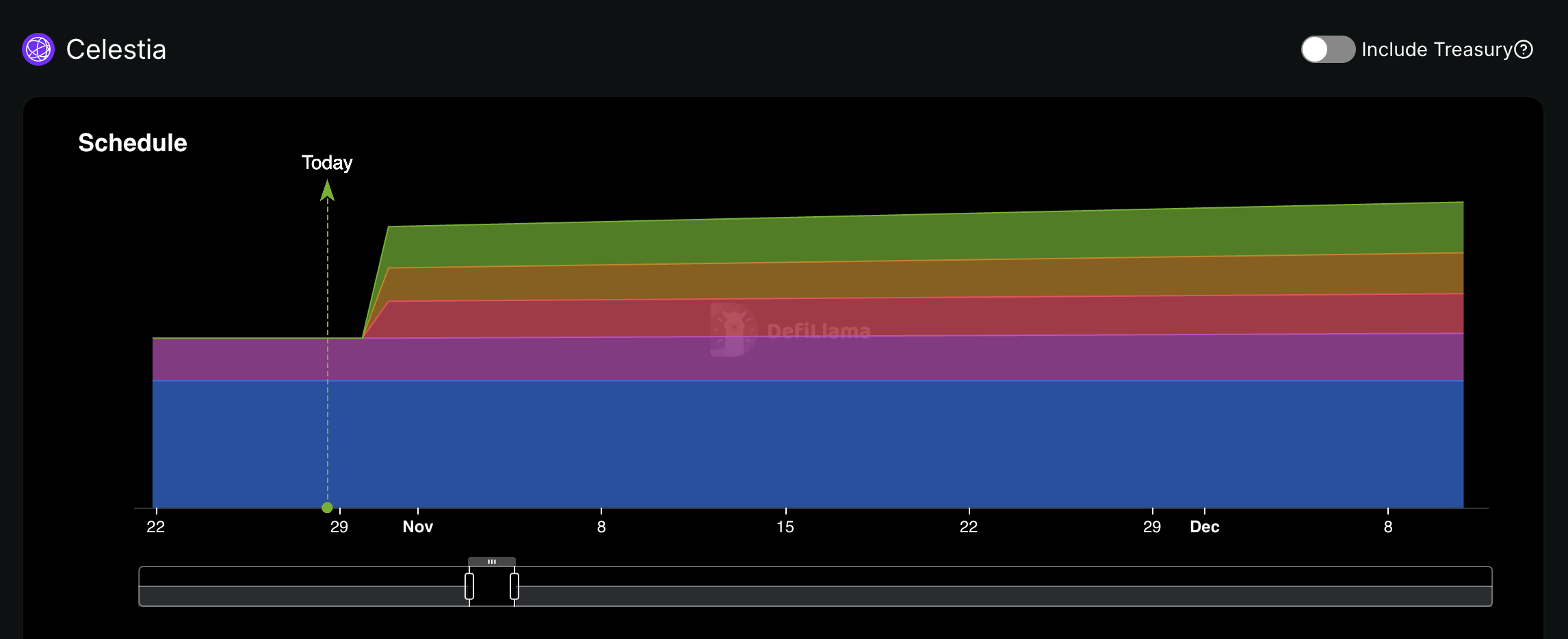

Celestia (TIA) value faces important challenges within the coming days as a number of elements align to affect its motion. The upcoming token unlock occasion, which is able to introduce a considerable quantity of recent provide, might heighten promoting strain and add volatility.

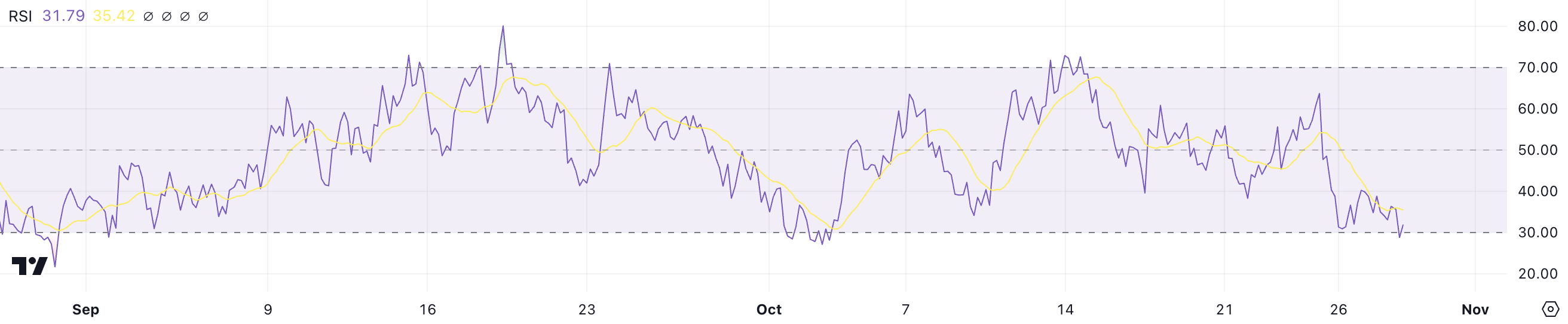

Current RSI actions point out a slight enchancment in market momentum, however the indicator stays near oversold territory. Moreover, the EMA traces proceed to sign a bearish development, suggesting that the worth might face resistance in any upward transfer amidst the looming provide enhance.

TIA Token Unlock Might Affect Its Value In The Subsequent Few Days

This week marks a big shift for TIA, with 73.3% of its circulating provide set to enter the market. On October 30, 175 million TIA tokens, valued at roughly $859 million at present costs, will likely be unlocked.

Following this substantial launch, TIA will proceed a each day unlock of about 950,000 tokens, steadily increasing its circulating provide over time.

Learn extra: 10 Greatest Altcoin Exchanges In 2024

Given TIA’s complete provide of 1 billion tokens, the upcoming launch of 175 million tokens represents an enormous enhance, about 17.5% of the overall provide. This sudden inflow might considerably influence TIA value, particularly within the brief time period.

A big enhance in provide with no corresponding rise in demand might result in elevated promoting strain, as recipients of the unlocked tokens could select to promote. Such a state of affairs would possibly lead to a value drop because the market absorbs this sudden enhance in circulating tokens.

Celestia RSI Is Again From Oversold

TIA’s Relative Power Index (RSI) has risen to 31.79 from 29 only a day in the past, indicating a slight shift in market momentum. This current enhance exhibits that some shopping for exercise has occurred, decreasing the downward strain and signaling a possible stabilization.

RSI is a momentum oscillator that ranges from 0 to 100 and is used to gauge whether or not an asset is overbought or oversold. Sometimes, an RSI beneath 30 signifies an oversold situation, whereas above 70 suggests an overbought one. The present TIA RSI of 31.79, whereas nonetheless close to oversold territory, signifies that promoting strain could have eased barely.

Given the upcoming token unlock, when 175 million TIA tokens will enter the market, this enhance in provide might push RSI again into oversold ranges. The inflow of tokens would possibly result in heightened promoting strain, additional negatively impacting value.

TIA Value Prediction: A Potential 24% Correction Forward?

Presently, the TIA value is buying and selling beneath all 4 EMAs, indicating bearish momentum. The crossover of the shorter EMAs beneath the longer EMAs exhibits a strengthening downward development.

The separation between the EMAs additional means that bearish strain is rising, and there was little proof of a reversal try thus far.

Learn extra: 11 Cryptos To Add To Your Portfolio Earlier than Altcoin Season

The blue traces above the present value point out resistance ranges round $5.73, $6.50, and $6.89, that are important hurdles for the worth to beat in any bullish transfer.

On the draw back, instant help ranges are marked in purple at $4.68 and $4.47. If promoting strain continues and the TIA unlocks drive the worth down, TIA might fall again to $3.72. That will signify a possible 24% value correction.

Disclaimer

According to the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.