Crypto markets have a number of US financial occasions to sit up for this week after Donald Trump’s re-election and the Federal Open Market Committee’s (FOMC) rate of interest resolution final week.

Amid the restored implication of US macroeconomic knowledge on Bitcoin (BTC) and crypto markets, merchants and traders ought to brace for volatility across the following occasions.

CPI

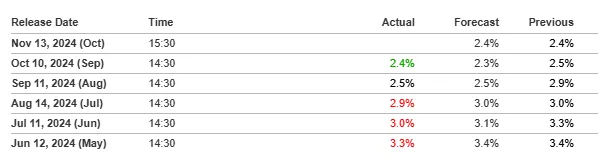

The US Shopper Worth Index (CPI) is an important financial knowledge this week, due for launch on Wednesday, November 13. Federal Reserve (Fed) chair Jerome Powell will launch the Shopper Worth Index (CPI) knowledge for October.

The discharge comes after the FOMC resorted to a 25 foundation level (bps) charge lower in final week’s assembly. Powell indicated that the policymakers didn’t plan to boost rates of interest, acknowledging that Individuals are nonetheless feeling the consequences of excessive costs. Towards this backdrop, US CPI shall be a key watch as it would affect the Fed’s coverage choices transferring ahead.

The US CPI for September was 2.4%, down from 2.5% in August and a pair of.9% in July. This implies a common easing in inflation since April.

Economists anticipate headline inflation to drop 0.2% for October. Additionally they forecast core CPI, the extra intently watched US financial knowledge that eliminates risky meals and vitality prices, to drop by 0.3%.

If the Wednesday knowledge is available in hotter-than-expected, nonetheless, it could counsel a possible inflation resurgence within the coming months. This might limit the pattern at which the Fed has been reducing coverage charges additional and, extra importantly, interrupt Bitcoin’s upward trajectory.

“We keep in mind that the lower rates go, the more liquidity institutional investors will have to invest in risky markets like Crypto,” mentioned Crypto Futur, a well-liked analyst on X.

Preliminary Jobless Claims

One other US financial occasion on the watchlist this week is the preliminary jobless claims. The variety of continued claims gauges the scale of the unemployed inhabitants. The labor division will launch this macroeconomic knowledge on Thursday, November 14, after new purposes elevated by 3,000 to 221,000 within the week via November 2.

It’s value mentioning that the FOMC’s considerations a few gradual weakening within the labor market prompted the central financial institution to chop rates of interest by half a share level in September. Towards this backdrop, Fed officers introduced a quarter-point charge lower final week. Of be aware is that having extreme jobless claims would improve the chance of recession as unemployment decreases buying energy.

PPI

The US Bureau of Labor Statistics (BLS) may also report October’s Core Producer Worth Index (PPI) this week. This knowledge determines worth will increase on the producer degree. Its affect on monetary markets comes because it measures inflation on the wholesale degree.

Will increase in PPI point out rising manufacturing prices, which might result in larger vitality and {hardware} prices required for mining and processing crypto. As such, a better core PPI on Friday might negatively have an effect on Bitcoin and crypto.

US Retail Gross sales

The US retail gross sales sum up the listing of US financial occasions with crypto implications this week. The Censors Bureau will launch the US retail gross sales knowledge on Friday, providing worthwhile insights into client spending developments.

This accounts for a good portion of the US financial system. In September, gross sales at US retailers elevated by 0.4%, and presently, a 0.3% improve is predicted from the earlier month.

Robust October US retail gross sales knowledge would sign decreased recession fears, reflecting a strong financial system and elevated client spending. This momentum would seemingly improve the enchantment of riskier property, together with shares and cryptocurrencies, because it suggests more healthy monetary circumstances.

As merchants and traders await the US financial knowledge, Bitcoin has been up by virtually 2% since Monday’s session opened. Regardless of these modest good points, the pioneer crypto is holding properly above the $80,000 psychological degree, buying and selling for $80,808 as of this writing.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.