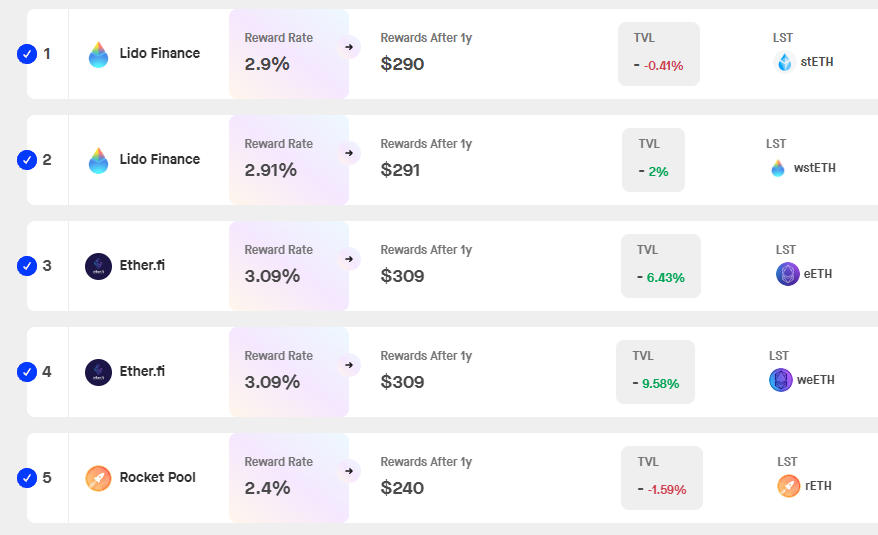

The Ethereum community maintained a staking rewards charge close to 3% within the third quarter of 2024, exhibiting a slight decline from over 3.5% earlier this 12 months.

This yield stays nicely under that of different in style proof-of-stake networks, resembling Cosmos, Polkadot, Celestia, and Solana. Staking rewards for these competing networks vary between 7% and 21%.

Ethereum Continues to Underperform within the Bull Market

Decrease staking rewards impression Ethereum’s ecosystem in two methods. Whereas diminished yields assist curb inflation on the community, which may attraction to long-term holders, in addition they discourage some new or present validators searching for extra aggressive returns.

Learn Extra: Ethereum Restaking – What Is it and How Does it Work?

In response to Kaiko Analysis, the community’s validator queue averaged lower than a day not too long ago, a notable shift from its peak wait time of 45 days in June 2023. Though this quick wait time makes staking extra accessible, it additionally indicators weaker demand for staking exercise.

The day by day depend of Ethereum validators awaiting entry has declined sharply, marking a considerable drop from over 95,000 in April 2023 to solely 473 presently.

This pattern suggests a cooling curiosity amongst potential validators, which may problem the community’s capacity to maintain a robust validator neighborhood if the pattern persists.

Amid the broader bull market, Ethereum’s current efficiency lags. Each Bitcoin and Solana noticed over 6% good points prior to now week, whereas ETH’s progress remained flat.

Moreover, in accordance with DeFiLlama information, Solana generated $25.48 million in community charges final week, surpassing Ethereum’s $22.13 million.

Ethereum reserves on exchanges have additionally decreased, with a drop from over $42 billion to roughly $38.9 billion. This diminished provide on exchanges may assist value stability or progress if demand strengthens.

Learn Extra: 9 Cryptocurrencies Providing the Highest Staking Yields (APY) in 2024

“Solana’s fee model has made it such that only people who want to access very competitive apps pay fees for those apps, while other users are largely unaffected,” crypto enterpreneur Mert Mumtaz wrote in a current X (previously Twitter) put up.

Regardless of these shifts, long-term ETH holders proceed to precise confidence within the asset’s future worth, contrasting with a extra cautious strategy from short-term buyers.

Disclaimer

All the knowledge contained on our web site is printed in good religion and for common info functions solely. Any motion the reader takes upon the knowledge discovered on our web site is strictly at their very own danger.