Ripple skilled notable progress within the third quarter. The agency noticed a lift in transaction quantity on the XRP Ledger and a rise in institutional curiosity in its XRP token.

This improvement comes because the agency continues to battle its case in opposition to the US Securities and Change Fee (SEC).

Ripple’s XRP Finds Institutional Traction as Buying and selling Volumes Surge

Ripple reported heightened institutional curiosity in XRP, partly pushed by the US SEC’s waning credibility within the crypto house. A number of monetary heavyweights, together with the Chicago Mercantile Change (CME), launched new XRP choices over the quarter. CME unveiled an XRP reference value, whereas Bitnomial introduced plans for an XRP futures product.

Additional, distinguished companies like Bitwise, Canary, and 21Shares filed to launch exchange-traded funds (ETFs) centered on XRP. Additionally, Grayscale launched an XRP Belief alongside efforts to transition its Digital Giant Cap Fund, which incorporates BTC, ETH, SOL, XRP, and AVAX, into an ETF.

Learn extra: XRP ETF Defined: What It Is and How It Works

Ripple CEO Brad Garlinghouse famous that these filings are a testomony to robust institutional demand for XRP merchandise. In accordance with him, the SEC’s extended challenges in regulating crypto have weakened its stance, additional diminishing its affect over the sector.

“The message from the market is clear — institutional interest in XRP products is stronger than ever…The SEC’s war on crypto has lost battle after battle — their continued disregard for the court’s authority will further erode the SEC’s credibility and reputation,” Garlinghouse said.

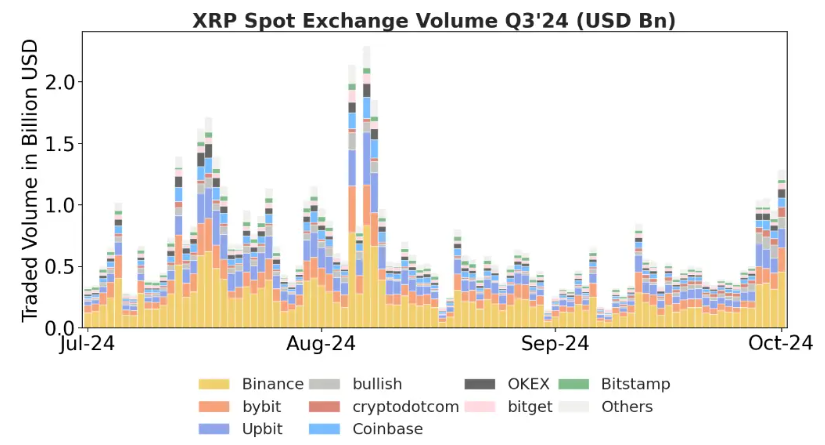

In the meantime, the rise in institutional curiosity led to elevated XRP buying and selling volumes. Common day by day volumes (ADV) on high exchanges ranged between $600 million and $700 million, with a 27% enhance within the XRP/BTC ratio over the quarter. Ripple defined that buying and selling on Binance, Bybit, and Upbit, averaged round $750 million through the early a part of Q3 earlier than stabilizing mid-quarter and rising once more in September’s last days.

Furthermore, the XRP Ledger community additionally noticed its transaction quantity almost double through the interval. In accordance with the report, the community’s whole transactions rose from 86.4 million in Q2 to 172.6 million in Q3 2024. Ripple clarified that this enhance was primarily on account of microtransactions, typically lower than 1 XRP every, possible a part of a spam marketing campaign.

“Despite the increase in activity, much of it involved small-volume transactions, so total on-chain volume did not see a significant rise. The uptick was primarily driven by microtransactions (<1 XRP), which appeared to be part of a spam messaging campaign,” Ripple defined.

Learn extra: Ripple (XRP) Worth Prediction 2024/2025/2030

Moreover, the Complete Worth Locked (TVL) inside Ripple’s Automated Market Makers (AMMs) greater than doubled. In the course of the interval, it rose from $8.5 million to $16.2 million. Nonetheless, common transaction prices on the community dropped, with charges declining by 32% from 0.00394 XRP to 0.00269 XRP per transaction.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections based mostly on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.