What else would one count on from expectations of expanded funds deficits, larger incipient inflation within the context of a Taylor rule response perform, when the foreign money is secure have asset?

From Bloomberg:

“We see a good chance of substantial dollar strength through next calendar year and potentially into 2026 as well,” stated Helen Given, a foreign-exchange dealer at Monex. “A Trump administration changes the calculus on forecasting in a very material way as domestic policy points to a big spending spree and international policy is likely to be quite protectionist.”

…

JPMorgan says the sentiment shock round Trump’s win is sufficient to increase the buck, even with no official tariff announcement. Whereas the greenback’s path is unlikely to be a straight line given the dearth of visibility in regards to the timing of Trump’s insurance policies, Chandan sees the gauge of the buck strengthening as a lot as 7% in coming months. That can ship the euro towards parity with the buck and the yuan nearing 7.40 per greenback.

Globally, this may have extreme penalties for Europe (recession says one financial institution), and for rising market economies, provided that greenback appreciation induces extra stress than larger US rates of interest.

For the US, that is going to make harder any try and reverse the development towards decrease US exercise share in manufacturing (notably since tariffs will seemingly make manufacturing general much less aggressive even within the absence of greenback appreciation– see Cox and Russ).

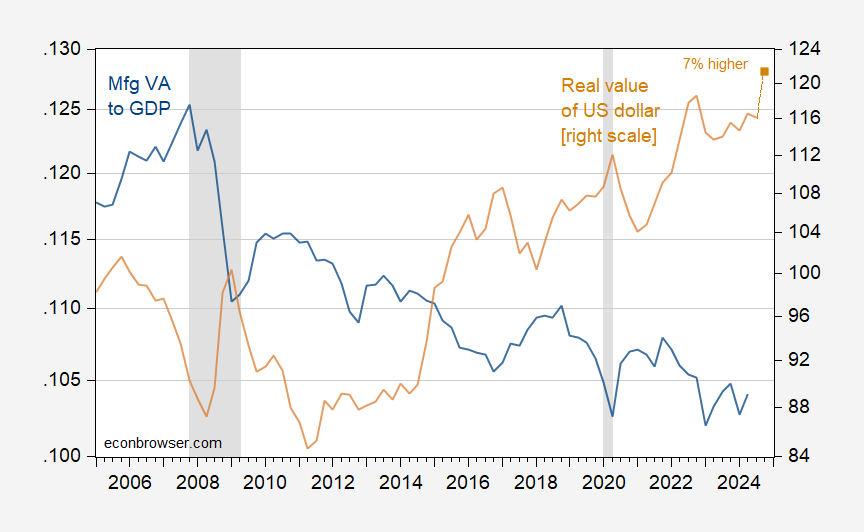

Determine 1: Worth added in manufacturing to actual GDP in Ch.2017$ (blue, left log scale), and actual worth of US greenback (tan, proper log scale), and assuming 7% appreciation from October to December (tan sq., proper log scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, Federal Reserve by way of FRED, NBER, and writer’s calculations.

Visible inspection of the 2 sequence suggests a deviation from development arising from the 2014, 2018 and 2022 appreciation episodes of the greenback.

If we will take historical past as a information, implementing a commerce conflict within the more likely to be chaotic coverage means of the Trump 2.0 period is more likely to elevate financial coverage uncertainty. This in flip is more likely to exacerbate greenback appreciation. From this put up:

Suppose you thought a hybrid actual curiosity differential/Taylor fundamentals mannequin labored for explaining the actual commerce weighted greenback. One would possibly estimate over the 2001Q3-2019Q1 interval the next:

rt = –0.81 – 0.74(πUSt – πRoWt) + 1.09(yUSt – yRoWt) + 10.6(iUSt – iRoWt) + 0.20epuInternationalt + ut

Adj-R2 = 0.65, SER = 0.0506, NOBS = 71, DW = 0.44. Daring denotes significance at 5% msl, utilizing HAC strong customary errors.

The place r is the log actual commerce weighted worth of the US greenback towards a broad basket of currencies (r enhance implies appreciation, 1973M03=0), π is one-year inflation, y is log actual GDP, i is the ten yr nominal rate of interest, and epuInternational is the log Financial Coverage Uncertainty international index, market GDP weighted from Baker, Bloom and Davis. RoW is the rest-of-the-world, all RoW information from Dallas Fed DGEI. Curiosity and inflation charges are in decimal kind (10% = 0.10).

The coefficients match up roughly with idea — or not less than a idea. Larger inflation relative to the rest-of-the-world weakens the greenback, larger relative US GDP and better US long run rates of interest recognize the greenback. Most importantly, a larger diploma of world financial coverage uncertainty, as measured by the Baker, Bloom and Davis methodology, strengthens the greenback.