SUI worth has struggled not too long ago to safe $2.00 as a help degree, drifting additional away from this mark as enthusiasm wanes amongst merchants.

The altcoin’s current downward pattern displays the market’s cautious sentiment, as SUI faces challenges in stabilizing and rallying in the direction of a brand new all-time excessive (ATH).

SUI Wants a Push

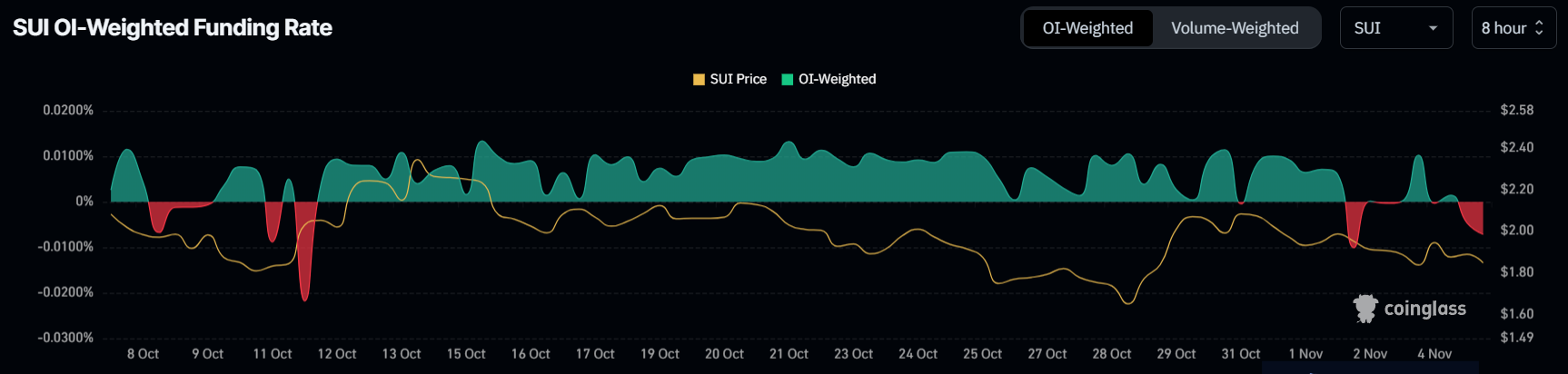

SUI’s market sentiment stays combined, as evidenced by fluctuating funding charges which have alternated between constructive and adverse. This inconsistency signifies uncertainty amongst merchants, who seem cut up on SUI’s short-term trajectory.

Such back-and-forth sentiment usually results in elevated volatility and might weigh on the altcoin’s worth. Many SUI merchants are presently inserting brief contracts, aiming to revenue from anticipated declines, which has added downward strain.

This short-selling pattern alerts that merchants are cautious of SUI’s rapid prospects, with many anticipating additional dips. So long as this sentiment holds, SUI might wrestle to realize upward momentum. Such expectations can create a self-fulfilling cycle, the place decrease costs reinforce bearish sentiment, main extra merchants to take brief positions.

Learn Extra: Every thing You Have to Know In regards to the Sui Blockchain

SUI’s macro momentum additionally factors to a cooling pattern, significantly because the Relative Power Index (RSI) has been declining since mid-October. Beforehand, within the overbought zone, the RSI had fallen steadily and now hovered simply above the impartial degree of fifty.0. This decline suggests waning bullish momentum, and if the RSI dips beneath 50.0, it may sign stronger bearish situations for SUI.

When the RSI stays above 50, it usually signifies an opportunity for worth stabilization. Nevertheless, with the indicator on a constant downward path, the chance of an imminent reversal grows weaker.

SUI Value Prediction: Recovering Losses

Presently, SUI is buying and selling at $1.92, beneath the $2.03 resistance degree. For SUI to make any headway towards reaching its earlier ATH of $2.36, it should first flip $2.03 right into a stable help degree. Doing so would sign renewed bullish curiosity and will appeal to additional shopping for momentum.

If SUI fails to interrupt by means of the $2.03 barrier, the altcoin will probably proceed consolidating above its $1.69 help. Extended consolidation may contribute to market uncertainty as merchants stay hesitant to commit totally to SUI. This lack of a transparent pattern retains the worth in a holding sample, delaying any important strikes towards a brand new ATH.

Learn Extra: A Information to the ten Greatest Sui (SUI) Wallets in 2024

The bearish-neutral outlook for SUI will probably be invalidated if it manages to show $2.03 into help whereas broader market situations flip bullish. Such a shift would increase confidence in SUI’s trajectory, doubtlessly reigniting its rally ambitions and setting the stage for a brand new all-time excessive.

Disclaimer

According to the Belief Challenge pointers, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.