On Tuesday, Bitcoin (BTC) exchange-traded funds (ETFs) skilled their first web unfavourable circulation in seven days. This comes amid the regular decline in market exercise, which has precipitated the main coin’s value to plummet to a weekly low.

As of this writing, Bitcoin trades at $66,776, noting a 2% value drop over the previous week. With bearish sentiment steadily rising across the coin, holders might have to organize for potential additional losses.

Bitcoin ETFs Document Outflows

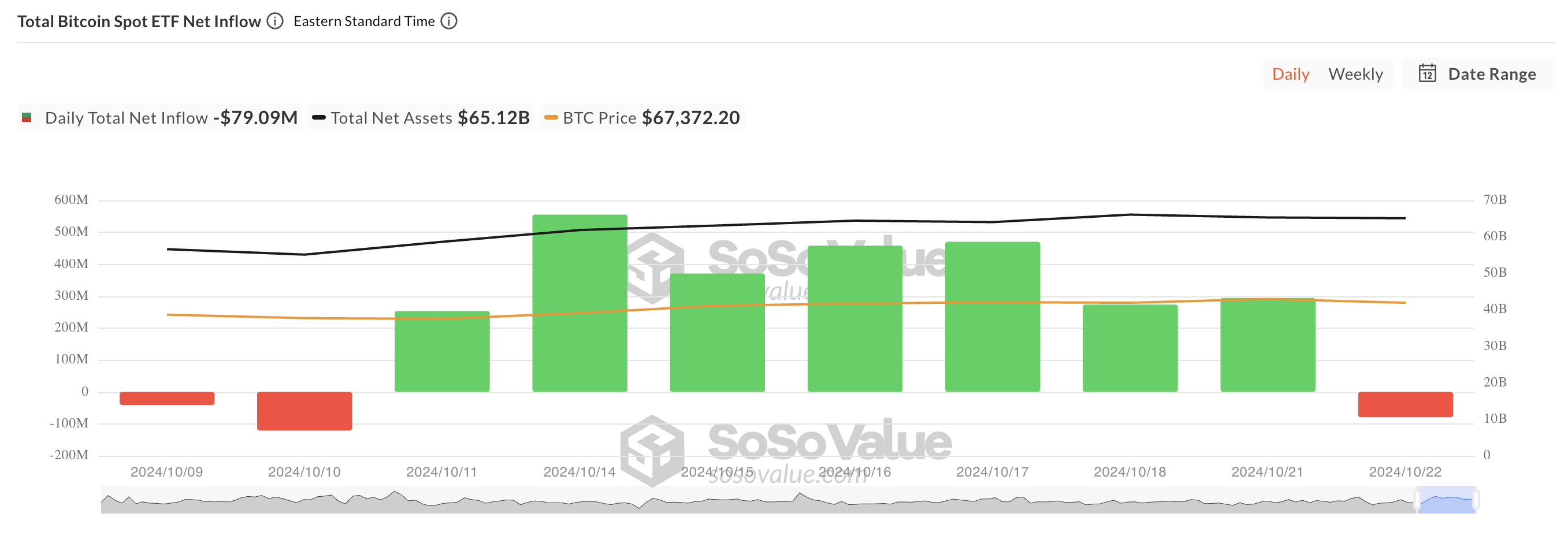

Information from SosoValue exhibits that BTC spot ETFs skilled a web outflow of $79.09 million on Tuesday, breaking a streak of seven consecutive days of inflows that totaled over $2 billion.

Learn extra: High 7 Platforms To Earn Bitcoin Signal-Up Bonuses in 2024

Tuesday’s unfavourable circulation was primarily as a consequence of a $134 million outflow from the ARK 21Shares Bitcoin ETF, as different ETF merchandise noticed both inflows or recorded no exercise. Moreso, the biggest ETF supplier by property underneath administration, BlackRock’s iShares Bitcoin ETF (IBIT), recorded $43 million in inflows, considerably down from $329 million the day past.

This decline in institutional demand is essentially attributed to the current drop in Bitcoin’s worth. Over the previous week, the cryptocurrency has fallen by 2%, reaching its lowest value level in seven days as of press time.

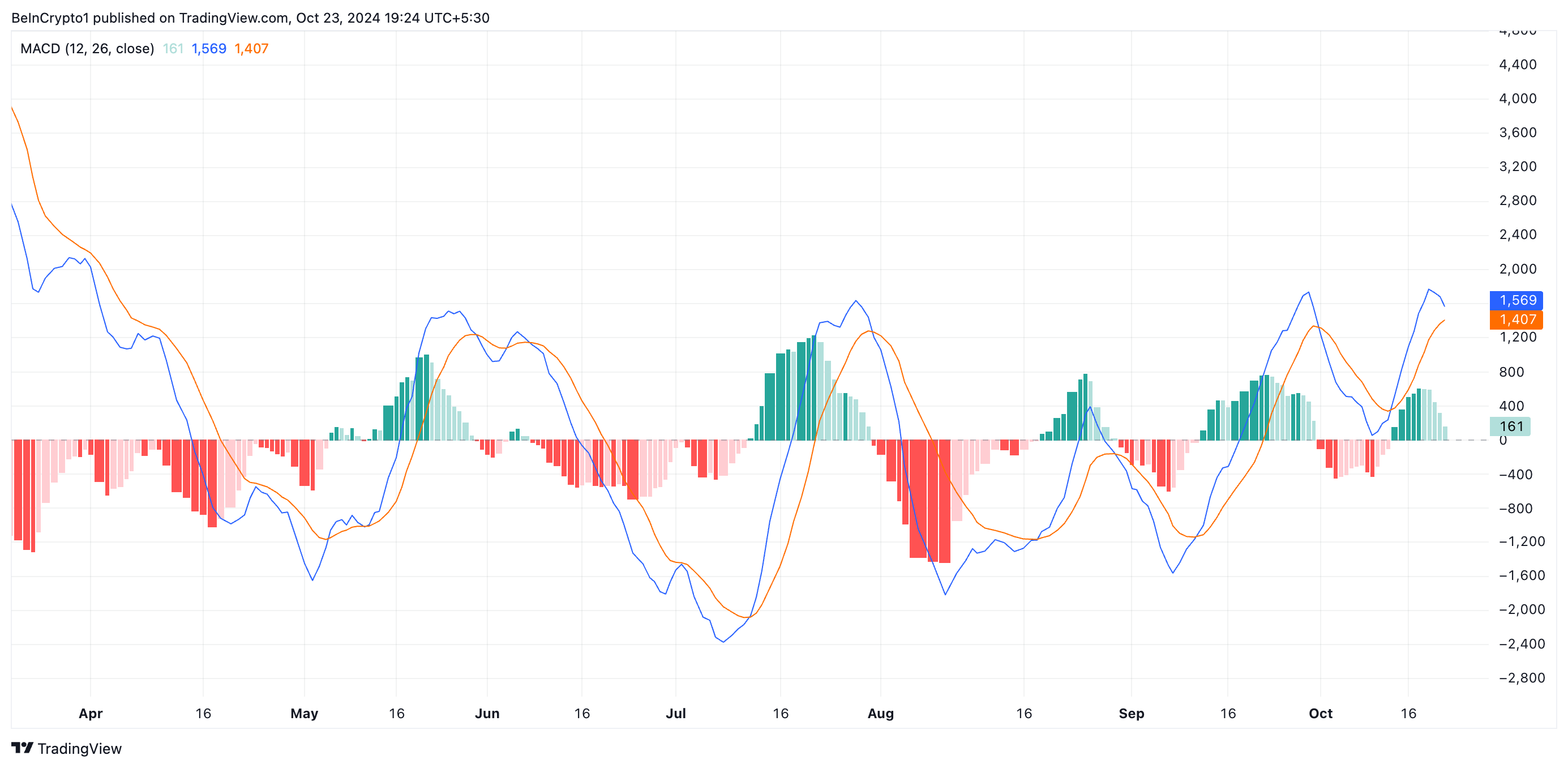

BeInCrypto’s evaluation of its momentum indicators has revealed the gradual progress in bearish sentiment towards the main coin. For instance, readings from its Transferring common convergence/divergence (MACD) present its MACD line (blue) poised to cross beneath its pattern line (orange).

This indicator measures an asset’s value tendencies and momentum and identifies potential purchase or promote alerts. When arrange this fashion, it confirms elevated promoting strain out there. The potential crossover means that the asset’s value momentum is weakening, and a downward pattern or correction might observe.

BTC Value Prediction: Coin Has Solely Two Choices

Bitcoin’s value is falling towards its 20-day exponential transferring common (EMA), which measures its common value over the previous 20 buying and selling days.

When an asset’s value falls towards this stage, it suggests the asset is pulling again however could discover help across the 20-day EMA. If the worth fails to carry above the 20-day EMA and breaks beneath it, this considerably will increase the opportunity of a pattern reversal. It means that bearish sentiment is rising, and additional draw back would possibly observe.

As of this writing, Bitcoin is buying and selling at $66,776. That is simply above the earlier resistance stage of $64,543, which it just lately flipped into help.

If the rising bearish sentiment causes this help to fail upon retest, Bitcoin’s value might drop towards its subsequent main help at $61,686. Ought to BTC bears break via this stage, the worth could plunge additional to $58,828.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

Nonetheless, if market sentiment improves and bullish momentum builds, Bitcoin might rally towards $68,612. Clearing this resistance would place BTC for a possible run to reclaim its all-time excessive of $73,794.

Disclaimer

In step with the Belief Mission pointers, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.