In its Q3 earnings report, MicroStrategy introduced a $42 billion capital-raising initiative geared toward Bitcoin (BTC) acquisitions over the subsequent three years.

This marks probably the most bold BTC funding plans ever undertaken by a public firm.

MicroStrategy Q3 Earnings: What Traders Have to Know

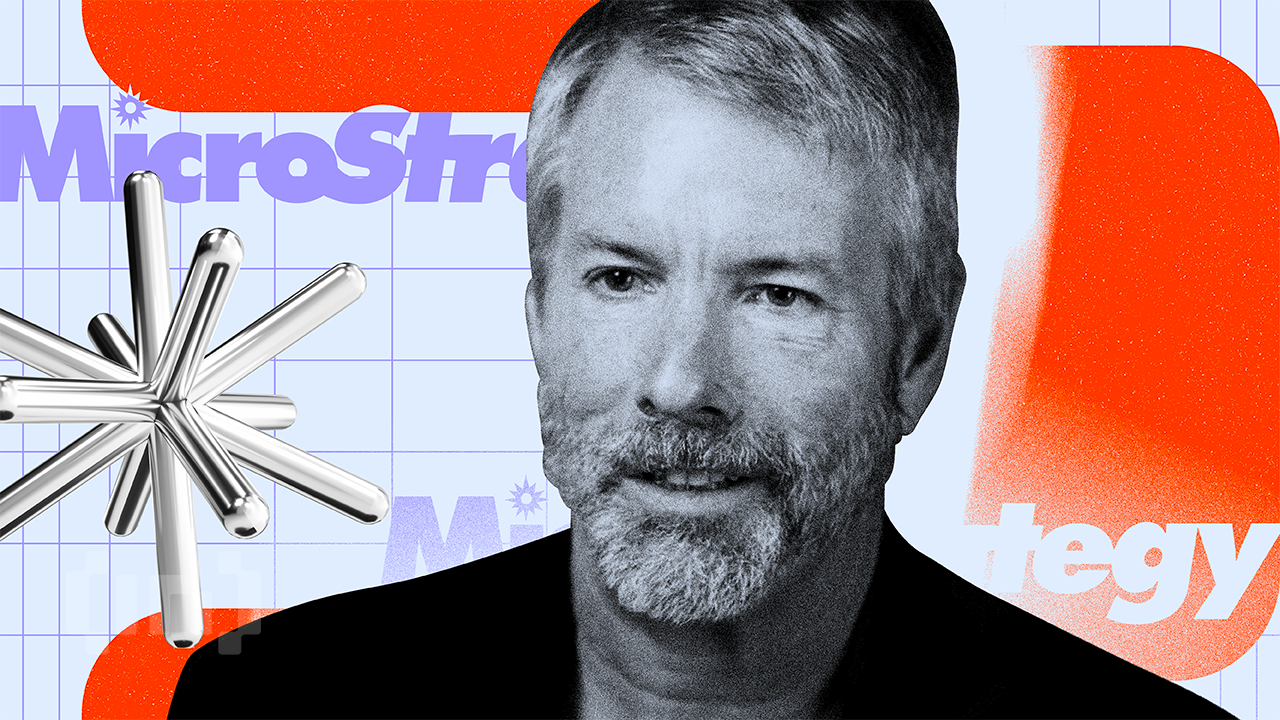

Government Chairman Michael Saylor and CEO Phong Le revealed MicroStrategy’s “21/21 Plan” throughout MicroStrategy’s Q3 2024 earnings name. They purpose to amass important Bitcoin reserves between 2025 and 2027. In response to Saylor, this aggressive technique solidifies Bitcoin as “digital capital,” including that it may redefine company treasury methods and monetary markets.

“Today, we are announcing a strategic goal of raising $42 billion of capital over the next 3 years, comprised of $21 billion of equity and $21 billion of fixed income securities, which we refer to as our ‘21/21 Plan,” the report learn.

The funds will primarily goal Bitcoin acquisitions as a part of MicroStrategy’s three-year capital market technique. Not too long ago, the corporate filed a record-setting $21 billion at-the-market (ATM) fairness providing, marking the biggest of its sort in monetary historical past.

Learn extra: Who Owns the Most Bitcoin in 2024?

The agency, identified for its steadfast dedication to Bitcoin, already holds 252,220 BTC, value over $18 billion. This follows a Q3 acquisition of 25,889 Bitcoins for $1.6 billion at a median value of $60,839 every. Nevertheless, the corporate reported a ten.34% decline in income, right down to $116.07 million for Q3.

Regardless of the drop, Saylor emphasised that MicroStrategy’s future lies in its Bitcoin-centric strategy. Because the “world’s first and largest Bitcoin treasury company,” it envisions sustaining an clever leverage technique. Notably, the intention is to guard long-term shareholder worth whereas constructing monetary merchandise rooted in Bitcoin.

MicroStrategy additionally targets a 6-10% annual “Bitcoin yield” — metric evaluating Bitcoin holdings to diluted shares. This plan signifies the corporate’s imaginative and prescient to maneuver past merely holding Bitcoin, doubtlessly creating a marketplace for Bitcoin-backed securities.

“Bitcoin is the best use of proceeds, maybe in the history of the capital markets…We are going to buy and hold Bitcoin indefinitely, exclusively, securely. If you’re waiting for us to hedge, to sell it, to get out on top, if you’re looking for us to diversify, go elsewhere,” Saylor remarked.

MicroStrategy’s adoption of Bitcoin-based capital merchandise may set a precedent for digital asset-driven finance. In the meantime, Robinhood additionally launched its Q3 earnings. As BeInCrypto reported, the outcomes highlighted its strategic enlargement in crypto-related choices.

This aligns with MicroStrategy’s ambitions for digital belongings. With over $10 billion in internet deposits for the third consecutive quarter, Robinhood’s belongings underneath custody reached a file $152 billion.

In the meantime, income grew 36% year-over-year to $637 million. Given Robinhood’s entry into prediction markets, this might enhance considerably in This fall. That is as the event coincides with the 2024 US election cycle and marks one in every of its most intriguing expansions.

“Looking ahead, we’re energized by the progress we’re making and believe we are well positioned to drive higher earnings and free cash flow per share over time, driven by our 20% plus net deposit growth, diversified business model, and 90% fixed cost base,” Robinhoo CFO Jason Warnick stated.

Learn extra: How To Use Polymarket In America: Step-by-Step Information

The brand new characteristic permits customers to commerce based mostly on the doubtless outcomes of elections, which is a doubtlessly profitable addition, given the rising public curiosity in prediction markets.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.