The crypto market will witness $3.98 billion in Bitcoin (BTC) and Ethereum (ETH) choices contracts expire at present. This large expiration might influence short-term value motion, particularly as each property have just lately declined.

With Bitcoin choices valued at $3.4 billion and Ethereum at $581.57 million, merchants are bracing for potential volatility.

Excessive-Stakes Crypto Choices Expirations: What Merchants Ought to Watch Right this moment

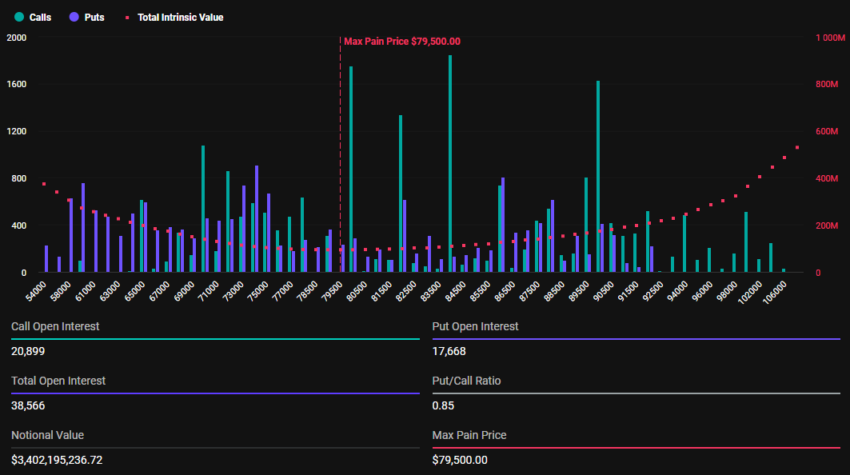

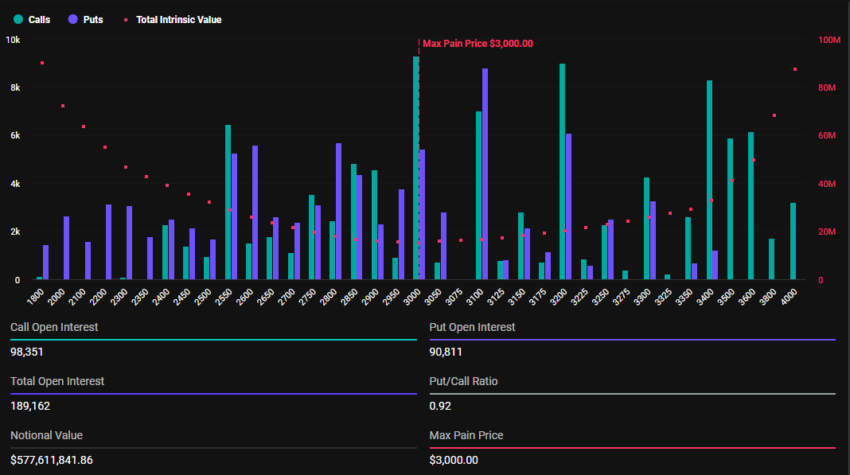

In accordance with Deribit knowledge, Bitcoin choices expiration includes 38,566 contracts, in comparison with 48,794 contracts final week. Equally, Ethereum’s expiring choices complete 189,018 contracts, down from 294,380 contracts the earlier week.

For Bitcoin, the expiring choices have a most ache value of $79,500 and a put-to-call ratio of 0.85. This means a typically bullish sentiment regardless of the asset’s latest pullback. As compared, their Ethereum counterparts have a most ache value of $3,000 and a put-to-call ratio of 0.92, reflecting an analogous market outlook.

The utmost ache level is a vital metric that always guides market conduct. It represents the worth degree at which most choices expire nugatory, inflicting most monetary “pain” on merchants.

In the meantime, the put-to-call ratios beneath 1 for each Bitcoin and Ethereum recommend optimism out there, with extra merchants betting on value will increase. Whereas the put choices signify bets on value declines, name choices level to bets on value will increase. Taken collectively, this metric (put-to-call ratio) gauges market sentiment.

Merchants and buyers ought to brace for volatility, as choices expirations usually trigger short-term value fluctuations, which create market uncertainty.

“The market could be very volatile, so trade with caution,” prime Asian crypto influencer Smart Recommendation warned.

Nevertheless, markets often stabilize quickly after as merchants adapt to the brand new value surroundings. With at present’s high-volume expiration, merchants and buyers can anticipate an analogous final result, probably influencing future crypto market developments. As Bitcoin and Ethereum choices close to expiration, each property might strategy their respective strike costs.

It is a results of the Max Ache idea, which predicts that choices costs will converge across the strike costs the place the biggest variety of contracts — each calls and places — expire nugatory.

Extra Headwinds With Yr-Finish Crypto Choices Expiry

With markets nonetheless optimistic, the final sentiment is that Bitcoin’s upside potential stays viable, probably reaching $100,000 earlier than year-end. Nonetheless, greater issues lie forward, with many crypto choices due for expiry on the finish of the month and, probably, much more (round $11.8 billion for BTC) on December 27.

These dates are important given Bitcoin bull runs have a tendency to finish exactly on the finish of the 12 months, between November and December. Nevertheless, contemplating they solely began between October and November, they’ve usually prolonged into the early months of the brand new 12 months.

The expiration of those Bitcoin choices on the finish of the 12 months might current as a serious catalyst. It might affect quick value motion in addition to the trajectory into the brand new 12 months, 2025. With bulls trying on the 12 months’s finish expiration as a novel alternative to foray into unchartered territory past $100,000, bears decide to limiting the worth discovery to defend their positions.

“Looking at the options market, the market is clearly polarized and trading is very fragmented, with some of the larger traders heading for the sky to go long, while more traders are currently on the short side of the market,” Greeks.dwell shared.

Ought to the positioning battle intensify in direction of the top of the 12 months, the fallout from these choices expiring might ripple past December, setting new requirements for Bitcoin and Ethereum.

The most recent knowledge exhibits that Bitcoin’s buying and selling worth has dropped by 2.46% to $87,813. Equally, Ethereum has fallen by 5.43%, now buying and selling at $3,053.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm information independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.