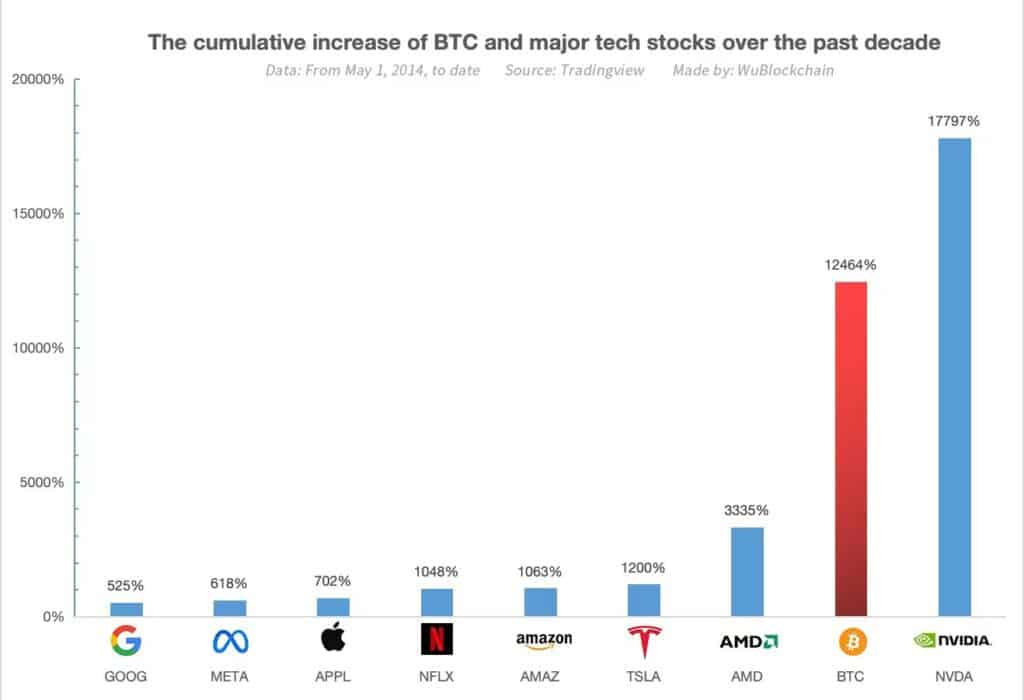

Bitcoin, crypto’s high token, outperformed equities from tech giants like Amazon, Google, and Netflix over the earlier 10 years.

Regardless of solely debuting 15 years in the past, Bitcoin (BTC) has efficiently competed with the most important names within the expertise business.

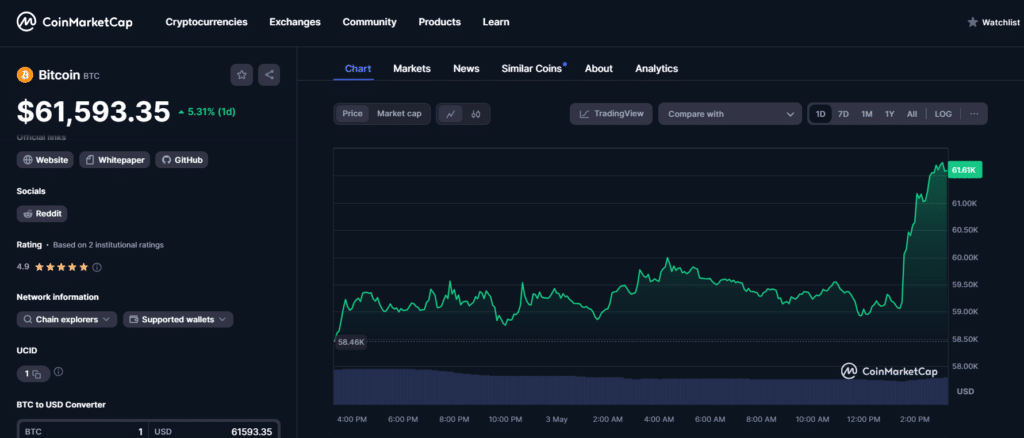

On the shut of 2014, a BTC value about $378. Not too long ago, digital belongings have been largely in a downturn, and BTC modified arms 16% beneath its all-time excessive set in March, at $61,500 per token worth at press time, per CoinMarketCap.

Bitcoin ranked second amongst tech investments

TradingView knowledge confirmed that GPU maker Nvidia was the one tech heavyweight to outclass BTC over the previous 10 years. Nvidia’s inventory NVDA has returned a cumulative 17,797%, towards Bitcoin’s 12,464%.

Semiconductor producer Superior Micro Gadgets (AMD) adopted in third with a 3,335% worth enhance. A 1,200% enhance within the inventory worth of Elon Musk’s Tesla (TSLA) positioned the corporate fourth, and Jeff Bezos’ Amazon accomplished the highest 5 with a 1,063% achieve. Different Silicon Valley gamers noticed included Netflix (NFLX), Apple (APPL), Meta (META), and Google (GOOG).

What’s subsequent for BTC?

Final month, a hardcoded on-chain shift designed by BTC creator Satoshi Nakamoto went reside, slashing block mining rewards by 50% and straining miner revenues. The Bitcoin halving maintains shortage by curbing token inflation, introducing a contemporary provide dynamic to the market.

Traditionally, a market lull follows the halving and costs stagnate for a while earlier than rising larger. Speculators surmised that the development may change within the short-term throughout this cycle, however an knowledgeable advised crypto.information that the long-term influence outweighs rapid worth motion.

DCL.Hyperlink Partnerships Lead Peter M. Moricz stated BTC miners should undertake a extra energy-efficient strategy and hedge operations to cowl bills. One miner, Stronghold Digital Mining, is assessing its choices to remain afloat, together with promoting its enterprise to most shareholder worth.

Moricz argued {that a} main concern is mining centralization, fairly than income. As extra entities consolidate companies and attainable mergers happen, the danger of presidency affect will increase, and “this is the main concern for the BTC ecosystem going forward,” Moricz defined.

Concerning worth motion, the monetary markets veteran remarked that larger BTC costs are inevitable regardless of skepticism from some Wall Avenue stalwarts.

“The BTC ETF has pulled all the value motion ahead fairly than after the halving. Even then, the historic sample confirmed that every worth motion was decrease than 4 years prior. BTC rallied for the previous 7 months, ever because the BlackRock BTC ETF utility was rumored, and with IBIT pulling in a file amount of cash for any ETF, the steam had run out for now.

A correction, with some sideway buying and selling, will give a wholesome marketplace for the following leg up. BTC shortage is actual – there are solely 21 million BTC on the market it doesn’t matter what Jamie Dimon says.”

Peter M. Moricz, DCL.Hyperlink Partnerships Lead