Two distinguished ETF issuers superior their XRP-based asset initiatives in the present day. Grayscale launched buying and selling on its XRP Belief fund, whereas 21Shares submitted an official software for an XRP ETF.

Whereas Grayscale’s Belief fund holds potential for eventual conversion into an ETF, its long-term buyer enchantment stays unsure.

The XRP ETF Race

Grayscale introduced that its XRP Belief is now open to eligible accredited traders. Launched two months in the past, this belief is seen as a doable precursor to an ETF. Grayscale beforehand transformed its Bitcoin belief into an ETF after securing regulatory approval and is at the moment working to transform one other fund into an ETF.

“Grayscale XRP Trust (the “Trust”) is without doubt one of the first securities solely invested in and deriving worth from the value of XRP… avoiding the challenges of shopping for, storing, and safekeeping XRP straight. Shares of the Belief are designed to trace the XRP market value,” the corporate claimed on its web site.

Learn extra: XRP ETF Defined: What It Is and How It Works

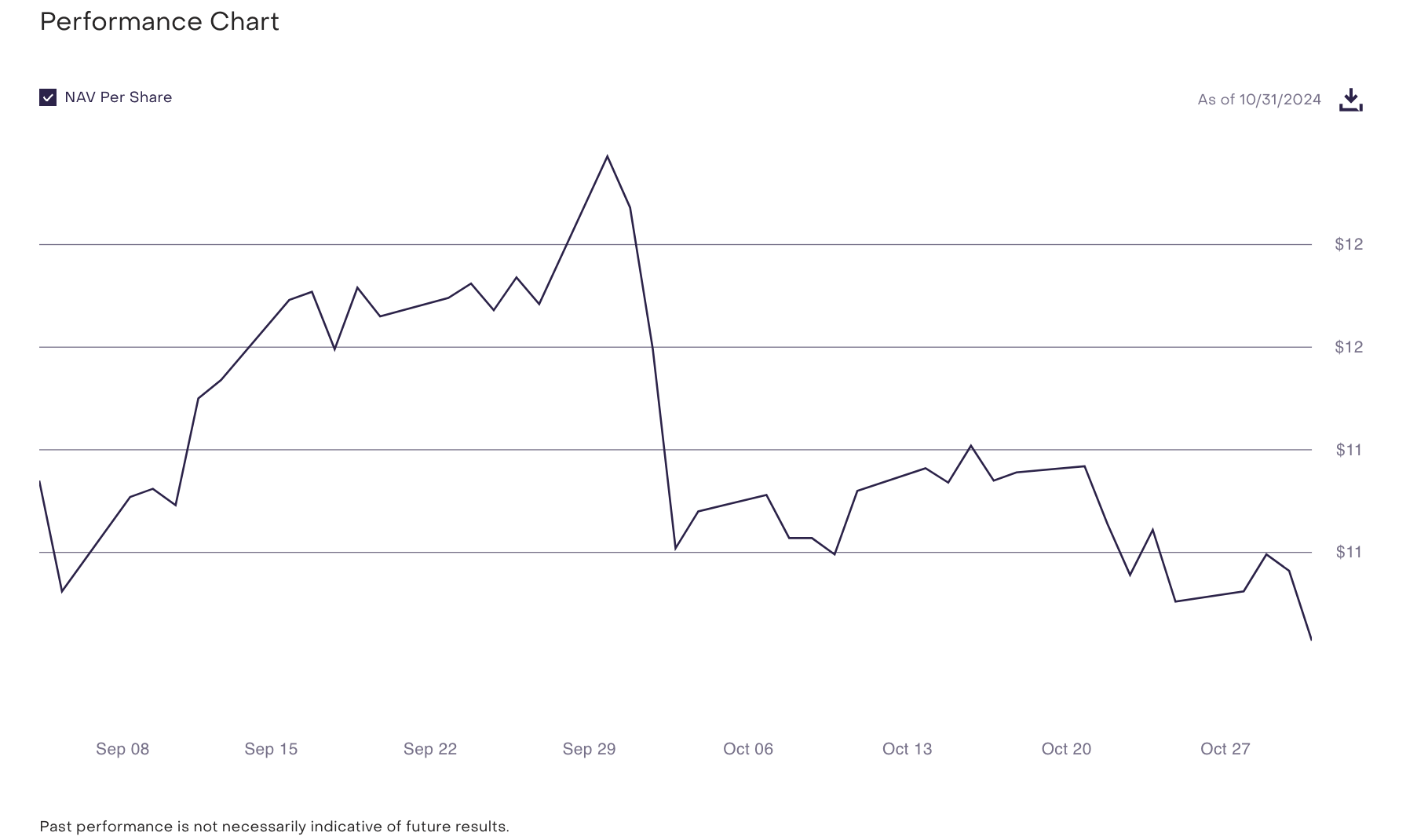

The opportunity of an XRP ETF is rising within the crypto house. Ripple’s CEO referred to as eventual regulatory approval “inevitable”, and a number of other corporations have already filed their very own petitions. Grayscale’s non-ETF belief technique has been dependable previously, permitting for early earnings. Nevertheless, this looser construction additionally has downsides: the XRP Belief’s value truly declined when buying and selling started.

Though Grayscale’s Bitcoin Belief (GBTC) was an early chief within the ETF market, it rapidly misplaced floor to youthful opponents. The corporate even went as far as to launch a second Bitcoin-based ETF, trying to get well this market share. Grayscale’s pre-ETF belief fund technique might permit early market entry, however its prospects might abandon it for a devoted ETF product.

If the SEC does approve an XRP ETF within the close to future, Grayscale may have loads of opponents. Based on filed paperwork, funding agency 21Shares can also be getting into the race. 21Shares is already a Bitcoin ETF issuer and has additionally petitioned for a Solana ETF. The race is heating up, and it may rework the face of Ripple.

Learn extra: Ripple (XRP) Value Prediction 2024/2025/2030

In the end, the SEC has been very quiet in regards to the probability of approving these merchandise. As soon as the Fee formally begins confirming or rejecting these purposes, they’re locked right into a sequence of deadlines. In different phrases, they may both have to maneuver the efforts alongside or explicitly block them. For now, this ambiguity remains to be sustainable, and it doesn’t present indicators of shifting.

Disclaimer

In adherence to the Belief Challenge pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.