Buying and selling knowledge reveals that BlackRock’s Bitcoin ETF, IBIT, has surpassed the agency’s gold ETF providing. This comes even though gold can also be having fun with intense worth rallies.

A cocktail of optimistic alerts, comparable to Donald Trump’s election and US rate of interest cuts, is fueling this stupendous development.

BlackRock’s Report-Breaking Inflows

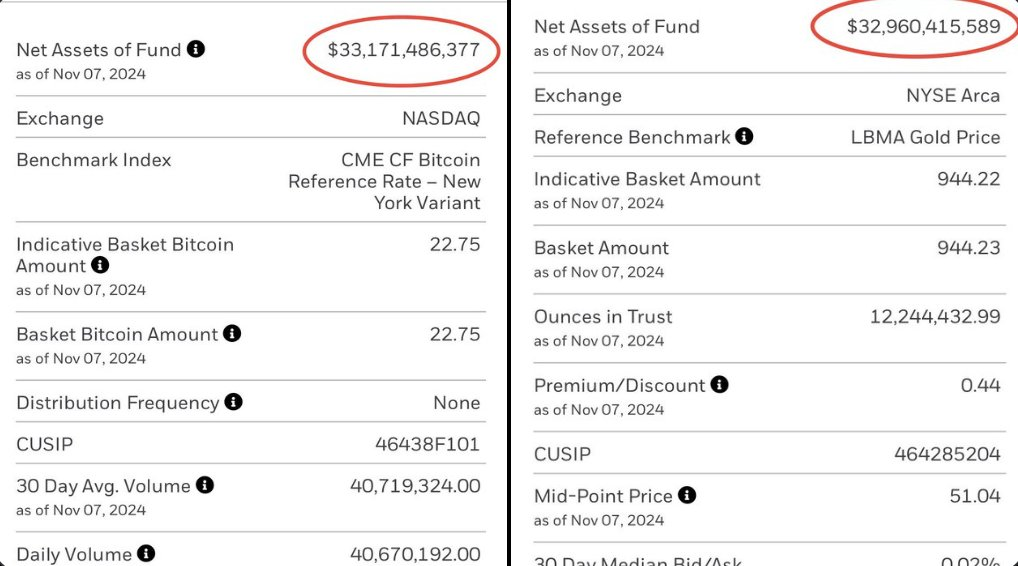

In keeping with latest buying and selling knowledge, BlackRock’s Bitcoin ETF (IBIT) is now bigger than its Gold ETF. This outstanding milestone occurred whereas Bitcoin loved an all-time excessive, however it’s extra spectacular as a result of gold has additionally been at its highest worth since 1980. This determine performs into the long-time argument that Bitcoin is “digital gold,” with increased potential as a brand new retailer of worth.

BlackRock’s IBIT has dramatically surged in worth not too long ago. By late October, it was already buying and selling at a six-month excessive, and confirmed robust indicators of latest momentum. Since Donald Trump gained re-election, nevertheless, this momentum was turbocharged, and the Bitcoin ETFs noticed their highest single-day inflows with IBIT main the pack.

Trump’s stunning Presidential victory is seemingly making a potent cocktail of bullish alerts for all the crypto sphere. The impression is perhaps much more pronounced for Bitcoin ETFs particularly. For the reason that election, risk-on ETF property of all classes are hovering, and crypto merchandise are benefitting from the pattern. These mutually useful market elements can feed into one another.

There’s “a significant risk of a feedback loop, where rising ETF inflows push Bitcoin prices higher, attracting more capital,” claimed Caroline Bowler, Chief Government Officer of crypto trade BTC Markets Pty.

Even nonetheless, IBIT is reaping the best advantages in the entire ETF market. Yesterday, the Bitcoin ETFs noticed $1.38 billion in inflows, however a staggering $1.1 billion of this went to IBIT. The closest runner-up, BitWise’s ETF, gained a relatively paltry $190 million, and not one of the different merchandise crossed the $100 million threshold.

In different phrases, IBIT is having fun with a commanding presence in a well-performing market. BlackRock has additionally been buying bitcoins at a heightened price, surpassing all analyst expectations. Some commentators have apprehensive that the agency is well-positioned to spur “de-decentralization” in crypto, by concentrating extraordinarily excessive capital and momentum in a TradFi establishment.

For now, nevertheless, IBIT doesn’t present any indicators of slowing. The Fed’s cuts to rates of interest yesterday are one other ingredient spelling excessive positive aspects for Bitcoin ETFs. At this price, these rapacious positive aspects might proceed into the foreseeable future.

Disclaimer

In adherence to the Belief Undertaking tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.