Crypto markets are bracing for what’s arguably probably the most unstable week in 2024. Three US macroeconomic information occasions are on the calendar and have the potential to have an effect on buyers’ portfolios considerably.

In the meantime, Bitcoin (BTC) is buying and selling beneath $70,000, with prospects for extra beneficial properties because the fourth quarter (This autumn) has traditionally boded effectively for the pioneer crypto.

US Elections: Donald Trump vs. Kamala Harris

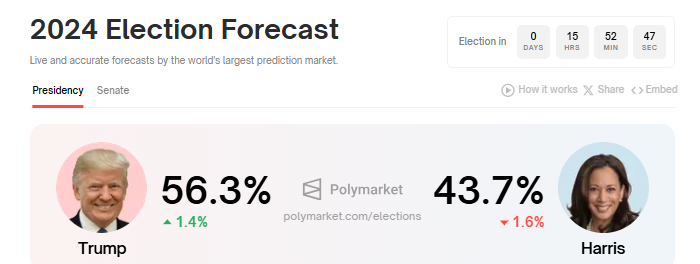

The US market is approaching the climax of its political showdown between Donald Trump and Kamala Harris, from the Republican and Democratic events, respectively, on Tuesday, November 5. Based mostly on information on Polymarket, the US elections are solely hours away, with Trump narrowly within the lead.

Learn Extra: How Can Blockchain Be Used for Voting in 2024?

However, Polymarket’s trade peer within the prediction market, Kalshi, reveals an virtually comparable margin, with Trump main by 52% towards Harris’ 48%. This distinction displays the variations in these platforms’ consumer bases. However, analysts anticipate a unstable day for Bitcoin.

The US election outcomes might have important implications for financial coverage, regulatory environments, and investor sentiment. Relying on the winner, insurance policies concerning cryptocurrency would possibly change, doubtlessly affecting Bitcoin value, with the sentiment spilling over to different crypto tokens.

“I’m expecting this week to be a real firecracker, with lots of volatility. The Key day will be Tuesday, as the US election voting comes to a close. If there is no clear winner as the day progresses, it could get quite scary for Bitcoin,” mentioned Mark Cullen, an analyst at AlphaBTC.

Preliminary Jobless Claims: Labor Market Gauge

Past the US elections, crypto markets may also monitor the preliminary jobless claims on Thursday, November 7. This financial information helps gauge the tightness or softness of the labor market within the US. Whereas the job market has softened, unemployment charges stay low on an absolute foundation.

Final week, US residents submitting new purposes for unemployment insurance coverage got here in at 216,000 from the week ending October 25, down from the earlier 228,000. Nevertheless, there’s a consensus forecast of 220,000.

Excessive preliminary jobless claims within the Thursday report recommend rising financial hardship and a weakening labor market. This might result in decreased client spending and funding in conventional belongings like shares and bonds. Consequently, some buyers could flip to different belongings like cryptocurrencies as a hedge towards financial uncertainty.

FOMC Curiosity Fee Choice and Jerome Powell Speech

On Thursday, the Federal Open Market Committee (FOMC) will launch minutes from its final assembly, adopted by feedback from Federal Reserve (Fed) Chair Jerome Powell. The Fed operates underneath a twin mandate: to maintain inflation, as measured by the Shopper Value Index (CPI), at 2% yearly, and to maintain full employment.

The FOMC’s November assembly is scheduled for subsequent Wednesday and Thursday, with economists speculating on the potential of one other price reduce. On the earlier assembly, the Fed decreased rates of interest by 50 foundation factors (0.5%) as US CPI dropped to 2.4%.

One other price reduce could also be possible as inflation nears the Fed’s 2% goal, whereas the unemployment price has risen from 3.7% to 4.1% this yr, indicating potential softening within the job market.

Learn extra: How one can Shield Your self From Inflation Utilizing Cryptocurrency

Just lately, Powell mentioned the draw back dangers to employment have elevated, hinting at extra price cuts to assist financial development earlier than the state of affairs worsens. Furthermore, the FOMC’s forecast in September advised that the federal funds price might fall by one other 50 foundation factors earlier than the top of 2024.

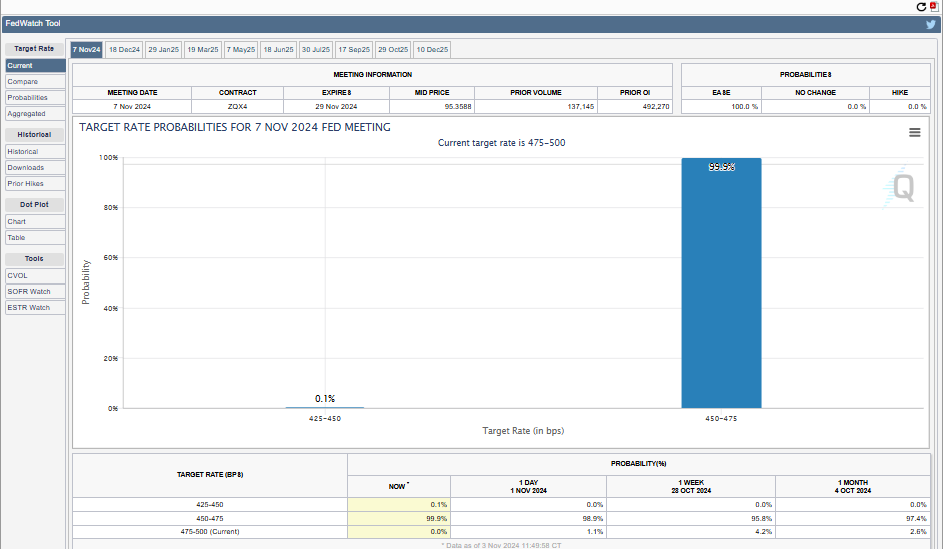

With solely November and December conferences remaining, possible, two 25-basis-point cuts are possible underway. In opposition to this backdrop, the CME Fed Watchtool reveals a 99.9% likelihood of a 25 bps price reduce within the Thursday US financial information launch.

In the meantime, Spotonchain anticipates an additional upside for Bitcoin after the US elections and FOMC assembly, setting a BTC value goal of $100,000 in 2024. The rally, Spotonchain says, will come no matter who wins the elections.

“The market is entering its most volatile week with the US election and FOMC meeting, but this rally may be here to stay. Historically, the real bull run begins post-election, and we believe that whether Trump or Harris becomes the next president, BTC will continue its upward journey, potentially reaching 100,000 this year,” Spotonchain mentioned.

On the time of writing, BTC is buying and selling for $68,698, signifying a modest 0.34% surge because the Monday session opened.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please word that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.