Bitcoin doesn’t require a U.S. greenback crash to grow to be a six-figure asset class, Bitwise CIO Matt Hougan opined on X.

Bitcoin (BTC) has usually been hailed as a hedge in opposition to the greenback’s declining buying energy and as a possible beneficiary of an enormous fiat implosion.

Some proponents have advised that Bitcoin wants a greenback collapse to succeed in $200,000 per BTC and past. Nonetheless, Hougan argued that this assumption is inaccurate for 2 foremost causes: rising demand for store-of-value belongings and protracted authorities spending.

In response to the Bitwise govt, these elements reinforce investor conviction once they spend money on Bitcoin. Hougan additional argued that store-of-value markets have gained momentum on account of “governments abusing their currencies.”

As an example, U.S. spending has accelerated in recent times, and the nation’s debt has surpassed $35 trillion. Analysts estimate the nationwide debt grows by about $1 trillion each 100 days at its present tempo.

Moreover, Limitless Funds CIO Bob Elliott cited information indicating that “developed world sovereign debt,” reminiscent of U.S. Treasuries, might now not successfully function bailout mechanisms, doubtlessly supporting a pro-Bitcoin outlook.

Hougan expects this sample to proceed, resulting in extra mature BTC markets, elevated adoption, and better costs for the main cryptocurrency.

So, no, the greenback doesn’t have to collapse for bitcoin to hit $200k. All you want is Bitcoin to proceed on its present path of maturing as an institutional asset. Nevertheless it’s more and more wanting like each components of the argument will come true. That’s why Bitcoin is surging towards all-time highs.

Matt Hougan, Bitwise CIO

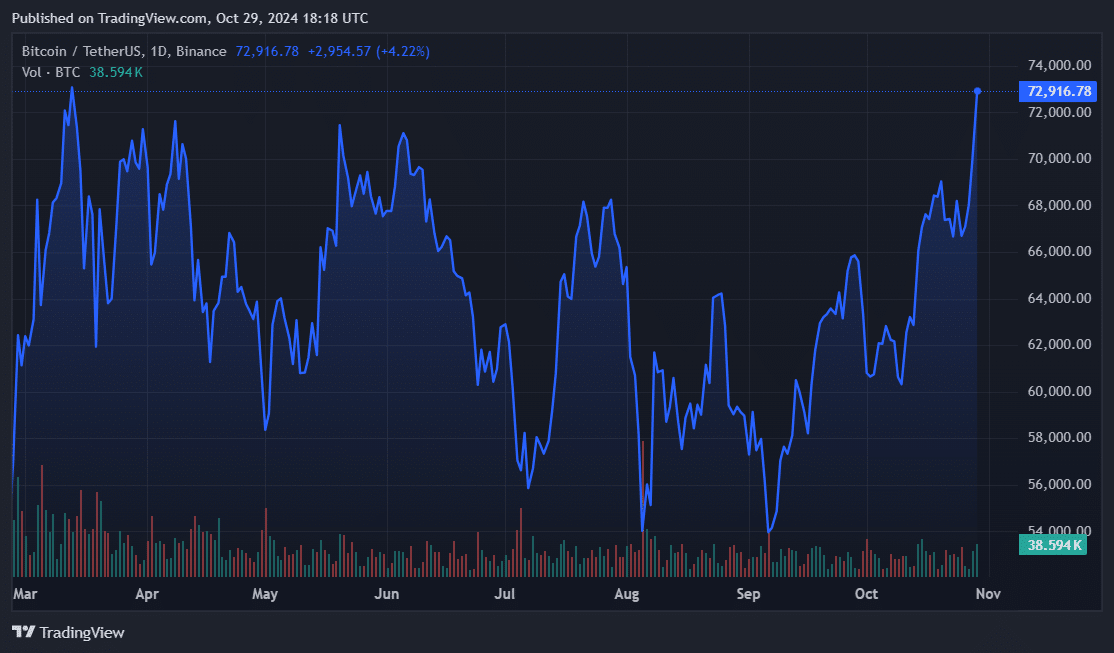

Hougan’s remarks got here on Oct. 29, as BTC rallied nearer to its all-time excessive set in March. BTC rose 5% within the final 24 hours, reaching $72,756. Whereas technical indicators pointed to a possible Bitcoin breakout, historic patterns warn of volatility as U.S. residents put together to vote within the upcoming presidential election.