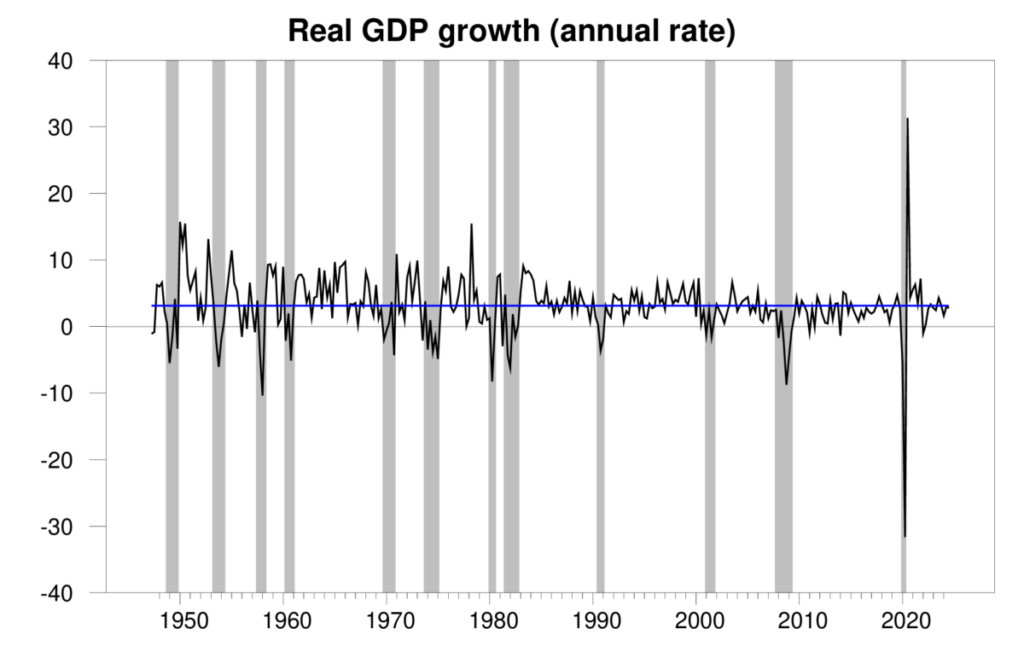

The Bureau of Financial Evaluation introduced right this moment that seasonally adjusted U.S. actual GDP grew at a 2.8% annual price within the third quarter. That’s near the long-run historic common of three.1%. With inflation coming down, I feel we now can declare that the Fed has achieved the admirable however troublesome goal of a “soft landing” — bringing inflation down with out tipping the U.S. into recession.

Quarterly actual GDP progress at an annual price, 1947:Q2-2024:Q3, with the historic common (3.1%) in blue. Calculated as 400 instances the distinction within the pure log of actual GDP from the earlier quarter.

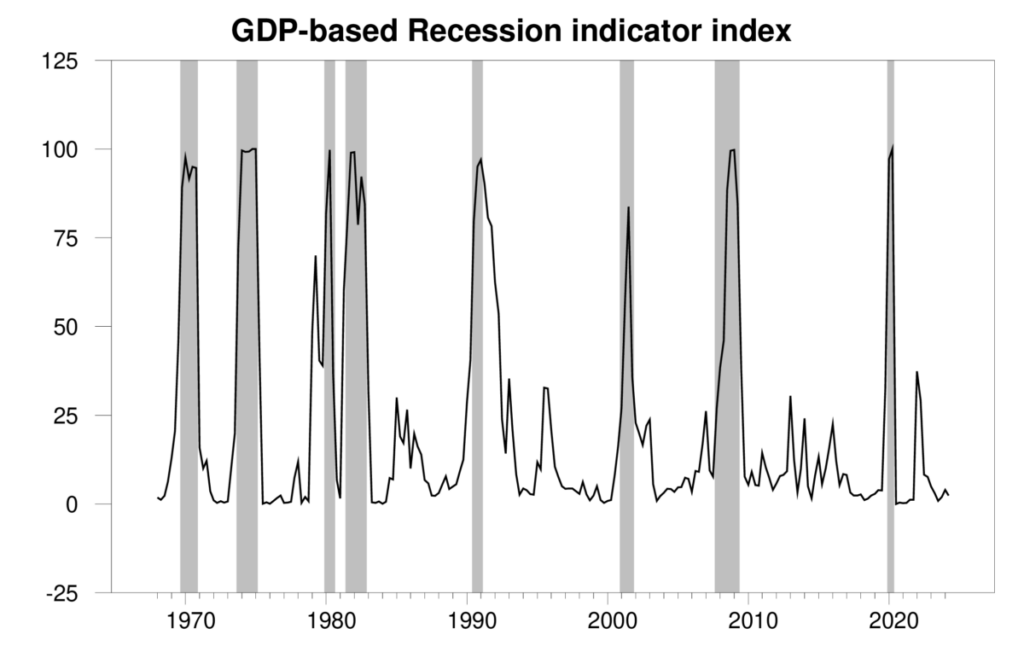

The brand new numbers put the Econbrowser recession indicator index at 2.4%. That’s fairly a low quantity, and indicators an unambiguous continuation of the financial enlargement that started in 2020:Q3.

GDP-based recession indicator index. The plotted worth for every date is predicated solely on the GDP numbers that have been publicly out there as of 1 quarter after the indicated date, with 2024:Q2 the final date proven on the graph. Shaded areas characterize the NBER’s dates for recessions, which dates weren’t utilized in any approach in establishing the index.

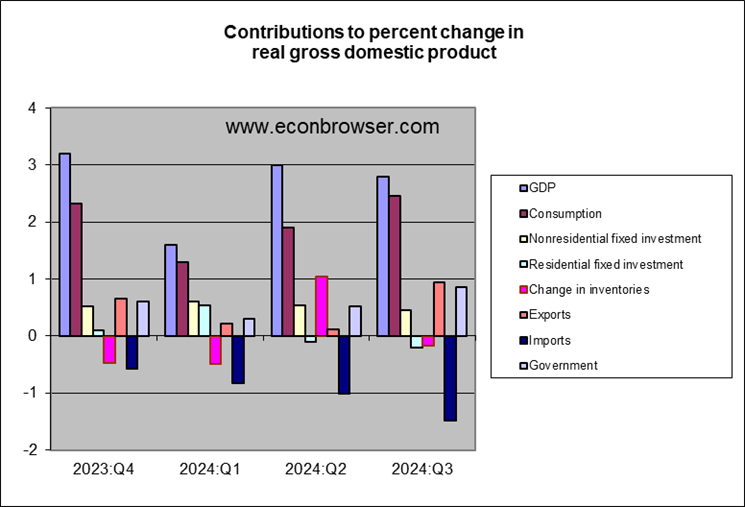

GDP progress was led by robust spending by shoppers, who appear to be regaining confidence as employment progress continues robust. Third-quarter GDP was additionally boosted by an enormous enhance in authorities spending related to navy help to Israel and Ukraine. A surge in imports, that are subtracted from GDP, held GDP progress again. Slower new house building additionally subtracted from GDP progress, however to not the diploma that we’d see if the Fed had engineered an enormous housing crunch.

Markets additionally breathed a sigh of reduction this week that the navy battle within the Center East doesn’t look (for now) as if it’s going to result in an enormous disruption in oil manufacturing or delivery. All this is sufficient to convey a smile again to the face of our Little Econ Watcher.

For now.