Bitcoin (BTC) is ready to finish October, which initially began tough, on a powerful notice. Over the previous 30 days, BTC has surged by 13%, prompting many analysts to foretell that this upward momentum will persist into the Bitcoin November 2024 worth outlook.

However what’s driving this optimistic outlook? This in-depth on-chain evaluation sheds mild on the underlying elements contributing to this bullish sentiment.

Bitcoin Has Many Elements in Its Favor, Analysts Say

For starters, digital asset analysis agency 10x Analysis opined that BTC may proceed to maneuver upwards. Based on the agency’s prediction, Bitcoin’s rally to $73,000 this month is one motive the value can proceed to rise.

To help this level, 10x Analysis talked about that every time Bitcoin hits a six-month excessive, its worth will increase by no less than 40% inside the subsequent three months. Based mostly on this sentiment, Bitcoin’s worth is more likely to surpass $100,000 earlier than the top of January 2025, which additionally means it might break its all-time excessive in November.

In addition to this, the agency, through its YouTube web page, famous that catalysts, together with the US elections surging Bitcoin ETF inflows, which run into billions of {dollars} over the previous few weeks, might additionally play a task.

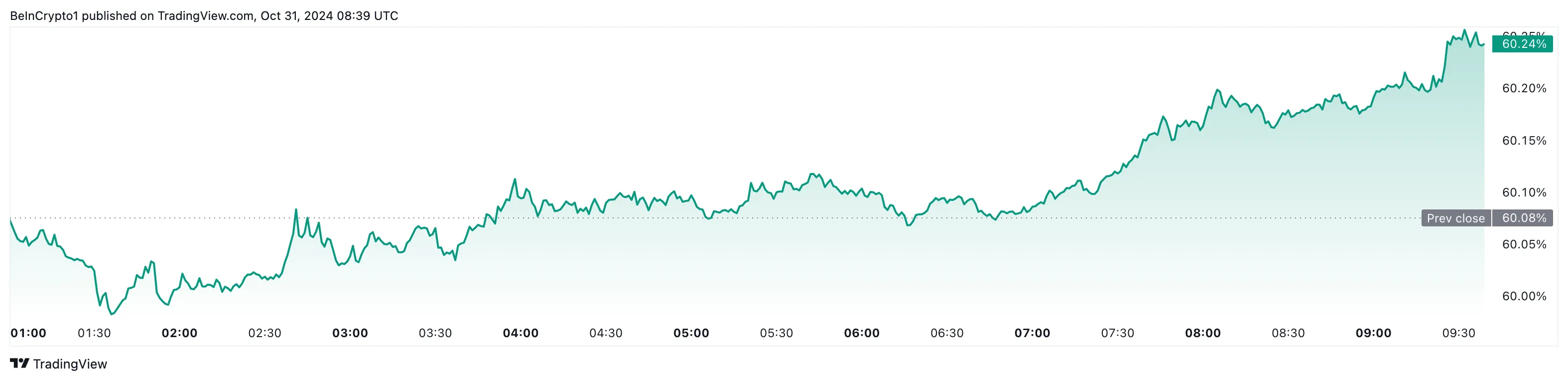

One other issue that might have an effect on Bitcoin’s November 2024 worth efficiency is its dominance. As of this writing, Bitcoin’s dominance has elevated to 60%.

Learn extra: 5 Finest Platforms To Purchase Bitcoin Mining Shares After 2024 Halving

Excessive dominance in Bitcoin’s market presence means that it’s main the cryptocurrency house, notably in periods of uncertainty.

This development typically signifies that traders are gravitating towards Bitcoin’s relative stability, choosing its perceived security in distinction to the upper dangers related to altcoins.

Curiously, on-chain information from Glassnode additionally appear to agree with 10x Analysis’s prediction. Based on Glassnode, the Pi Cycle Prime, which reveals the potential peak BTC may hit, reveals that the cryptocurrency might rally to $115,903.

If that’s the case, Bitcoin’s November 2024 prediction for Bitcoin might see the value break above its all-time excessive. Michaël van de Poppe, founding father of MN Buying and selling, additionally appears to agree with the outlook.

“I think $80,000 in November and $90,000-100,000 in December will help Altcoins to outperform strongly as yields are going to drop.” van de Poppe stated in a submit on X.

BTC Value Prediction: $76,000 Minimal in November?

On the every day chart, Bitcoin nonetheless has a bullish technical setup, suggesting that the value might rise nicely above $72,319. First off, the cryptocurrency has been capable of surpass the most important resistance at $71,473.

Traditionally, when Bitcoin’s worth will get rejected at this zone, it undergoes a notable correction. As an example, in April, when this occurred, BTC dropped by 14% inside some days. The same factor occurred in June, which precipitated Bitcoin’s worth to drop by 22% in lower than a month.

Moreover, the Relative Energy Index (RSI), which measures momentum, has continued to ascend. This motion is just like the way it moved through the run-up to the all-time excessive in March.

Learn extra: Bitcoin (BTC) Value Prediction 2024/2025/2030

Ought to this development proceed, BTC might rally above $76,000 in November. Alternatively, a decline under $70,000 within the quick time period might invalidate this prediction. In that state of affairs, BTC might decline to $66,448.

Disclaimer

In step with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.