Reader Bruce Corridor writes:

The attention-grabbing factor is that for the reason that PCE runs constantly 2pp beneath CPI.

This struck me as a shocking stylized reality, at variance with what I knew from varied analyses I’d carried out. I wrote that the distinction was about 0.45 ppts over 1986-2019. Mr. Corridor then cited a MorningStar report notes:

at its peak in the summertime of 2022, CPI inflation was nearly 2 full proportion factors larger than PCE inflation (9.0% vs. 7.1%).

Nicely I actually can’t deny that is the case. Nonetheless, then one has to marvel concerning the assertion:

The attention-grabbing factor is that for the reason that PCE runs constantly 2pp beneath CPI.

I don’t assume one month of inflation differential at 1.87 ppts constitutes “consistently”.

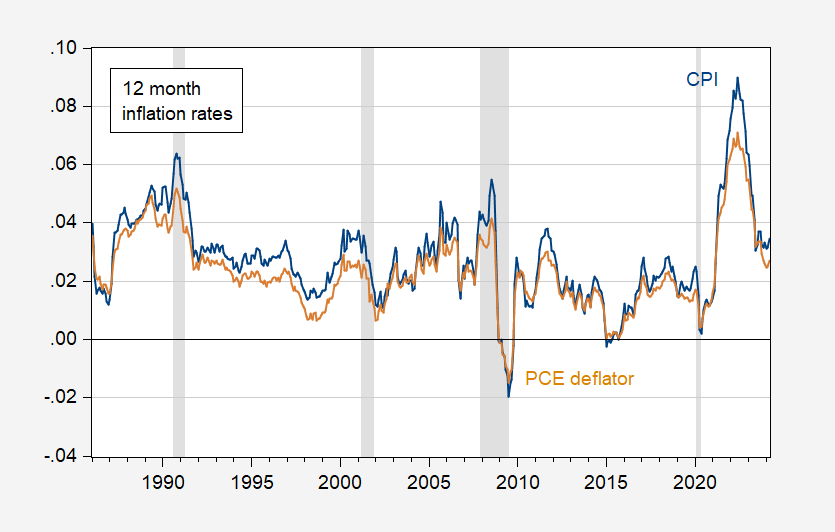

To verify, listed here are 12 month inflation charges, 1986-2024 (Nice Moderation onward):

Determine 1: CPI 12 month inflation fee (blue), PCE deflator (tan). NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, BLS by way of FRED, NBER, and writer’s calculations.

Doesn’t seem like “consistent” is the suitable adjective to me. By the best way, the distinction is 1.87 ppts at most (one month). It’s 1.83 the following month.

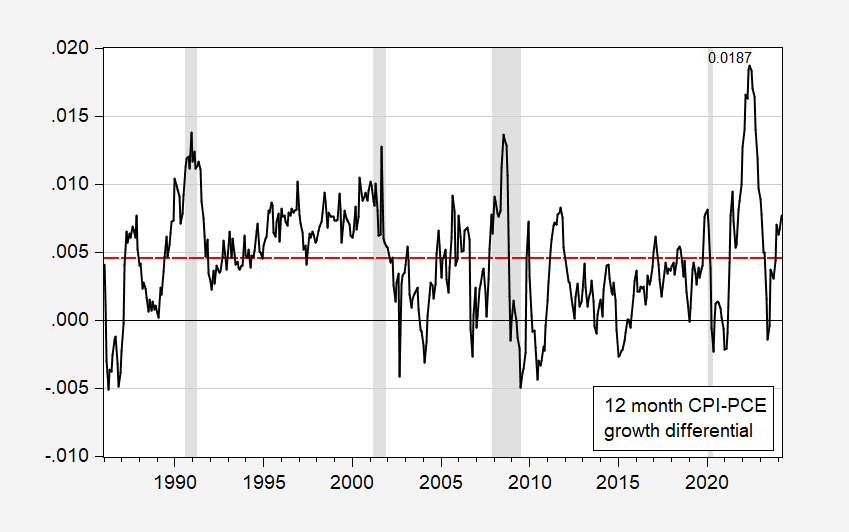

What does the differential seem like over time? That is proven in Determine 2, with a crimson dashed line on the (common) differential worth for 1986-2024M03. The crimson dashed line is obtained utilizing a regression of the CPI inflation fee minus PCE deflator inflation fee.

Determine 2: CPI-PCE deflator 12 month differential (black). Purple dashed line at common worth for 19986-2024M03. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, BEA, NBER and writer’s calculations.

Now, is it true that CPI is a “better” measure of shopper items and companies prices? Sure, most likely for the prices that customers face, versus the price of items and companies households devour (maintaining in thoughts that for some issues, e.g., well being care, the buyer doesn’t face all the prices). However, we all know that CPI is quasi-Laspeyres (whereas PCE deflator is chain-weighted). This base-weight points is considerably minimized as CPI has gone to annual adjustments in some weights, making it nearer to the chain-weighted CPI.

Anyway, this recap is barely dated however largely relevant (aside from frequency of CPI weight adjustments).