Hedera (HBAR) has grow to be the highest loser out of the highest 100 cryptocurrencies following a 20% value lower within the final 24 hours. This HBAR value drop got here simply hours after the worth rallied by 180%

BeInCrypto’s findings recommend that the current notable market decline could also be tied to rising hypothesis over the potential successor to the US SEC Chair place. Nonetheless, this isn’t the only issue influencing the downturn.

Hedera Slides in A number of Areas Due to This

HBAR witnessed a value surge after Canary Capital filed its first exchange-traded fund (ETF) utility for the asset. The information marked a major milestone for Hedera, instilling optimism amongst traders and triggering an preliminary value hike.

Nonetheless, the triple-digit rally in HBAR’s value appears extra intently tied to hypothesis relating to the US president-elect Donald Trump’s potential nomination of Brian Brooks, a Hedera board member, as the following SEC chair.

However yesterday, November 19, the rumors modified, with some media platforms suggesting that crypto lawyer Teresa Goody Guillen might now be the highest candidate. In consequence, the HBAR value dropped by 20%.

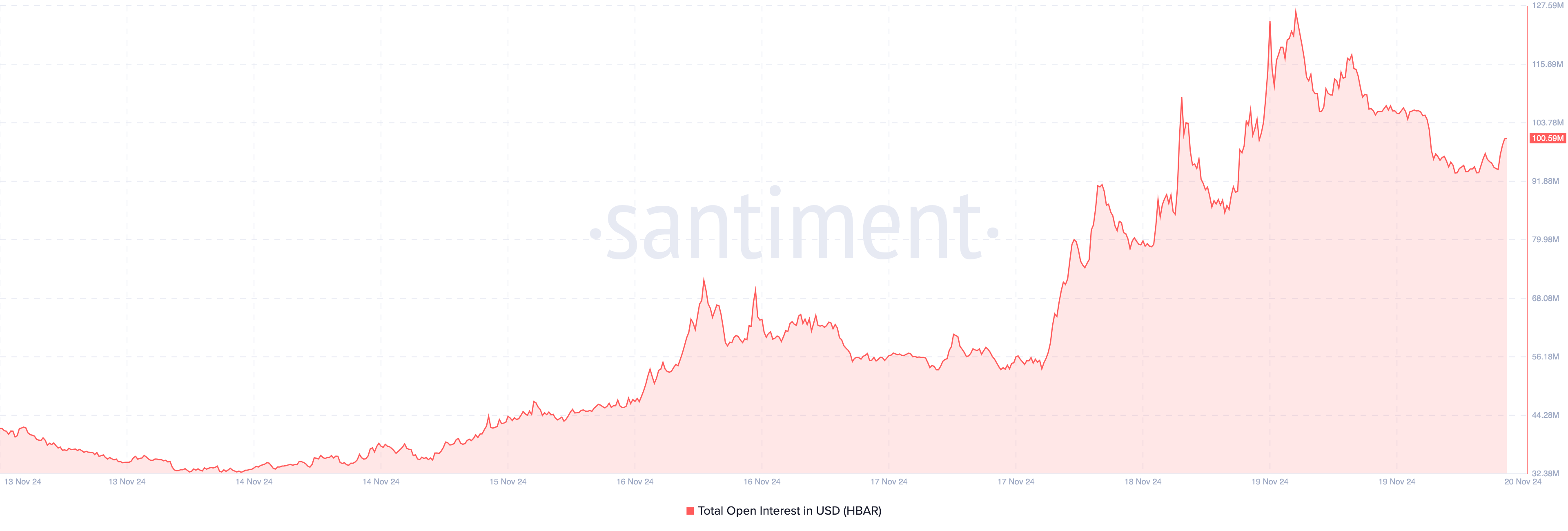

Following the event, whole Open Curiosity (OI) in HBAR derivatives has dropped from $120 million to $100.95 million.

The decline in OI displays lowered speculative exercise, as fewer merchants are initiating new positions. Additional, this discount in speculative exercise typically results in diminished liquidity, suggesting the altcoin might battle to maintain its current uptrend.

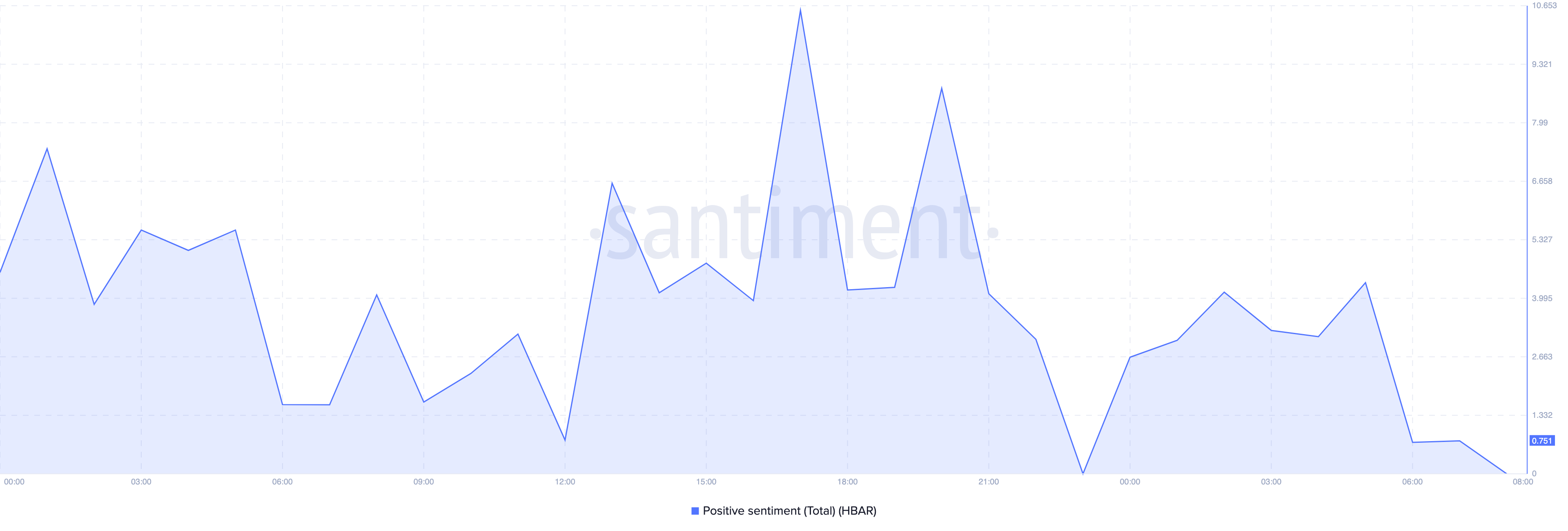

Moreover, the constructive sentiment surrounding the challenge, which had beforehand elevated, has now waned. Usually, an increase in constructive sentiment signifies a surge in bullish commentary concerning the cryptocurrency.

Nonetheless, the current drop in sentiment suggests a lower in these bullish discussions. If this development persists, it might additional problem HBAR value capacity to climb greater within the quick time period.

HBAR Value Prediction: Bearish

From a technical perspective, the HBAR value drop could possibly be attributed to the truth that the altcoin had grow to be overbought. This was indicated by the Relative Power Index (RSI), which measures momentum,

Aside from measuring momentum, the RSI additionally exhibits if a cryptocurrency is overbought or oversold. When the studying is above 70.00, it’s overbought. Alternatively, whether it is under 30.00, it’s oversold.

With this place, the HBAR value may probably drop from $0.13 to $0.095. Nonetheless, if shopping for strain will increase once more for the altcoin, this may change. If that occurs, HBAR might rise to $0.016.

Disclaimer

In keeping with the Belief Challenge tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.