Sundar Pichai, chief govt officer of Alphabet Inc., throughout Stanford’s 2024 Enterprise, Authorities, and Society discussion board in Stanford, California, US, on Wednesday, April 3, 2024.

Loren Elliott | Bloomberg | Getty Pictures

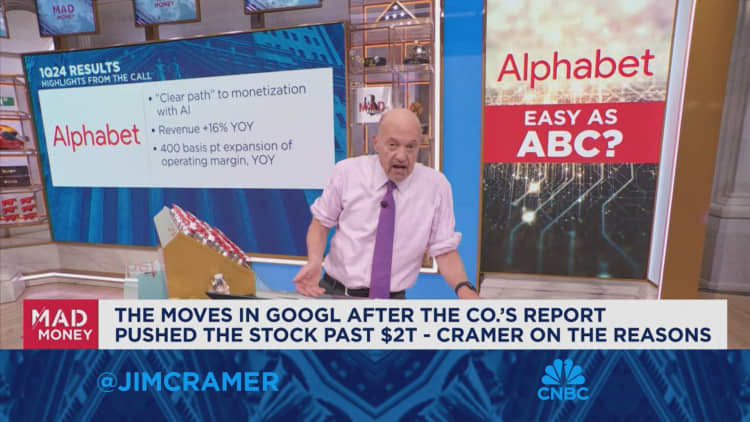

Google’s enterprise is rising at its quickest price in two years, and a blowout earnings report in April sparked the largest rally in Alphabet shares since 2015, pushing the corporate’s market cap previous $2 trillion.

However at an all-hands assembly final week with CEO Sundar Pichai and CFO Ruth Porat, staff had been extra targeted on why that efficiency is not translating into greater pay, and the way lengthy the corporate’s cost-cutting measures are going to be in place.

“We’ve noticed a significant decline in morale, increased distrust and a disconnect between leadership and the workforce,” a remark posted on an inside discussion board forward of the assembly learn. “How does leadership plan to address these concerns and regain the trust, morale and cohesion that have been foundational to our company’s success?”

Google is utilizing synthetic intelligence to summarize worker feedback and questions for the discussion board.

Alphabet’s high management has been on the defensive for the previous few years, as vocal staffers have railed about post-pandemic return-to-office mandates, the corporate’s cloud contracts with the army, fewer perks and an prolonged stretch of layoffs — totaling greater than 12,000 final yr — together with different price cuts that started when the financial system turned in 2022.

Staff have additionally complained a few lack of belief and calls for that they work on tighter deadlines with fewer sources and diminished alternatives for inside development.

The interior strife continues regardless of Alphabet’s better-than-expected first-quarter earnings report, wherein the corporate additionally introduced its first dividend in addition to a $70 billion buyback.

“Despite the company’s stellar performance and record earnings, many Googlers have not received meaningful compensation increases” a top-rated worker query learn. “When will employee compensation fairly reflect the company’s success and is there a conscious decision to keep wages lower due to a cooling employment market?”

One other highly-rated remark centered across the firm’s priorities, together with its hefty investments in synthetic intelligence.

“To many people, there’s a clear disconnect between spending billions on stock buybacks and dividends and re-investing in AI and retraining critical Googlers,” the put up mentioned.

Ruth Porat, Alphabet’s chief monetary officer, seems on a panel session on the World Financial Discussion board in Davos, Switzerland, on Could 24, 2022.

Hollie Adams | Bloomberg | Getty Pictures

“Our priority is to invest in growth,” Porat mentioned, as she took the microphone to reply to questions. “Revenue should be growing faster than expenses.”

She additionally took the uncommon step of admitting to management’s errors in its prior dealing with of investments.

“The problem is a couple of years ago — two years ago, to be precise — we actually got that upside down and expenses started growing faster than revenues,” mentioned Porat, who introduced practically a yr in the past that she could be stepping down from the CFO place however hasn’t but vacated the workplace. “The problem with that is it’s not sustainable.”

Google executives have been hammering this theme of late.

Search boss Prabhakar Raghavan, in an inside assembly final month, pointed to Google’s core enterprise challenges, saying “things are not like they were 15 to 20 years ago,” and urged staff to work quicker. He advised his staff, “It’s not like life is going to be hunky-dory, forever.”

Google’s cloud enterprise was amongst items instructing staff to maneuver inside shorter timelines although that they had fewer sources after price cuts.

Google’s use of money

There have been loads of worker questions forward of final week’s assembly directed on the firm’s buyback, Porat mentioned.

As of final quarter, Alphabet had greater than $100 billion in money on the steadiness sheet however, Porat mentioned, “you can’t just drain it” or the corporate would discover itself in the identical place as in 2022.

Against this, distributing money to shareholders is just not thought-about an expense on the steadiness sheet, she mentioned, including that the board has a fiduciary responsibility to contemplate such measures. Buybacks and dividends do not exchange investments in AI, Porat mentioned.

Pichai chimed in when Porat wrapped up her response.

“I think you almost set the record for the longest TGIF answer,” he mentioned. Google all-hands conferences had been initially referred to as TGIFs as a result of they happened on Fridays, however now they’ll happen on different days of the week.

Pichai then joked that management ought to maintain a “Finance 101” Ted Speak for workers.

With respect to the decline in morale introduced up by staff, Pichai mentioned “leadership has a lot of responsibility here, adding that “it is an iterative course of.”

Pichai said the company staffed up too much during the Covid pandemic.

“We employed loads of staff and from there, we’ve had course correction,” Pichai said.

Alphabet’s full-time headcount climbed to over 190,000 at the end of 2022, up almost 22% from a year earlier and 40% higher than at the close of 2020.

Pichai, who replaced Google co-founder Larry Page as CEO of Alphabet in 2019, has taken his share of criticism of late for his messaging to the workforce as well as his lofty pay package, which swelled to $226 million, including stock awards, in 2022.

The package in 2022 included $218 million in equities through a triennial stock grant. His total pay in 2023 was $8.8 million, up from about $8 million the prior year (excluding the stock grant), according to Alphabet’s proxy filing. Other than Pichai’s $2 million salary for each year, most of his additional compensation was for personal security.

Employees have complained about the level of Pichai’s compensation at a time when the company is downsizing.

“Given the latest headcount and optimistic earnings, what’s the firm’s headcount technique?” one question read. Another asked, “Given the robust outcomes, are we completed with cost-cutting?”

Pichai said the company is “working via an extended interval of transition as an organization” which includes cutting expenses and “driving efficiencies.” Regarding the latter point, he said, “We need to do that without end.”

“To be clear, we’re rising our bills as an organization this yr, however we’re moderating our tempo of development” Pichai said. “We see alternatives the place we are able to re-allocate folks and get issues completed.”

A Google spokesperson reiterated to CNBC that the company is investing in its biggest priorities and will continue to hire in those areas.

The spokesperson also said most employees will receive a pay raise this year, including an increased salary, equity grants and a bonus. Executives at the all-hands meeting said that staffers who received raises last year got smaller raises than usual.

Another comment floated ahead of the meeting was tied to “rising issues about jobs shifting from the U.S. to lower-cost areas.” CNBC reported final week that Google is shedding a minimum of 200 staff from its “Core” organization, which includes key teams and engineering talent.

Executives were asked about the ongoing layoffs, despite the strong earnings report, and “when can we anticipate an finish to the uncertainty and disruption that layoffs create?”

Pichai said the company will have worked through the majority of layoffs in the first half of 2024.

“Assuming present situations, the second half of the yr might be a lot smaller in scale,” Pichai said, referring to job cuts. He said it will continue to be “very, very disciplined about managing headcount development all year long.”

That means the company is still making tough choices regarding investments in new projects.

“There’s loads of demand to do new issues and, up to now, we might have simply completed it reflexively by rising headcount,” Pichai said. “We will not do it now via the transition we’re in.”

WATCH: Alphabet’s investor name had a ‘outstanding’ stage of transparency, says Jim Cramer