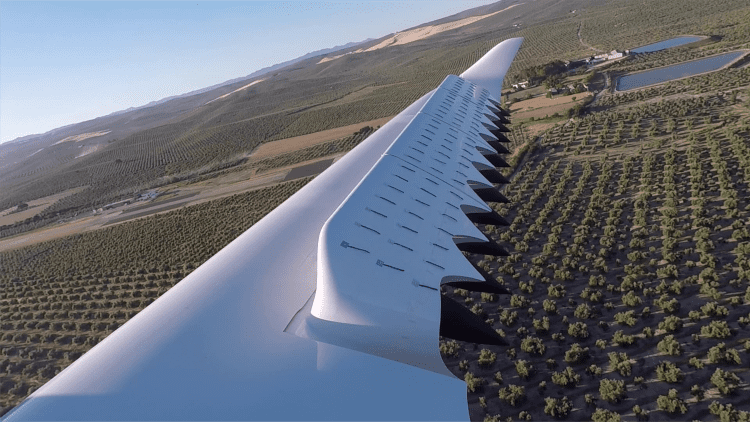

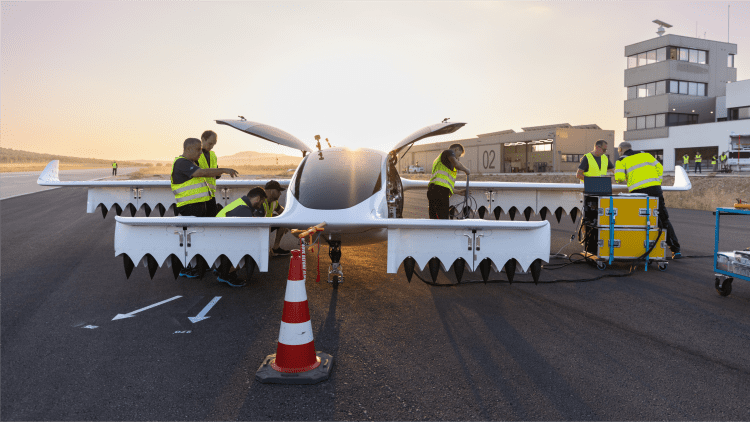

German firm Lilium produces flying electrical passenger drones.

Lilium

German aerospace startup Lilium faces insolvency if it does not increase emergency funding from the state authorities for the southeastern state of Bavaria.

Insolvency would mark a dramatic fall for a startup as soon as touted as Europe’s greatest probability at constructing the Twenty first-century equal of “cars” that may fly.

Lilium is one in all a sequence of companies attempting to construct “eVTOLs,” or electrical vertical take-off and touchdown, automobiles.

Popularly often called flying vehicles or air taxis, these automobiles are being developed by startups in america, Europe and Asia.

At the moment, nonetheless, Lilium is in hassle. The corporate is desperately attempting to boost taxpayer funds in Germany. And thus far, it has been unsuccessful.

What occurred?

Lilium has been negotiating an emergency capital injection with each Germany’s federal authorities and the Bavarian state authorities.

The agency had requested 50 million euros ($54 million) of loans from the federal authorities. Nevertheless, its request was rejected by German lawmakers.

In a regulatory submitting launched final week, Lilium stated it had “received indication that the budget committee of the parliament of the Federal Republic of Germany will not approve a €50 million guarantee of a contemplated €100 million convertible loan.”

The proposed state help would have been issued by KfW, the German state-owned improvement financial institution.

Lilium is “continuing discussions with the Free State of Bavaria with respect to a guarantee of at least €50 million,” Lilium added in its submitting.

A Lilium spokesperson advised CNBC the corporate does not plan to remark additional past the assertion outlined in its 6K submitting.

In response to Germany’s determination to disclaim Lilium state help, Hubert Aiwanger, Bavaria’s financial system minister, criticized the transfer, saying it was “regrettable” that the federal authorities opted to not help the agency.

Danijel Višević, co-founder of Berlin-based local weather expertise buyers World Fund, stated that although it was “understandable” lawmakers denied Lilium help over issues across the authorities supporting one single firm over one other, there was a misguided notion amongst politicians that air taxis are a “toy for millionaires.” This concept, he stated, was “too short-sighted.”

Višević urged it was unfair that U.S. electrical automotive producer Tesla — which burned by billions of {dollars} earlier than making a revenue — was as soon as capable of obtain a U.S. authorities mortgage, however Lilium was not.

What Lilium tried to construct

“Flying cars” maybe is not the appropriate time period. However what Lilium was finally attempting to convey to the world was a vertical take-off and touchdown plane that might fly folks from one metropolis to a different to ease congestion on the roads.

The corporate initially wished to roll out its personal digital “hailing” service that might have seen customers order rides on its jets from designated areas the place it might be potential for the car to take off and land.

Lilium subsequently determined to alter its enterprise mannequin.

Reasonably than develop the entire service by itself, the corporate opted to companion up with airways and airport operators, which might construct out the service product and infrastructure wanted to energy its ambitions.

Lilium’s jets can price as a lot as $9 million. The corporate additionally had a six-seater model in improvement, which might have set a purchaser again about $7 million.

Lilium struck main offers with the likes of Lufthansa in Germany and Saudia in Saudi Arabia. It additionally agreed a tie-up with Groupe ADP, a world airport operator based mostly in Paris.

Rise and fall

Based by 4 college college students in 2015, Lilium quickly gained a repute as one in all Europe’s best-funded air taxi companies.

The corporate managed to boost tons of of tens of millions of {dollars} from buyers together with China’s Tencent, Atomico and Earlybird.

In September 2021, Lilium went public on the Nasdaq by way of a merger with a particular goal acquisition firm known as SPAC Qell.

At its peak, Lilium was value as a lot as $3.3 billion. Its shares have tanked to lower than 50 cents — a greater than 95% plunge from its inventory market debut.

WATCH: eVTOLS: Are flying vehicles lastly changing into actuality?