There was a loud minority of analysts considering we had been in, or imminently in, recession (see a listing right here). It’ll be attention-grabbing to see how these views are revised. Nevertheless, as I famous, whereas the info was not supportive of being in a recession as of October, three prospects might reconcile observations with such views: (1) the mannequin is incorrect, (2) the recession is right here, however we don’t realize it, or (3) the recession remains to be to return.

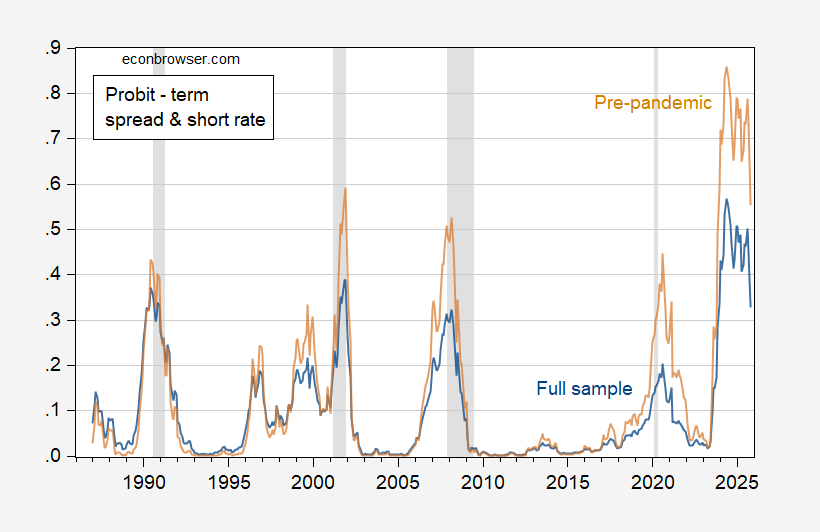

For example, right here’s the probit mannequin predictions from an ordinary time period unfold plus brief price 12-month forward mannequin, estimated each 1986M01-2023M10 (so assumes no recession occurred as of October 2024) and 1986M01-2018M12 (the latter means it omits the 2020 pandemic recession).

Determine 1: Estimated likelihood of recession 12 months forward utilizing 10yr-3mo time period unfold and 3mo price, estimated over total 1986-2023M10 pattern (blue), over restricted 1986-2018 pattern (tan). NBER peak-to-trough recession dates shaded grey. Supply: NBER and creator’s calculations.

Going by these estimated recession chances, the likelihood of being in a recession in January 2025 is 79% utilizing all the pattern. Utilizing a pre-pandemic pattern, it’s 50%. Nevertheless, as famous in Chinn and Ferrara (2024), this straightforward specification is dominated when it comes to pseuo-R2 and AUROCs by specs together with international time period spreads and debt-service ratios. Augmenting the time period unfold & brief price specification with debt service ratio (and utilizing real-time debt-service ratios) yields the next graph.

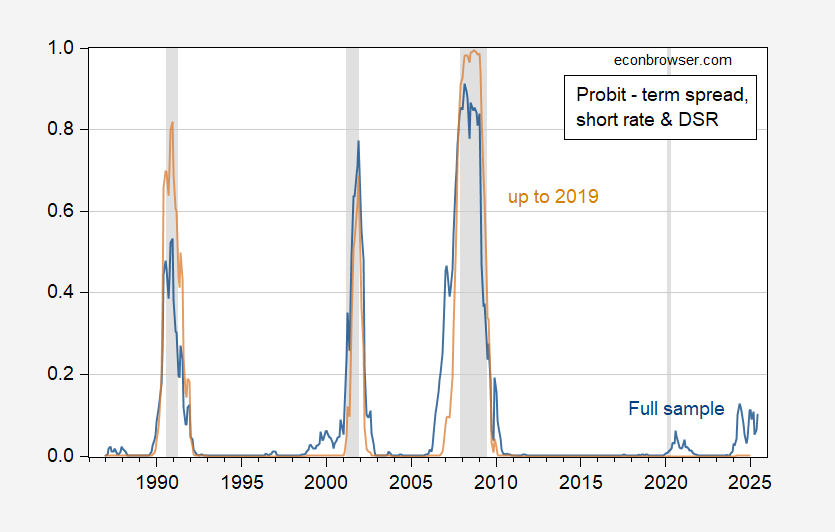

Determine 2: Estimated likelihood of recession 12 months forward utilizing 10yr-3mo time period unfold, 3mo price, and debt-service ratio, estimated over total 1986-2023M10 pattern (blue), over restricted 1986-2018 pattern utilizing related classic of debt-service ratio (tan). NBER peak-to-trough recession dates shaded grey. Supply: NBER and creator’s calculations.

The pseudo-R2 for the time period unfold plus brief price is 0.21, whereas that for the debt-service augmented specification is 0.56 (full pattern estimates).

The pre-pandemic estimates point out zero likelihood of recession as much as December 2024, whereas a full pattern estimate yields 11% likelihood in January 2025. Including in a international time period unfold (a la Ahmed and Chinn (2024)) pushes up that likelihood to 23%.

If the right mannequin is the DSR-augmented specification, then a recession within the subsequent 12 months is just not foreseen by the markets. Alternatively, if one thing sudden happens between now and 12 months from now (e.g., pandemic, battle), then the result is perhaps very completely different from the market’s expectation.

Addendum: 5pm CT

Or…one might see what the betting markets are saying about two consecutive quarters of detrimental GDP development in 2025 (presumably utilizing advance launch for the 2nd consecutive quarter…)

Supply: Kalshi, 9 Nov 24, 5pm CT.

Polymarket makes use of the NBER BCDC name as a payout criterion.