Raydium (RAY) worth has surged practically 20% over the previous week, displaying spectacular power throughout the Solana ecosystem. With Raydium sustaining a stronghold because the main decentralized alternate on Solana, its worth momentum is backed by substantial buying and selling exercise and liquidity.

Indicators present a bullish setup, with short-term transferring averages above long-term ones and RSI nonetheless beneath the overbought stage, hinting at potential room for additional positive aspects. Nevertheless, if upward momentum fades or Solana’s buying and selling quantity cools, RAY may face draw back stress, testing key assist ranges.

Raydium Is The Dominant Pressure In The Solana Ecosystem

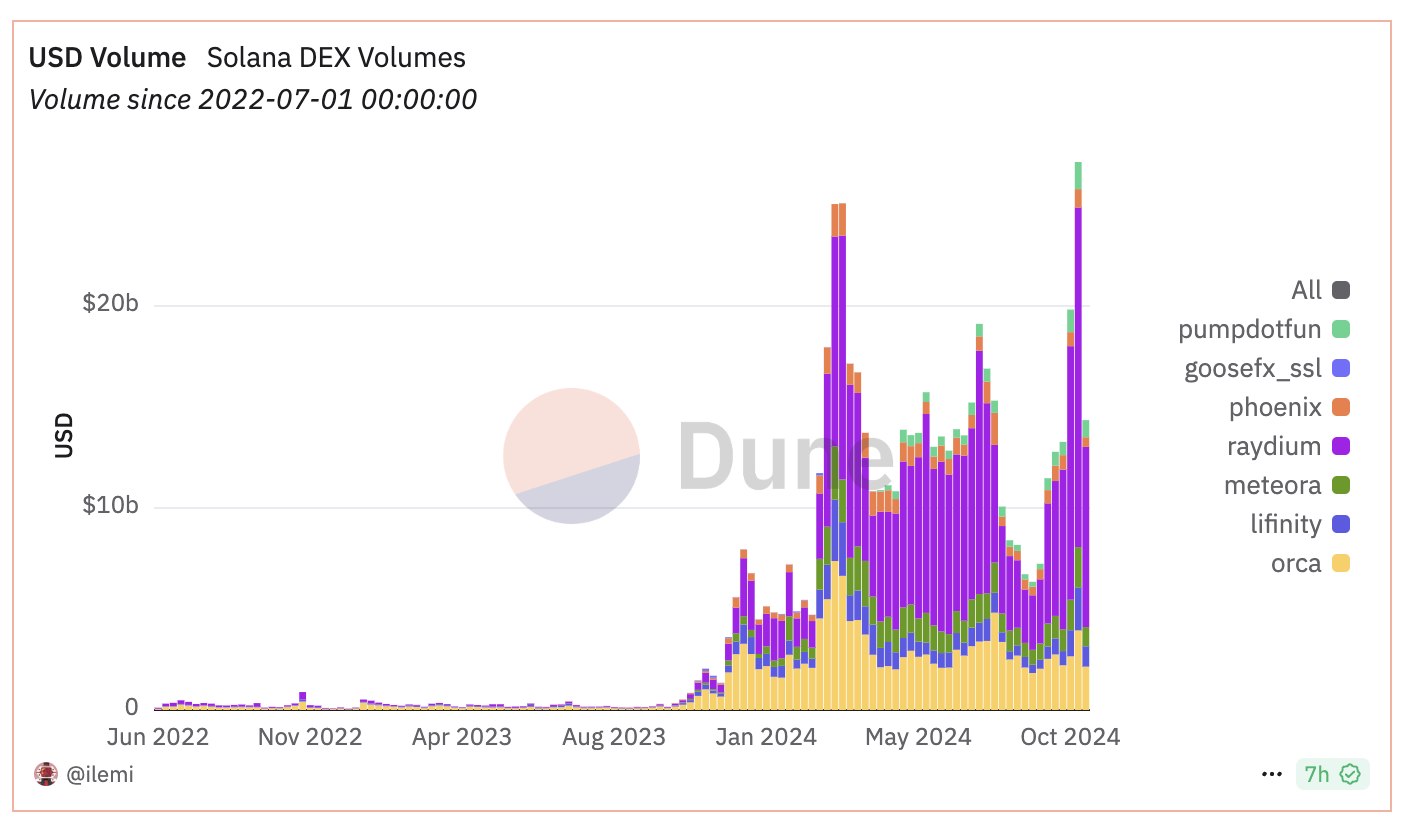

Raydium stands as one of the vital profitable purposes throughout the Solana ecosystem, simply main in buying and selling quantity. Amongst decentralized exchanges (DEXs) on Solana, Raydium persistently ranks as the most important, with a good portion of the ecosystem’s exercise flowing by way of its platform.

For example, throughout the week starting October 28, Solana’s DEX quantity hit $14.3 billion, with Raydium alone contributing $8.9 billion, representing a dominant 62% of the entire.

Learn extra: What Is Raydium (RAY)?

This weekly development of Raydium main the Solana DEX area underlines its stronghold within the ecosystem. Final week, for instance, Raydium handed Ethereum in charges.

As Solana continues to achieve consideration and entice institutional buyers, Raydium’s relevance and quantity dominance may enhance, probably impacting its worth within the close to time period.

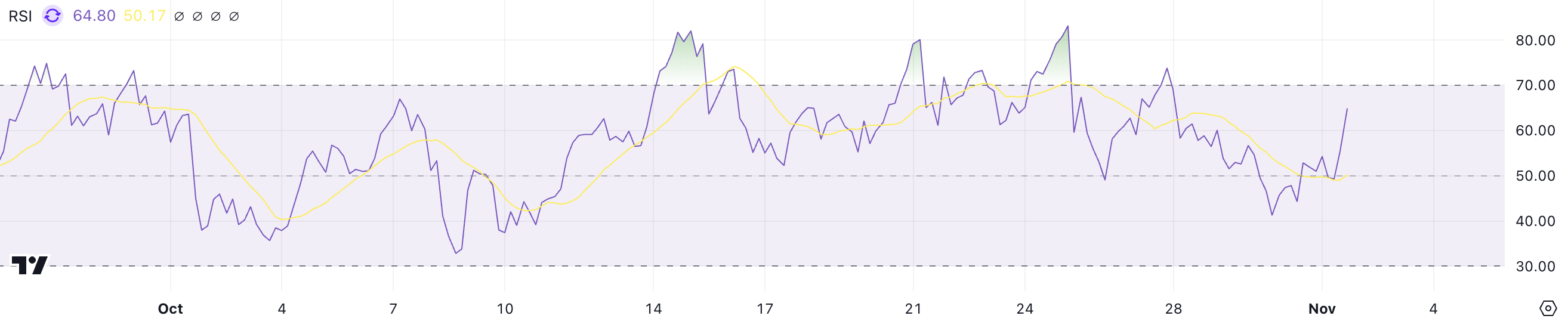

RAY RSI Is Beneath the Overbought Stage

RAY worth has gained 18.51% this week, but its RSI presently sits at 64.8, nonetheless beneath the overbought threshold. RSI, or the Relative Power Index, measures the velocity and magnitude of current worth modifications to gauge potential overbought or oversold situations.

Sometimes, RSI values above 70 point out an overbought asset, whereas values beneath 30 counsel it’s oversold. With RAY’s RSI beneath the overbought stage, this implies that the current uptrend should still have room to develop.

Though RAY’s worth has considerably risen, the reasonable RSI stage implies that purchasing stress isn’t but excessive, probably permitting for additional positive aspects earlier than reaching an overbought situation.

RAY Worth Prediction: Largest Worth Since 2022?

RAY’s EMA strains point out a bullish setup, with all EMAs positioned beneath the present worth and shorter-term EMAs trending above longer-term ones.

This alignment suggests sturdy upward momentum, with patrons sustaining management within the quick time period. If this uptrend holds and RSI stays underneath the overbought threshold of 70, RAY may surpass $3.62, marking its highest worth since 2022.

Learn extra: 11 Prime Solana Meme Cash to Watch in November 2024

Nevertheless, ought to the uptrend reverse – probably triggered by an overbought RSI or a slowdown in Solana DEX exercise – RAY may take a look at assist at $2.94. If that assist stage doesn’t maintain, RAY worth may proceed happening towards $2.65.

Disclaimer

According to the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.