Ethereum’s (ETH) worth just lately skilled a ten% decline, with failed makes an attempt to ascertain $2,700 as a help stage. Regardless of these setbacks, the altcoin has managed to hover above the uptrend line for the previous two months, a feat largely sustained by strategic whale exercise.

With substantial property at play, these high-value traders would possibly maintain the important thing to a possible reversal.

Ethereum Holders Panic

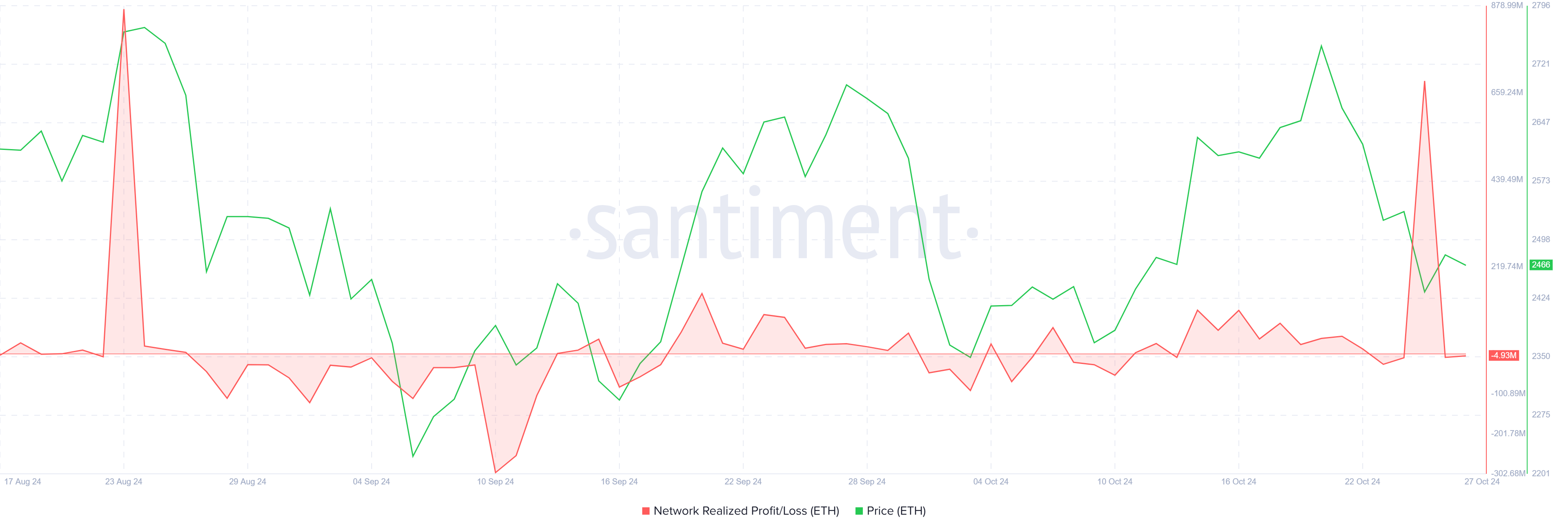

Ethereum just lately skilled a notable rise in profit-taking, marking the very best stage of realized income in two months. This surge signifies that quite a few ETH holders selected to money in on earlier good points, contributing to current worth fluctuations. The spike in promoting exercise coincides with a broader market decline, reflecting a defensive transfer by traders aiming to safe income amid a downturn.

This pattern may result in a sharp decline in ETH’s worth, heightening considerations and probably sparking a panic-driven sell-off. Such will increase in realized income usually counsel diminished short-term market confidence amongst traders.

Learn extra: Methods to Spend money on Ethereum ETFs?

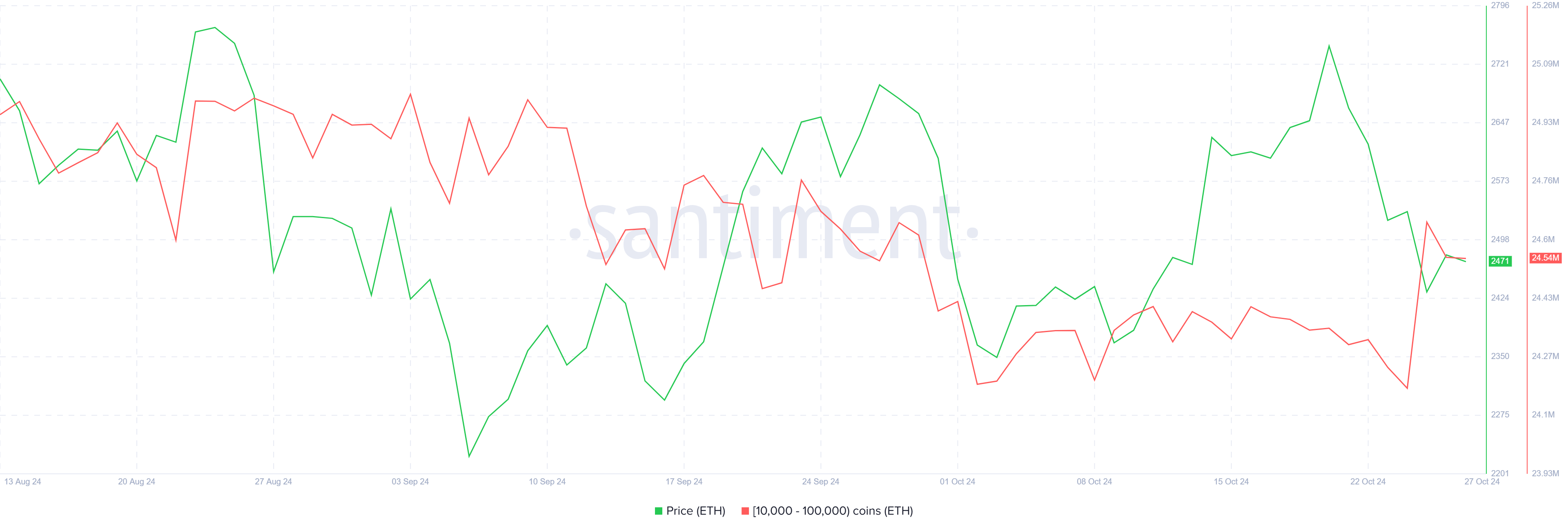

Amid the sell-off, whales are taking measures to counteract the drawdown. This group of high-value traders, notably these holding between 10,000 and 100,000 ETH, just lately gathered over 360,000 ETH, valued at greater than $880 million.

The buildup efforts by whales spotlight their strategic strategy and bolster broader market sentiment. Their actions display a vote of confidence in Ethereum’s long-term potential, at the same time as the value navigates by means of the present volatility. With whales capitalizing on decrease costs, there’s hope for extra steady help ranges, a minimum of quickly.

![]() ETH Worth Prediction: Not Repeating Historical past

ETH Worth Prediction: Not Repeating Historical past

Ethereum’s current 10% decline has introduced it precariously near the uptrend line, testing this stage as help. The downturn adopted a sequence of failed makes an attempt to interrupt above $2,700, inserting the altcoin’s present worth underneath vital stress. This fourth failed try has elevated ETH’s vulnerability, though the uptrend line continues to supply a semblance of stability.

At present, ETH’s quick goal is to flip the native resistance at $2,546 into help. Reaching this would offer Ethereum with a robust basis for one more try to breach the $2,698 mark, setting the stage for a transfer above $2,700. Reclaiming this stage as help would mark a notable shift in sentiment, signaling the potential for additional good points.

Learn extra: Ethereum (ETH) Worth Prediction 2024/2025/2030

Nonetheless, failure to breach $2,546 or a renewed wave of promoting may jeopardize ETH’s place alongside the uptrend line. Dropping this help may drive Ethereum’s worth right down to $2,344, invalidating any bullish-neutral outlook and ushering in a extra cautious sentiment throughout the market.

Disclaimer

According to the Belief Venture pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.