Ethereum (ETH) worth seems to be shifting inside a impartial vary, as indicated by a number of market metrics. The present Internet Unrealized Revenue/Loss (NUPL) worth indicators that the majority buyers are neither extremely worthwhile nor experiencing heavy losses.

This balanced sentiment suggests a mixture of cautious optimism and anxiousness however lacks the sturdy feelings that sometimes drive dramatic worth shifts. Mixed with the habits of bigger holders and key technical indicators, ETH may proceed its sideways motion within the brief time period.

ETH NUPL Is At present Impartial

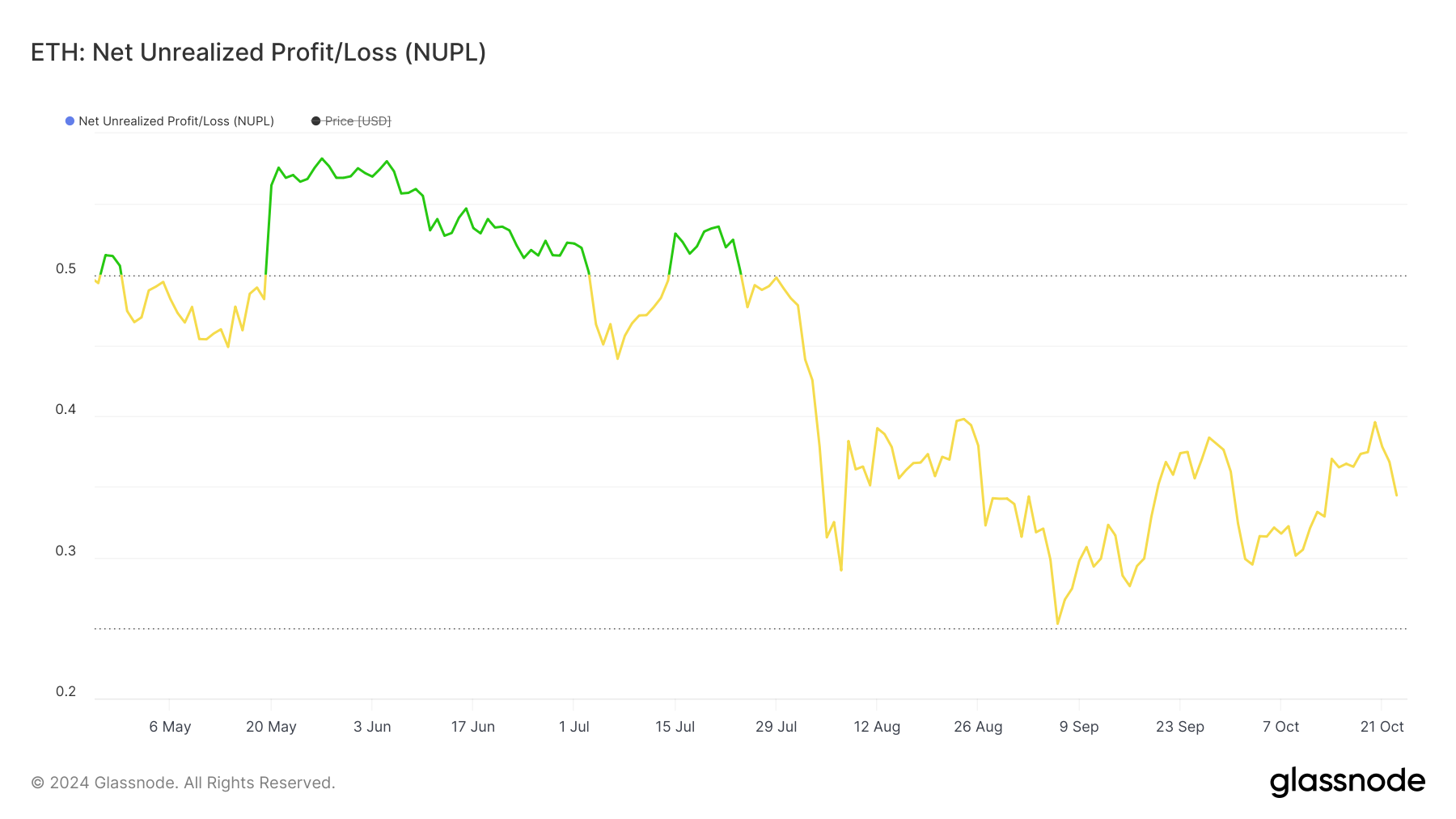

ETH’s NUPL is at present at 0.34, signaling a impartial market state. This worth suggests that the majority buyers are neither deeply in revenue nor in vital loss. It displays a balanced sentiment amongst holders, with a mixture of optimism and anxiousness however no excessive feelings that normally drive giant market actions.

Learn extra: Ethereum (ETH) Value Prediction 2024/2025/2030

NUPL, or Internet Unrealized Revenue/Loss, measures investor sentiment by evaluating unrealized positive aspects and losses. When NUPL is constructive, it signifies holders are in revenue, and when adverse, it indicators losses. A worth of 0.34 locations ETH within the ‘Optimism — Anxiety’ part, suggesting buyers really feel cautiously optimistic however are additionally cautious.

ETH is way from the extra excessive levels of ‘Hope — Fear’ or ‘Belief — Denial’, indicating a steady, impartial market situation. This neutrality factors to a possible sideways worth motion within the brief time period, as neither sturdy shopping for nor promoting strain is at present dominant.

Ethereum Whales Are Not Accumulating

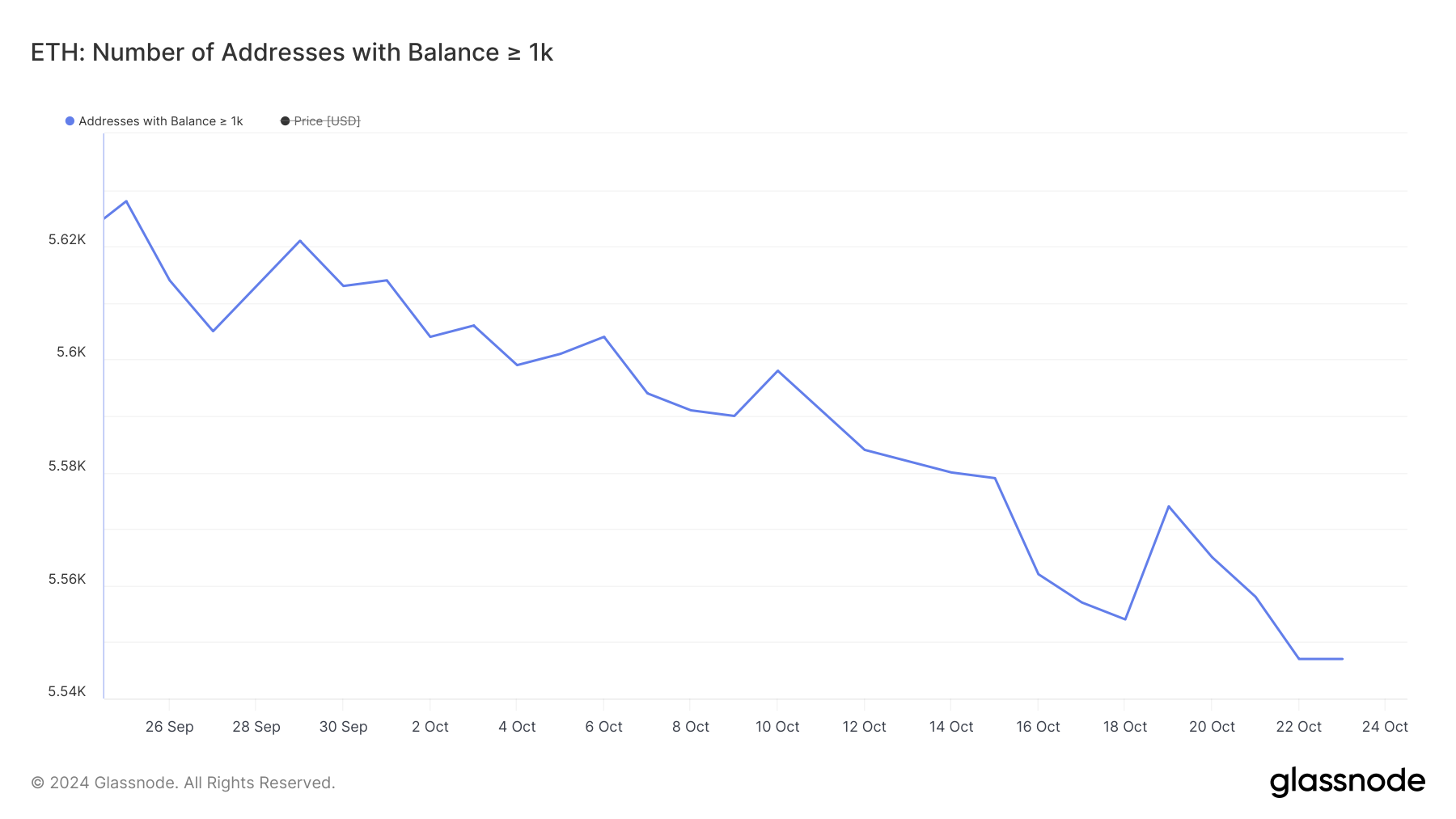

The variety of addresses holding a minimum of 1,000 ETH is declining, indicating that whales should not accumulating ETH. On September 25, there have been round 5,628 such addresses, and now this quantity has dropped to five,547. This regular lower suggests a insecurity amongst giant holders.

Monitoring these whale addresses is essential as a result of they’ll considerably affect market traits. When whales accumulate, it typically indicators optimism and may drive costs increased. Conversely, a decline exhibits hesitation or danger aversion.

The constant drop in whale addresses over the previous month implies that huge buyers should not assured sufficient to build up ETH presently. As a substitute, they could be reallocated to different belongings or ready for clearer indicators earlier than shopping for extra ETH.

ETH Value Prediction: Extra Sideways Actions Forward?

This Ethereum (ETH) chart shows a number of key shifting averages (EMAs) and potential help and resistance ranges. At present, ETH is buying and selling round $2,526, barely beneath a number of EMA traces, indicating downward strain.

That’s additionally bolstered by the truth that its short-term traces are happening. In the event that they cross beneath the long-term ones, this is able to create a bearish sign.

Learn extra: How one can Spend money on Ethereum ETFs?

The chart additionally highlights clear resistance ranges at $2,728 and $2,820, with earlier makes an attempt to interrupt these factors being unsuccessful. These ranges will must be breached convincingly to set off any sturdy bullish momentum. On the draw back, the help ranges are marked at $2,308 and $2,150, indicating areas the place consumers might step in.

The presence of those help and resistance ranges, together with the shortage of decisive motion round EMAs, means that ETH could proceed consolidating, with worth fluctuations inside the vary earlier than a transparent development develops.

Disclaimer

According to the Belief Mission pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your individual analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.