Each whole worth locked (TVL) and technical indicators are sending combined alerts for SUI worth. After reaching a milestone TVL above $1 billion, SUI’s market assist has proven indicators of hesitation, resulting in a interval of stagnation.

Moreover, its ADX means that whereas SUI is in a downtrend, the development lacks sturdy momentum, which might permit for a reversal. Buyers are watching key assist and resistance ranges intently, as these will probably form the subsequent route in SUI’s worth motion.

SUI TVL: Can It Go Again To $1 Billion?

SUI’s whole worth locked (TVL) presently stands at $979 million, having surged impressively from $313 million on August 4. On September 30, SUI’s TVL crossed the $1 billion mark for the primary time, a milestone that coincided with a notable worth improve.

Throughout this era, SUI’s worth climbed from $0.57 to $1.83, exhibiting sturdy market enthusiasm and confidence within the coin’s potential.

Learn extra: The whole lot You Have to Know Concerning the Sui Blockchain

Nonetheless, for the reason that finish of October, SUI’s TVL has proven indicators of stagnation, repeatedly dipping barely beneath $1 billion after which recovering. This back-and-forth motion displays a cautious market sentiment, suggesting that buyers could also be hesitant to commit long-term capital in SUI tokens.

This stagnation alerts potential volatility or downward stress for SUI’s worth, as a sustained insecurity in TVL might restrict additional worth progress. With out constant inflows, SUI would possibly wrestle to take care of its earlier momentum.

SUI ADX Exhibits the Present Downtrend Isn’t Robust

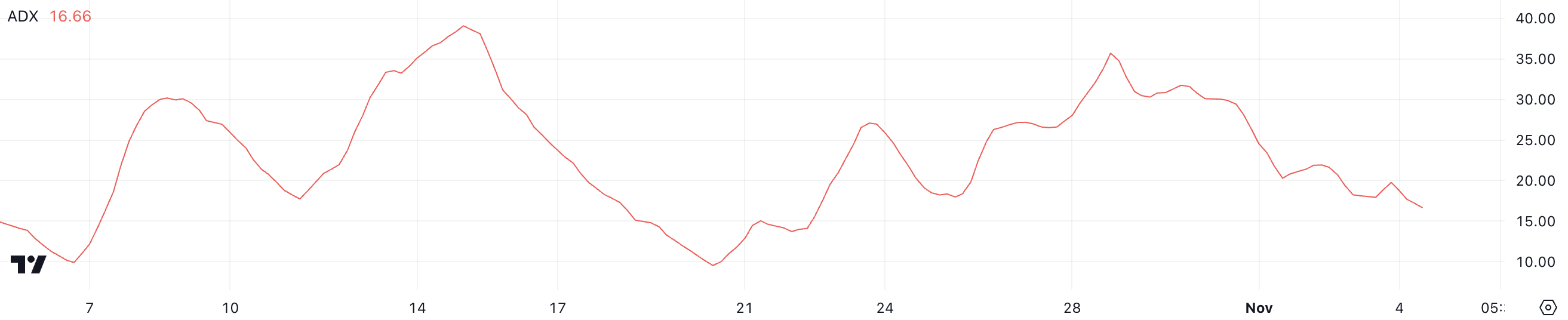

SUI’s ADX (Common Directional Index) presently sits at 16.66, reflecting a constant decline over the previous few weeks. A falling ADX signifies weakening momentum in SUI’s worth development, suggesting that the present downtrend lacks vital energy.

ADX helps measure the energy of a development moderately than its route, so this low studying implies that the market shouldn’t be absolutely dedicated to a sustained bearish motion.

ADX values are crucial for gauging development energy, with readings beneath 20 indicating a weak or non-trending market, whereas values above 25 sign a robust development, both up or down. The low ADX confirms that SUI’s present downtrend shouldn’t be significantly sturdy.

With the ADX at 16.66, the worth motion might stay subdued or lack clear route till momentum picks up. This implies SUI might proceed to float with out vital volatility until a stronger development begins to develop.

SUI Worth Prediction: Extra Corrections Forward?

SUI’s EMA traces are presently in a bearish alignment, with short-term averages crossing beneath the longer-term ones, a traditional sign of downward momentum. Nonetheless, the short-term traces have but to cross the oldest long-term EMA, which might create a “death cross.”

This formation is usually seen as a robust bearish indicator, signaling that additional declines could possibly be forward if it materializes. A loss of life cross suggests an intensifying downtrend that might put further stress on SUI’s worth.

Learn extra: A Information to the ten Finest Sui (SUI) Wallets in 2024

If the downtrend continues, SUI’s worth might first take a look at assist round $1.74. Ought to this stage fail to carry, it might drop additional to $1.60, marking a possible 13.9% correction.

Alternatively, the ADX signifies that the present downtrend lacks sturdy momentum, leaving room for a possible reversal. If an uptrend takes form, SUI might take a look at resistance at $2.16. Breaking this stage would open the door for additional features, with the worth probably reaching $2.36, a possible 26.8% improve.

Disclaimer

Consistent with the Belief Undertaking pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.