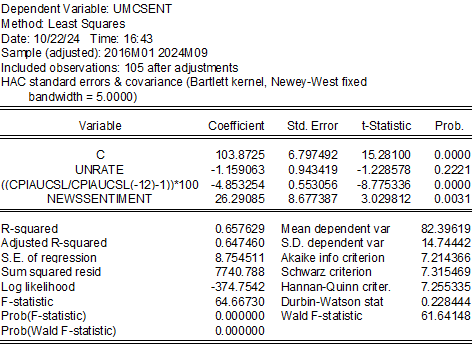

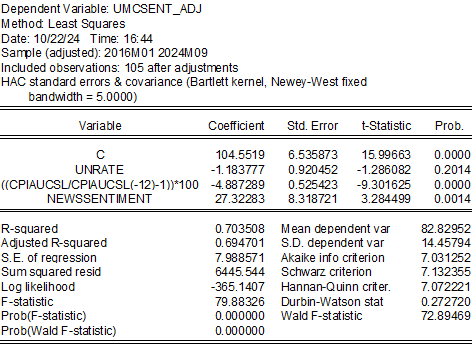

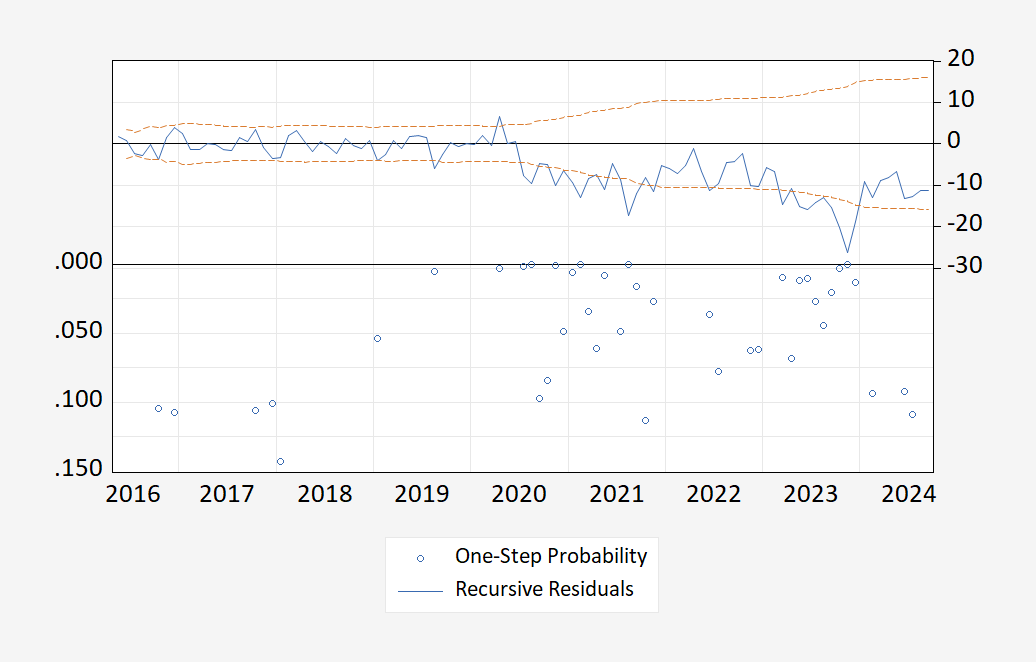

Take into account these two regressions, first with the official collection, and the second with the Cummings-Tedeschi adjusted collection:

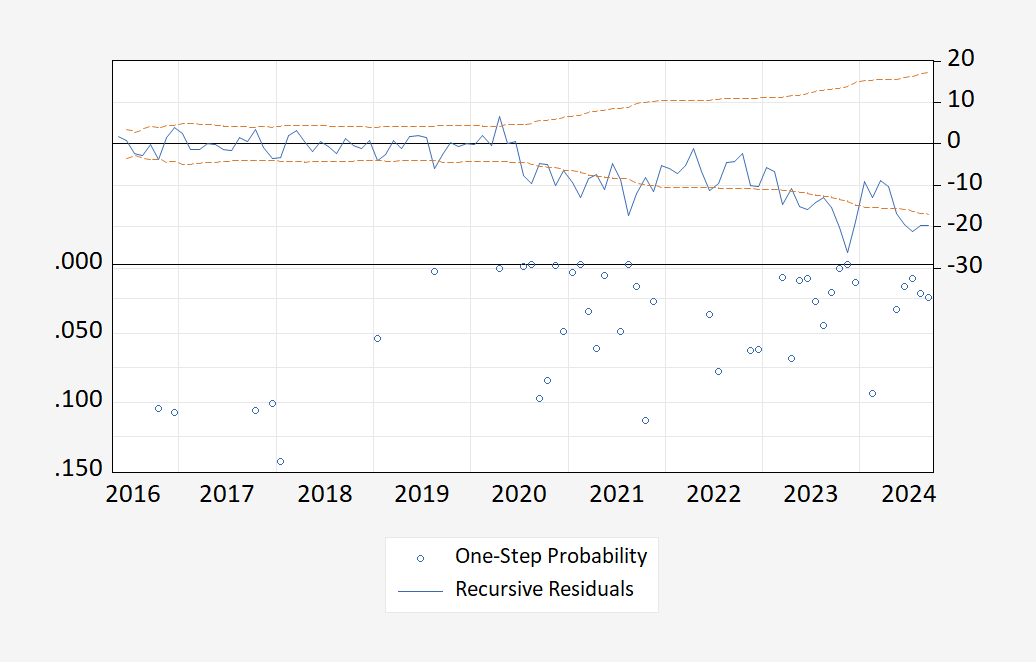

Now contemplate the respective recursive 1-step forward Chow assessments for stability.

Notice that whereas each regressions exhibit instability round 2020 and 2023, the Cummings-Tedeschi adjusted collection reveals no structural break in 2024 across the swap to on-line polling.

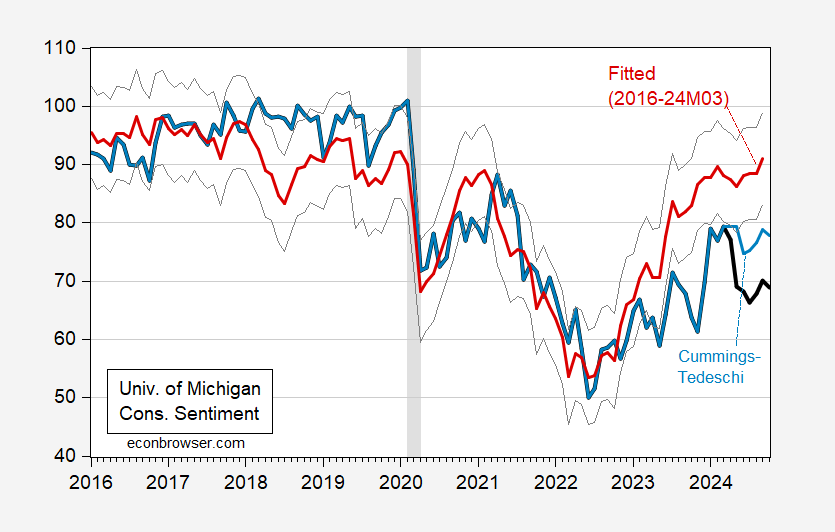

That being mentioned, the swap in survey strategies doesn’t totally clarify totally the hole between observables and sentiment. I estimate the regression over the 2016-2024M03 interval, and predict out of pattern for 2024M04-M10.

Determine 1: College of Michigan Client Sentiment (daring black), Cummings-Tedeschi adjusted collection (mild blue), fitted (purple), +/- one normal error (grey traces). NBER outlined peak-to-trough recession dates shaded grey. Supply: U.Michigan through FRED, BriefingBook, NBER and creator’s calculations.

So presumably lower than half of the hole is accounted for by the change in survey strategies.