At this time we’re happy to current a visitor contribution by Mark Copelovitch (Political Science and La Follette Faculty, College of Wisconsin – Madison) and Michael Wagner (Journalism and Mass Communication, College of Wisconsin – Madison).

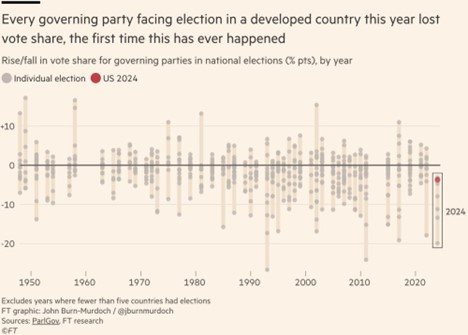

Final week, John Burns-Murdoch of the Monetary Occasions documented the anti-incumbent backlash in 2024 throughout the developed world. Donald Trump’s victory over Vice President Kamala Harris is sort of clearly a part of this broader worldwide pattern.

Burns-Murdoch linked Trump’s victory primarily to inflation: “Voters don’t like high prices, so they punished the Democrats for being in charge when inflation hit.” This has rapidly grow to be the standard knowledge in regards to the US election. We’re skeptical of this declare, and our analysis suggests we must always keep away from speeding to such conclusions. Our proof means that voters’ anger is most intently associated to what they’re listening to about inflation from information sources. Even after we look at what individuals know about inflation and, certainly, what they’re experiencing within the financial system itself, it’s listening to in regards to the horrible financial system, somewhat than dwelling within the first rate one, that appears to be driving voter conduct.

Via YouGov, we carried out surveys, from October 30 to November 4, within the US and Germany, by which we requested 2000 people in every nation about their views on inflation, the financial system, and politics. Our outcomes strongly assist the anti-incumbent backlash argument. Within the US, solely 29.9% of respondents approve (9.6% “strongly”) of President Joe Biden, whereas 54.3% disapprove (41.0% “strongly”). In Germany, Chancellor Olaf Scholz is much more unpopular: solely 15.4% approve (2.4% “strongly”) of his efficiency, whereas 60% disapprove (a staggering 36.4% “strongly”).

However anger at incumbents doesn’t seem like pushed by anger about inflation and the financial system – at the least if we imply this in materials phrases. To make sure, an awesome share of these in our surveys had been involved about inflation. On a 5-point scale, 62.9% of German respondents had been “concerned” or “very concerned” about inflation, and 59.5% thought it was a “big” or “very big” drawback for themselves and their households. Within the US, these numbers had been even increased: 76.1% and 67.1%.But when requested about their private monetary scenario, few stated they or their household are struggling (22.1% within the US, solely 12.3% in Germany). In actual fact, extra stated they’re dwelling comfortably (26.7% within the US, 36.6% Germany), and there’s solely a modest correlation within the US between household monetary scenario and whether or not individuals suppose inflation is an issue or approe of President Biden. The hyperlink between inflation concern and Biden approval is a bit increased, however that means numerous these involved about inflation will not be actually feeling materials hardship from it. Germany seems to be comparable: the correlation between approval of Olaf Scholz and whether or not one thinks inflation is a private/household drawback is extraordinarily low.

Furthermore, after we requested people if and the way they may pay an sudden invoice of both 500, 2000, or4000 {dollars} (euros), their most typical reply was that they might have the ability to pay from money financial savings (34.7% in US, 57.3% in Germany) or credit score (33.1% in US, 18.9% in Germany), whereas far fewer stated they might not have the ability to pay (19.3% in US, 12.4% in Germany) in any respect.. Voters could also be offended about inflation and the financial system, however they merely don’t report being worse off materially than 4 years in the past.

Nonetheless, each Individuals and Germans are deeply pessimistic in regards to the financial system. 52.4% of our US respondents (and 72.6% of Germans) suppose the financial system has gotten worse within the final 12 months. Much more shockingly, extra American respondents (39.6%) suppose the US is presently in recession than not (37.5%), regardless of 4.1% unemployment and 45 consecutive months of job progress. The German financial system is definitely a large number: he nation is in recession and actual wages and revenue stay beneath 2019 ranges. However the US financial system is booming, and most Individuals are higher off on nearly each metric (wages, revenue, consumption), than 4 years in the past, even controlling for inflation.

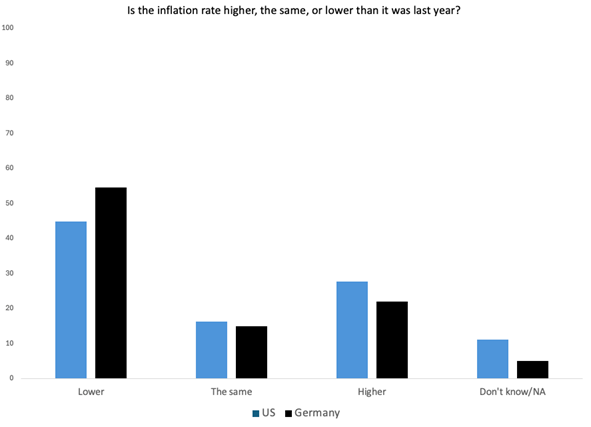

So is that this an data drawback? Nicely, it’s not a factual data drawback. Most individuals know precise costs. We requested our survey respondents in regards to the value of gasoline, milk, and the nationwide inflation charge, and so they overwhelmingly answered accurately, inside tiny margins. It doesn’t seem like the case that people will not be conscious of precise costs, equivalent to the truth that gasoline now prices almost $2 much less per gallon within the US than it did in 2022, or the truth that US milk costs are 5% decrease than two years in the past.

And but, regardless of having a transparent grasp of actual costs, about one quarter of respondents in each international locations stated inflation is increased now than a 12 months in the past.

Most Individuals and Germans appear to suppose the financial system is horrible and getting worse, regardless of their private scenario being fantastic. Many suppose inflation is rising, regardless of figuring out the precise value of milk and gasoline. And, most notably, they suppose opposition events perceive their considerations higher than incumbents: within the US, 38.9% of these we surveyed stated that the Democrats suppose inflation is a “big” or “very big” drawback on a 5-point scale, whereas 71.4% stated the identical of the Republicans. In Germany, these numbers for the SPD and AfD, respectively, had been 44.5% vs 52.4%.

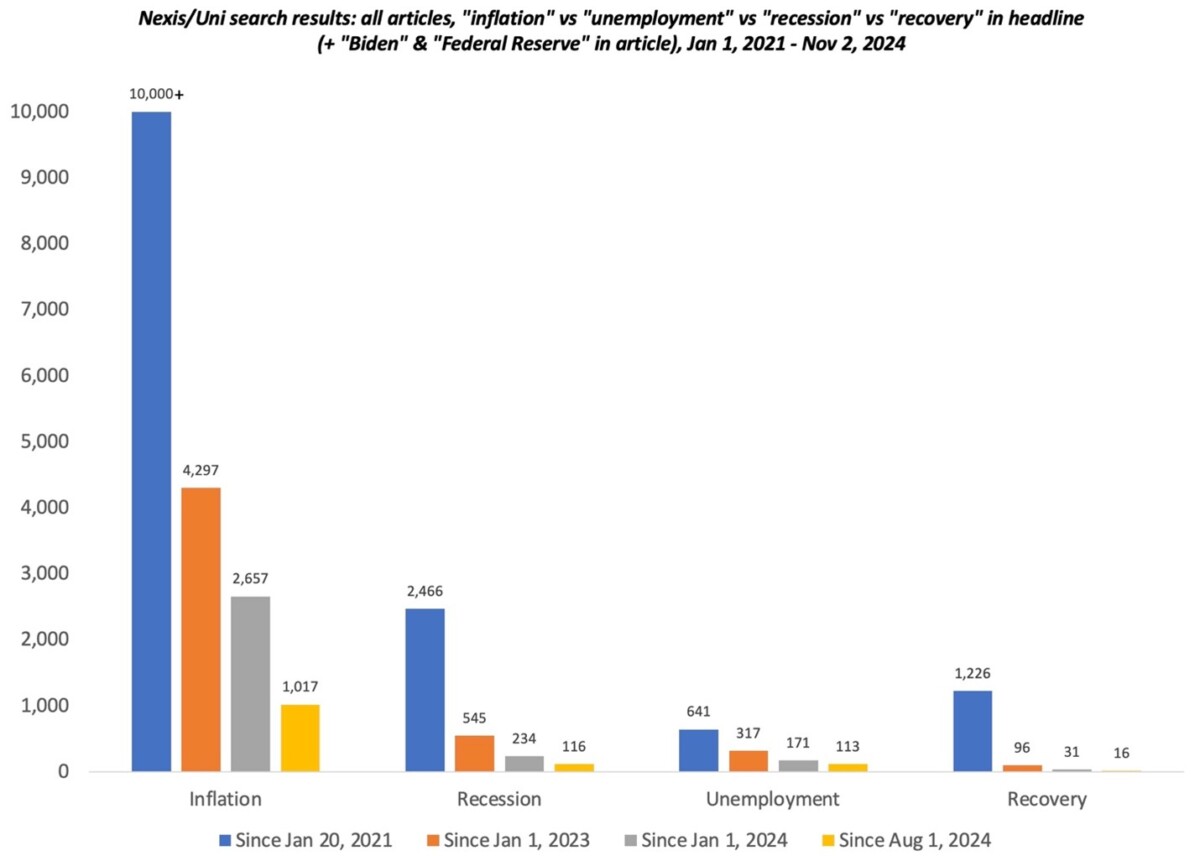

The backlash towards incumbents is actual, however it’s only not directly associated to factual details about inflation and the financial system. As an alternative, voter considerations seem like pushed extra by perceptions about this stuff than materials realities. This confirms findings of our previous analysis, the place we’ve got discovered that the only best determinant of voters’ considerations with inflation within the US, in 2022, was not any measure of fabric well-being, however somewhat the quantity of media – and particularly conservative media like Fox Information and speak radio – one consumes. We all know that US media protection since 2021 has been overwhelmingly biased towards adverse matters (inflation and recession) as a substitute of excellent information (low unemployment and the unprecedentedly speedy financial restoration), and this has been very true of extra conservative media shops.

Put merely, to replace James Carville’s well-known chestnut, it seems to be the “information economy,” silly. Individuals have overwhelmingly heard that the US financial system is horrible, and many citizens – regardless of reporting that they’re doing fantastic materially –clearly have internalized that message and brought it out on the incumbent political celebration.

Voters are clearly sad with incumbents. Maybe, as Burns-Murdoch argues, voters are additionally reacting to broader “geopolitical turmoil” and immigration. What is way much less clear is that voters punished the Democrats final week as a result of they hate and are affected by inflation and the horrible financial system. The frenzy to make this the standard knowledge in regards to the 2024 US presidential election is untimely.

This put up written by Mark Copelovitch and Michael Wagner.