Thet’s Jeffrey Tucker within the Epoch Instances by way of ZeroHedge.

It’s an inexpensive supposition {that a} recession will change into apparent to all by subsequent summer season. It would then be declared by yr’s finish. The next yr it might change into backdated with knowledge revisions that take us to 2022. At that time, it would change into apparent to folks that we have now a significant drawback. Cash velocity will freeze up, and banks will begin failing.

Might occur. I’m definitely with Mr. Tucker {that a} recession might happen. He believes we’ll lastly replace the info so.

It isn’t discernible in our time that we’re already in recession, however that’s due to some brittle statistical measures. For those who lengthen the inflation numbers to incorporate housing and curiosity, plus additional charges and shrinkflation, minus hedonic changes, after which alter the output numbers by the end result, you find yourself in a recession now.

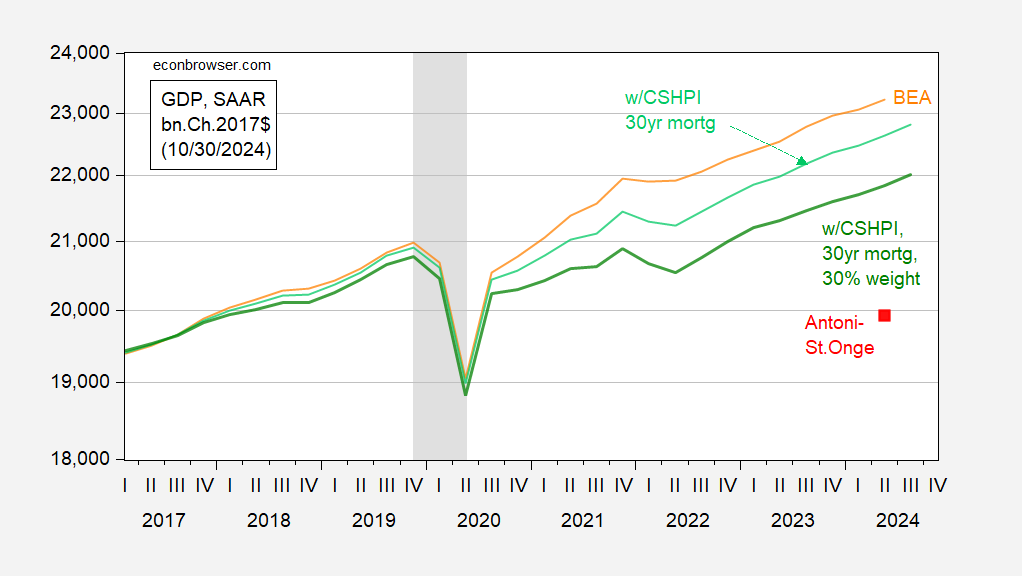

I feel Mr. Tucker is channeling the Antoni and St. Onge (2024) thesis, which was revealed in his journal. Nevertheless, as I’ve famous (additionally Chinn (2024)), it’s virtually unimaginable to breed these outcomes. On this up to date graph, I present how a lot the present BEA estimates differ from the Antoni-St. Onge quantity, and what I get making an attempt to include housing prices utilizing home costs and mortgage charges.

Determine 1: BEA GDP (orange), GDP incorporating PCE utilizing Case-Shiller Home Value Index – nationwide instances mortgage price issue index, utilizing BEA weight of 15% (mild inexperienced), utilizing 30% weight (darkish inexperienced), Antoni-St. Onge estimate (pink sq.), all in bn.Ch.2017$ SAAR. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, S&P Dow Jones, Fannie Mae by way of FRED, NBER, and writer’s calculations.

To match the Antoni-St. Onge degree of GDP for 2024Q2, BEA’s GDP degree must be revised down 15.3% (log phrases)! I feel I’m protected in saying revisions this huge haven’t occurred in fashionable historical past. For example the downward revision from April 2001 to July 2002 — which made the recession look a lot worse — was solely about 2.5%.