Two crypto corporations, dYdX and ConsenSys, have introduced a brand new spherical of layoffs. What’s taking place, and why are American regulators being blamed for this?

Antonio Juliano, the CEO of the decentralized derivatives change dYdX, introduced a 35% layoff. He thanked the previous staff for his or her work and defined the layoffs as the necessity to “revitalize” the change since, in its present kind, it’s “different from the company dYdX must be.”

“I have seen this over and again, and it will continue. What we are building is much larger than just a company, and this you will always be a part of.”

Notably, the layoffs at dYdX got here shortly after ConsenSys minimize its workers by 20%. ConsenSys CEO Joseph Lubin cited unfavorable macroeconomic circumstances, uncertainty over crypto regulation within the U.S., and the price of a authorized battle with the Securities and Change Fee (SEC).

On the identical time, Lubin referred to as the corporate’s monetary place steady.

In accordance with him, ConsenSys will give attention to its core income drivers, which aligns with its beforehand adopted technique. The corporate’s flagship merchandise, MetaMask and Linea, the second-layer Ethereum community, will function the idea for additional growth.

As well as, ConsenSys CEO stated that the laid-off staff will obtain assist after leaving the corporate, particularly, severance pay relying on the size of service, help with future employment, and expanded well being advantages.

Lubin additionally advised Fortune that the layoffs will have an effect on about 162 of the 828 staff working from all divisions at Consensys. Now, ConsenSys has now turn into the chief in layoffs in 2024, in accordance with layoffs.fyi.

Why the SEC is once more the wrongdoer of all of the worst?

Within the layoff assertion, Lubin cited the SEC as one of many the explanation why he’ll minimize workers. In June, the regulator sued the developer of the MetaMask pockets, noting that the corporate violated the regulation by the MetaMask Staking service.

The lawsuit comes shortly after ConsenSys filed a lawsuit in opposition to the SEC and 5 of its unnamed staff over its “oversight of ETH,” asking the courtroom to formally approve language that will not classify the asset as a safety.

Because of this, the SEC’s Division of Enforcement closed its investigation into Ethereum 2.0. The company took this step after the group despatched a letter asking for clarification on the asset class when approving the spot Ethereum ETF. Nevertheless, the lawsuit over the SEC’s allegations is ongoing, leaving ConsenSys dealing with authorized prices.

The layoffs come at a time when the market is bucking developments

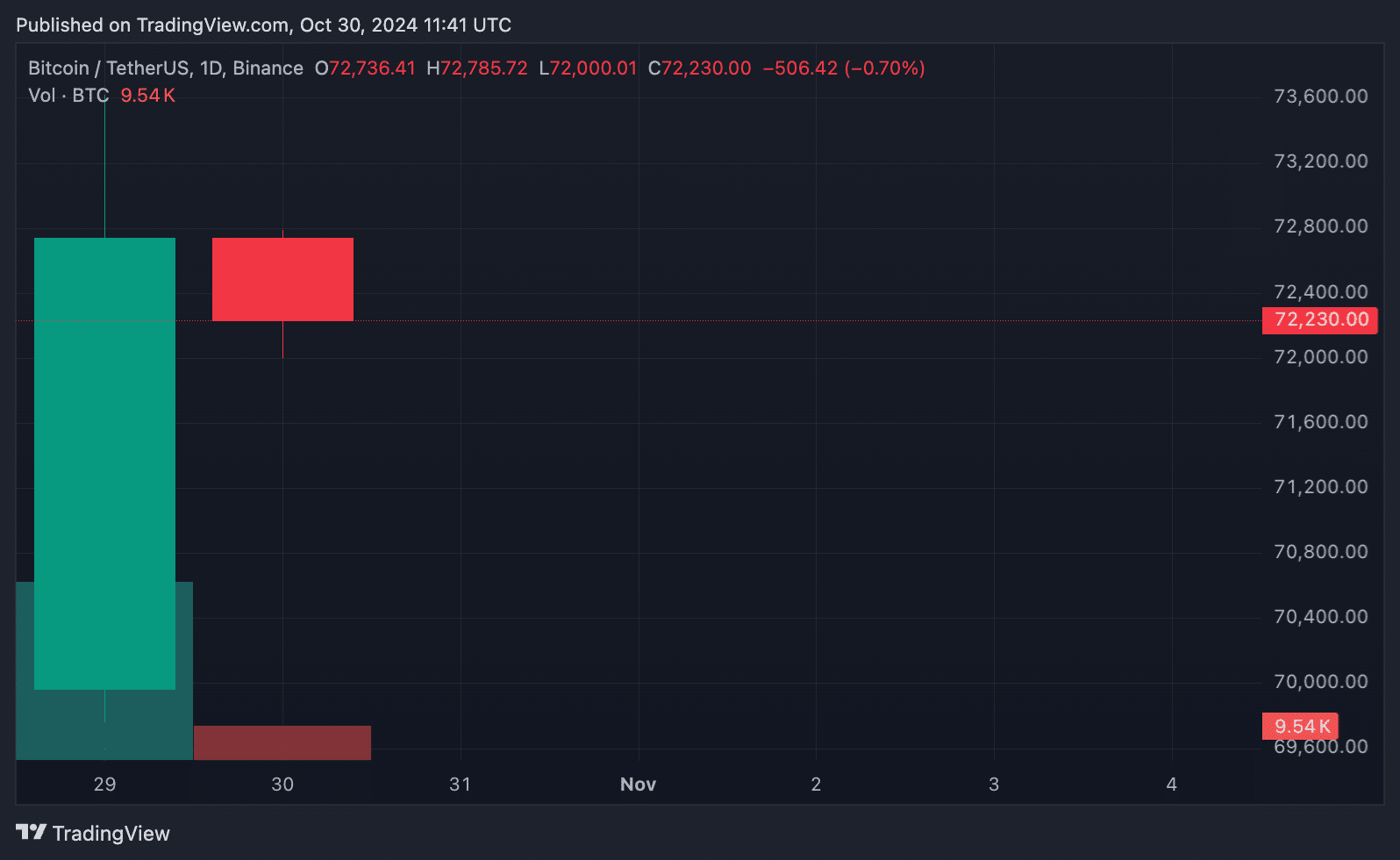

Notably, the crypto market was booming on the time of the layoff announcement, which is usually thought of an excellent time for crypto corporations. Thus, on Oct. 29, the Bitcoin (BTC) fee grew from $70,000 to only over $73,600, approaching the historic most of $73,777. For the reason that starting of the month, the cryptocurrency’s worth has grown by 12%. Analysts affiliate this development with forecasts for the U.S. presidential election.

Apparently, the expansion of Bitcoin can also be defined by the state of affairs within the U.S., which the CEO of ConsenSys beforehand complained about, explaining the layoffs.

The expansion within the worth of Bitcoin is because of a number of components. Particularly, curiosity in Bitcoin ETFs from giant corporations resembling BlackRock is rising, which attracts important investments. Not too long ago, the U.S. noticed an inflow of $2.7 billion into Bitcoin ETFs, which helped entice new buyers and lift the worth.

As well as, the will to guard in opposition to inflation considerably impacts the market. Towards a weakening greenback and rising inflation, many buyers are turning to restricted belongings resembling Bitcoin to protect their financial savings.

dYdX cuts workers whereas rivals achieve momentum

For the reason that starting of the yr, the crypto market has been recovering from an extended crypto winter, with many exchanges ramping up their development. In accordance with Bloomberg, Crypto.com, Binance, Coinbase, Gemini, and Kraken are hiring as cryptocurrencies like Bitcoin rise—not dYdX, although.

When asserting the workers discount, Juliano talked about that in its present kind, the change is totally different from what it must be, with out specifying what precisely he meant. Nevertheless, additional growth would require human capital able to reviving the platform. Due to this fact, asserting a 35% workers discount in opposition to the backdrop of crypto exchanges making an attempt to get probably the most out of the present rally appears illogical, to say the least, however Juliano is hardly anxious about FOMO.

How the dynamics of layoffs within the crypto business have modified?

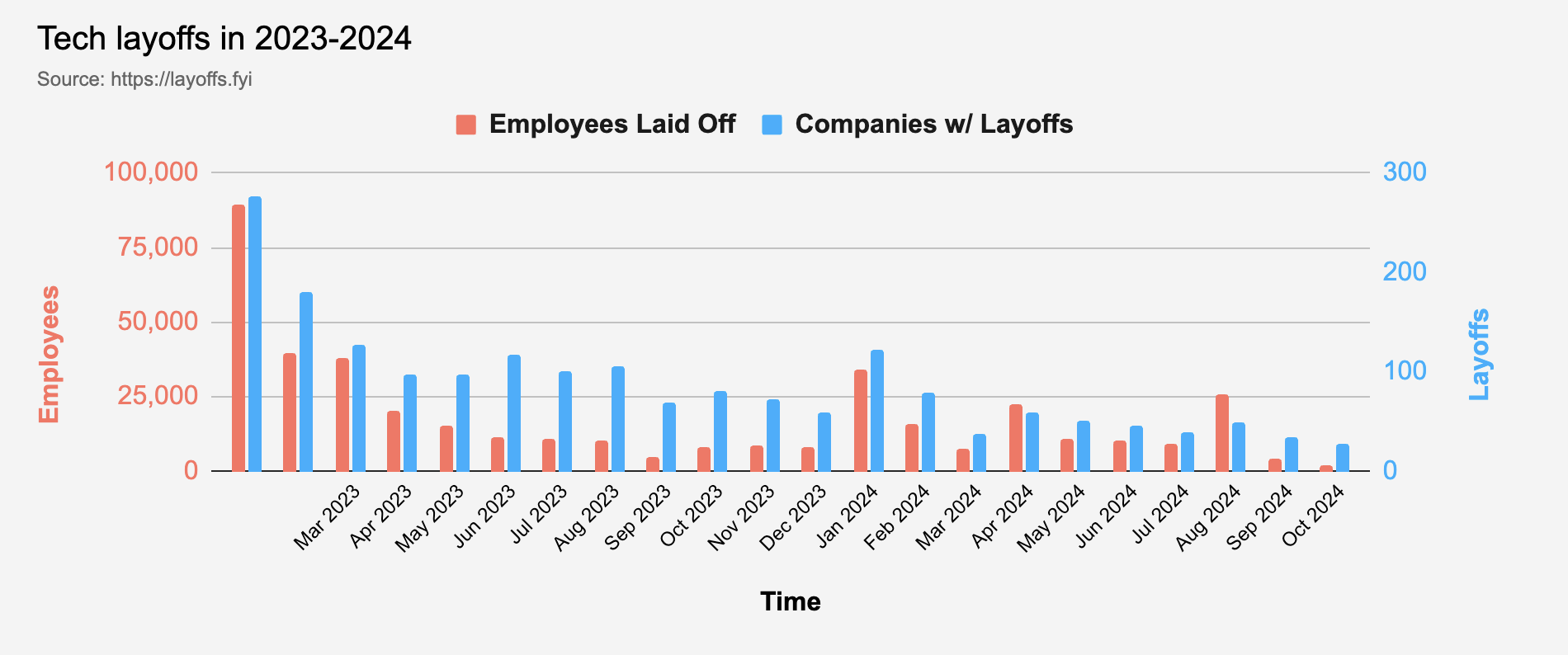

In accordance with layoffs.fyi, Q1 2023 was the height in layoffs since 2020, when greater than 167,000 staff misplaced their jobs. Nevertheless, in 2024, the state of affairs appears significantly better: the height of layoffs occurred in Q1, with 57,000 staff who misplaced their jobs. There have been even fewer layoffs within the second and third quarters – 43,000 and 38,000, respectively.

Thus, the story of dYdX and ConsenSys has turn into extra of an exception to the rule than a typical development for 2024. After huge layoffs in 2022 and 2023, the blockchain job market appears to be recovering.