Spot Ethereum exchange-traded funds recorded their highest-ever weekly inflows because the flagship altcoin shot previous the $3,000 mark for the primary time since August.

Based on SoSovalue knowledge, $154.66 million flowed into Ether-based ETF merchandise over the previous week, the best for the reason that Securities and Alternate Fee (SEC) accredited the choices in July.

The uptick in inflows started after Donald Trump gained the U.S. presidential elections, sparking a market extensive rally as market individuals stay hopeful that the brand new administration in Washington will introduce extra favorable rules for digital belongings.

Since Nov. 6, Ether ETFs have skilled three consecutive days of optimistic flows, accumulating over $217 million. Most inflows occurred on Nov. 8, when 4 ETF choices attracted $85.86 million, a degree not reached since early August.

Blackrock’s iShares Ethereum Belief ETF (ETHA) led the positive aspects whereas 21 Shares CETH, Invesco’s QETH, Franklin Templeton’s EZET, and Grayscale’s ETHE and Mini Belief noticed no flows.

The inflows recorded had been as follows:

- Blackrock’s ETHA, $59.8 million, 2-day influx streak.

- Constancy’s FETH, $18.4 million, 3-day influx streak.

- VanEck’s ETHV, $4.3 million, 2-day influx streak.

- Bitwise’s ETHW, $3.4 million, 2-day influx streak.

ETH set for 4k: analysts

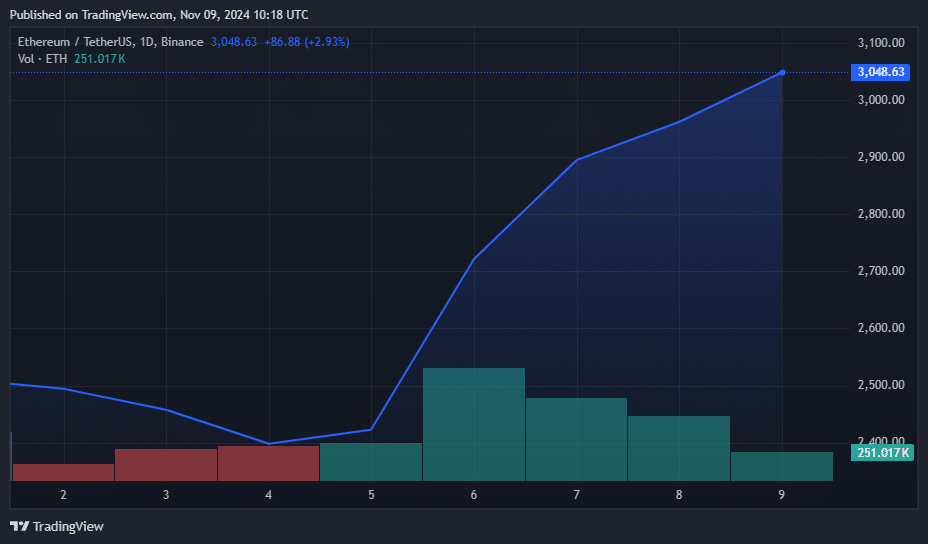

Ethereum (ETH) broke previous $3000 for the primary time since August through the early buying and selling hours on Nov 8. Analysts and buyers alike at the moment are throwing out optimistic value targets, seeing ETH’s latest positive aspects as the beginning of one thing greater.

After dipping to a weekly low of $2,395 on Nov. 5, ETH, the biggest altcoin, started an upward climb, reaching a three-month excessive. Boosted by favorable U.S. election outcomes, a Fed price lower, and rising ETF inflows, Ethereum outpaced Bitcoin, boasting weekly positive aspects exceeding 21% at press time.

If bulls handle to ascertain help above the three,000 mark, Ethereum could possibly be a run above $4000, as recommended by a number of analysts on X.

In a Nov. 9 submit, Pseudonymous analyst Fortunate advised his over 2.2 million followers {that a} “monster rally” could possibly be on the horizon. Primarily based on a chart shared by the dealer, the present uptrend might assist ETH reclaim $3800 within the quick time period and over $4,600 by February 2025.

On an analogous notice, fellow analyst Satoshi Flipper highlighted an 8-month descending channel sample that Ethereum is breaking out of, suggesting it’s primed for a breakout that might push it straight to $4,000 with little resistance in the way in which.

Within the quick time period, Ethereum faces resistance ranges between $3,100 and $3,200, in keeping with an ETH/USD 1-day chart shared by market commentator Earnings Sharks, who additionally hinted at a pattern reversal.

When writing, ETH was up over 4.2% prior to now 24 hours, promoting for $3040 per coin, and is down just a little over 37% from its all-time excessive of $4878, reached in late 2021.