The market skilled a rollercoaster journey, with the worldwide crypto market cap rising from $2.33 trillion to a three-month peak of $2.5 trillion by mid-week earlier than settling at $2.38 trillion on the finish of the week.

Bitcoin (BTC) triggered the uptrend, having surged to retest the March 2024 all-time excessive above $73,000 earlier than dealing with a significant correction.

Listed here are a few of the outstanding crypto belongings to concentrate to this week following their noteworthy value motion:

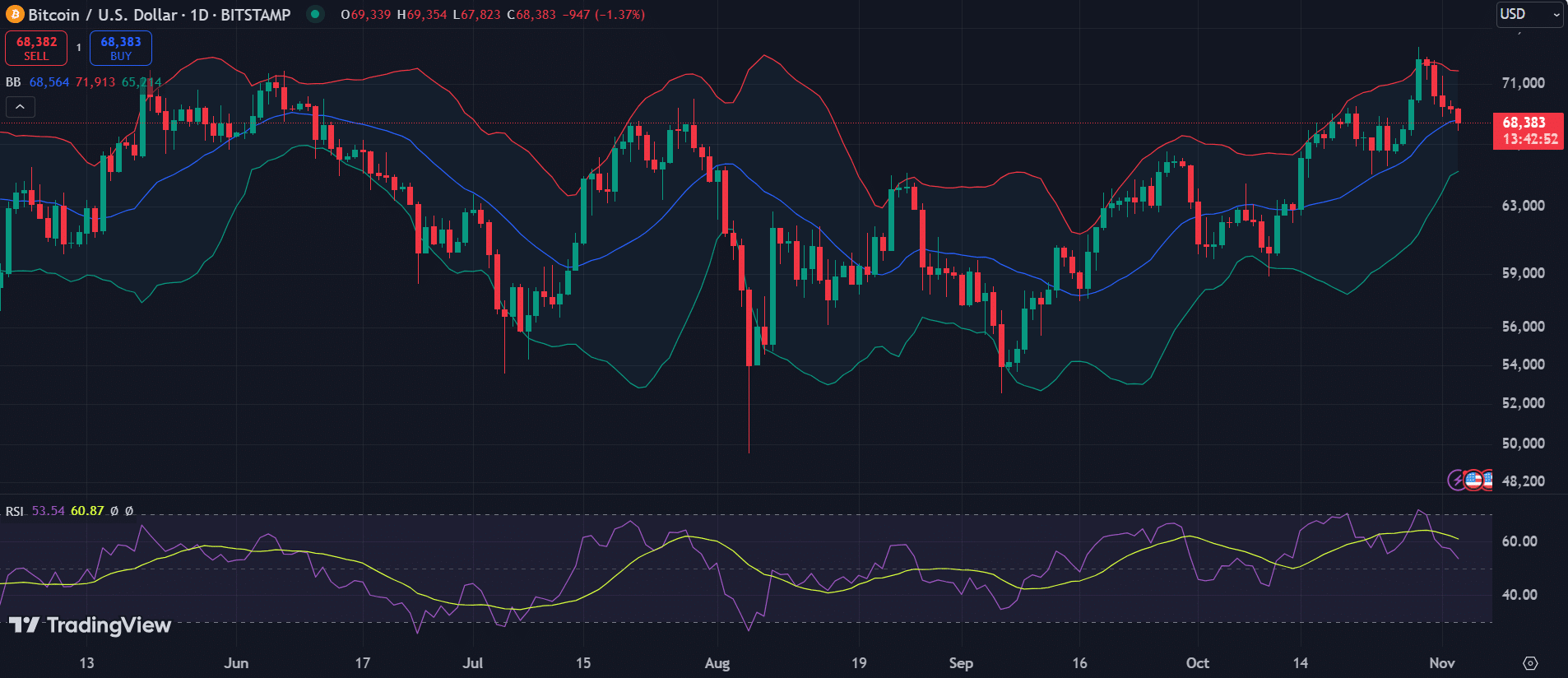

BTC retests ATH

Bitcoin’s begin to the week coincided with a bullish momentum that started on Oct. 26. By Monday, the asset had recorded three consecutive intraday positive factors, knocking on the $70,000 area.

The spectacular uptrend spilled into Oct. 29, as Bitcoin first overcame the $71,000 resistance and pushed additional to breach the elusive $73,000 stage, reaching a seven-month peak. This allowed the main cryptocurrency to retest its March ATH.

Nonetheless, this surge preceded an enormous correction. Consequently, Bitcoin’s value motion went downhill within the 4 days that adopted, with the 20-day MA at $68,564 now performing as a direct protection towards additional draw back danger.

If the 20-day MA help offers manner, BTC would wish to carry above the decrease Bollinger Band at $65,214 amid the upcoming US presidential election this week. Nonetheless, a restoration above $71,913 might grant the bulls renewed power to once more attain the ATH.

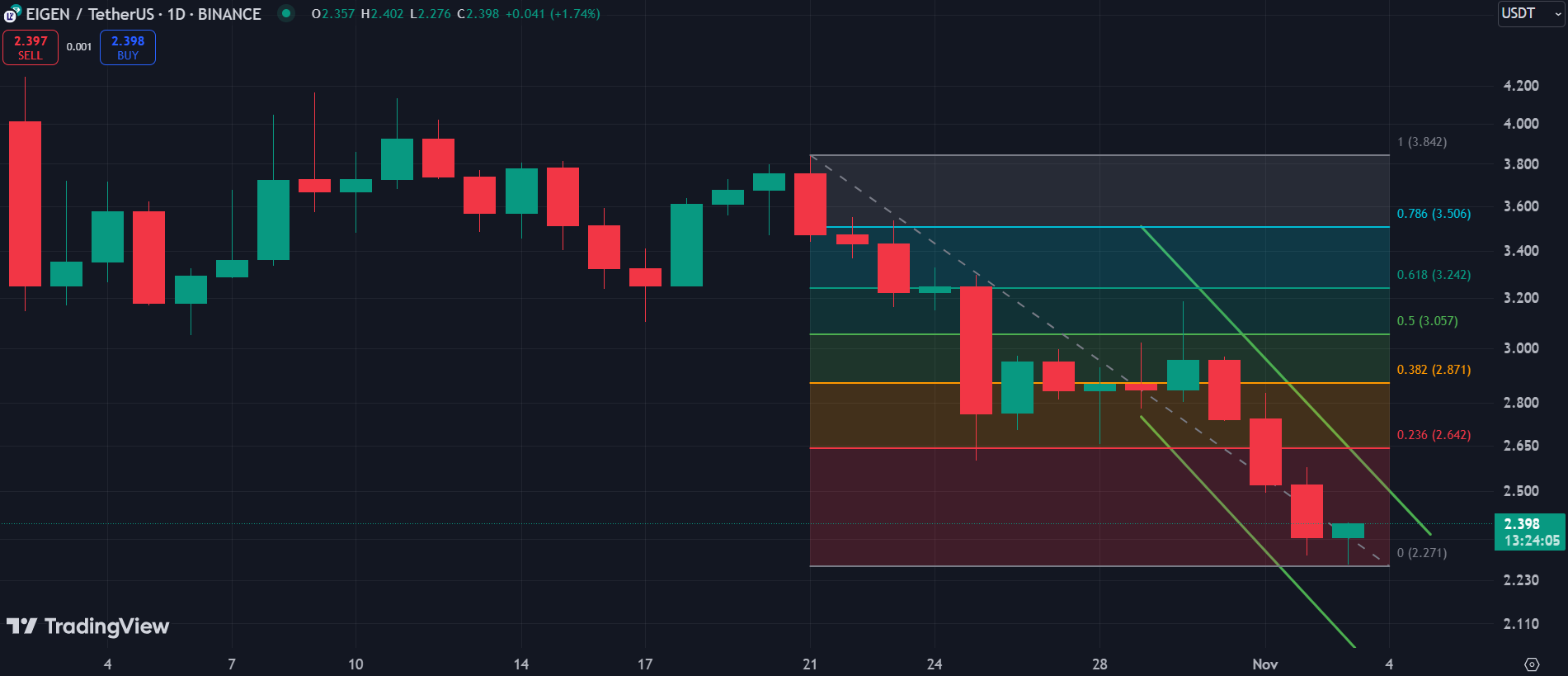

EIGEN slides 17%

Regardless of the broader market seeing gentle positive factors final week, EigenLayer (EIGEN), the native token of the Ethereum restaking protocol of the identical identify, closed the week with an enormous 17% drop after an preliminary rise.

EIGEN has been struggling to reclaim its peak above $4 because the Oct. 1 debut. The asset had rallied to a excessive of $4.90 on Binance earlier than correcting. It has since continued to consolidate, with final week introducing extra bearish strain.

As Bitcoin retraced mid-week, EIGEN confronted large declines over three days, forming a downward channel. To beat this pattern, EigenLayer should shut above the 23.6% Fibonacci retracement stage at $2.642 this week.

KAS faces uncertainty

Final week, Kaspa (KAS) charted its course amid market uncertainties, diverging from broader market traits. Though it noticed positive factors towards the top of the week, KAS in the end closed with a 4.4% decline.

The token skilled fluctuations all through the week however remained under the pivot stage of $0.2592, confirming the prevailing bearish momentum, because the -DI at 31.1 largely exceeds the +DI at 13.3.

For KAS to shift momentum this week, it should break by way of this pivot stage and recuperate the late October excessive of $0.1311.

Surpassing this stage would introduce the primary main resistance at $0.1492. Kaspa might use this zone as a springboard to reclaim the psychological ranges of $0.15 and $0.16, with a second key hurdle at $0.1636.