Stellar (XLM) has skilled a 50% value surge over the previous 24 hours, making it the top-performing asset throughout this era. This surge will be attributed to the current 10-Ok submitting submitted by Grayscale Investments LLC for its Grayscale Stellar Lumens Belief.

At press time, the altcoin trades at $0.45, its highest value level since 2021. Nevertheless, readings from its each day chart trace at a attainable short-term decline. Right here is how.

Stellar Lumens Belief Sees Spike in Internet Property

On Friday, Grayscale Investments LLC’s Grayscale Stellar Lumens Belief (XLM) submitted its 10-Ok submitting for the fiscal 12 months ended September 30, 2024. It famous that the belief recorded a ten% uptick in its total web property through the monetary 12 months thought-about.

A ten-Ok submitting is an annual report that publicly traded firms within the US are required to undergo the Securities and Change Fee (SEC). It offers an outline of the corporate’s monetary efficiency. It consists of the entity’s audited monetary statements, enterprise operations, threat components, and administration dialogue and evaluation.

In keeping with the report, the Grayscale Stellar Lumens Belief (XLM), an funding automobile providing traders publicity to XLM, confronted losses. This was as a result of token’s value depreciation through the interval thought-about and the charges paid to the belief’s sponsors. Nevertheless, these losses had been offset by the 34,875,230 XLM tokens valued at $3,923 added to the belief. This resulted in a web improve within the belief’s total property.

XLM Reacts To the Information

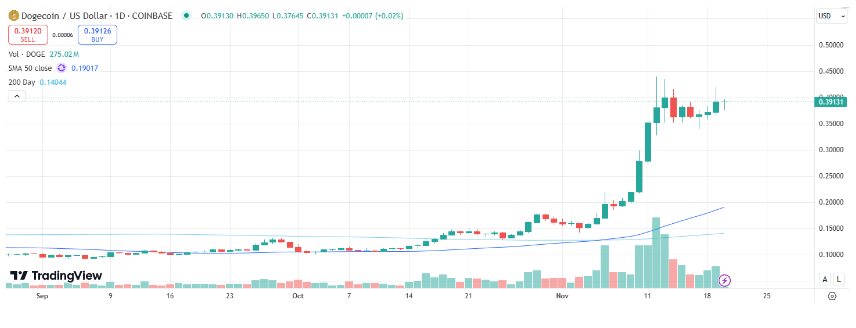

The constructive sentiment round this submitting has resulted in a spike in XLM’s worth. Over the previous 24 hours, the token’s value has surged 58%, making it the market’s high gainer. As of this writing, the altcoin trades at $0.45, a value final noticed in November 2021.

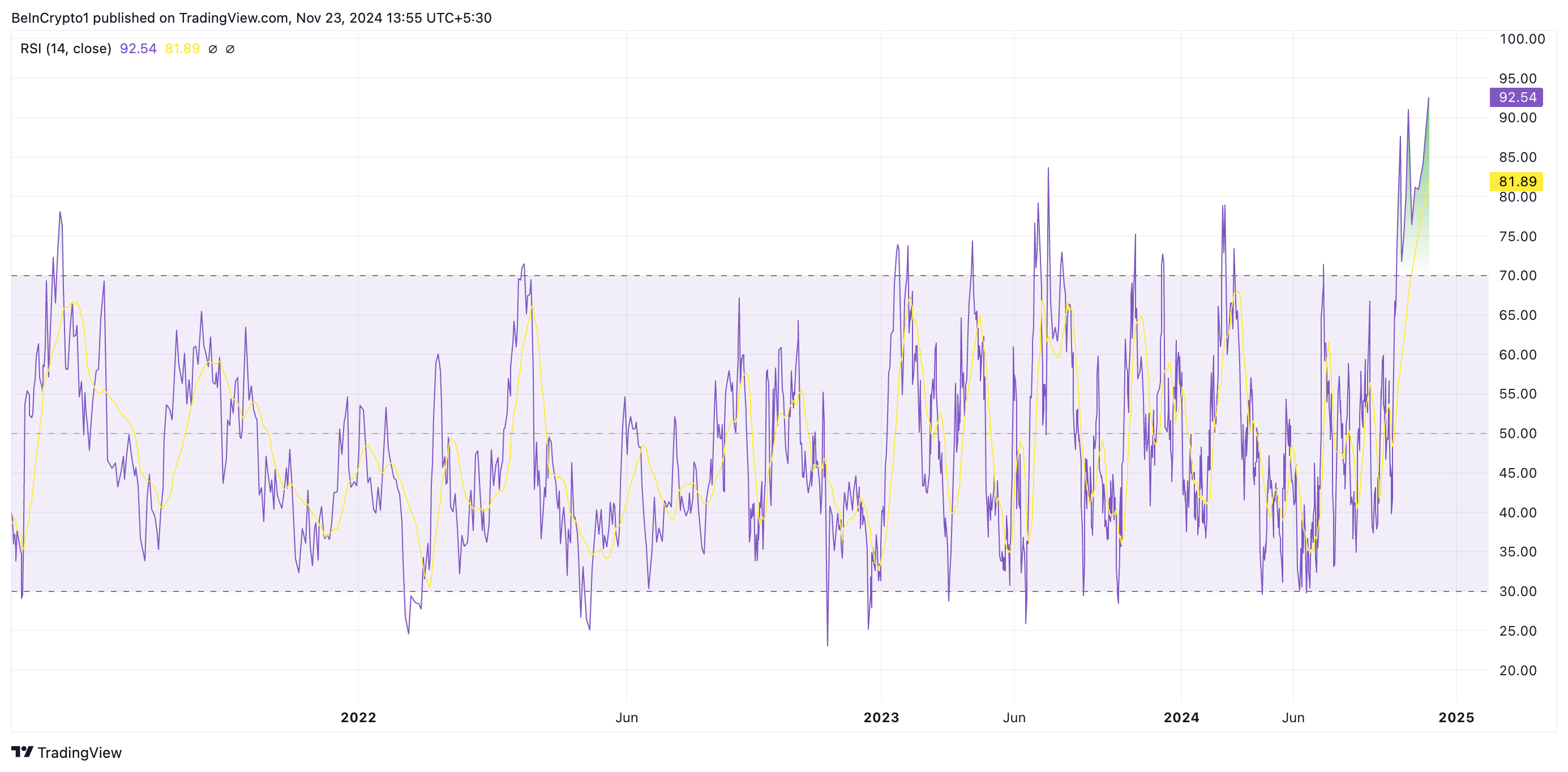

Nevertheless, readings from its each day chart recommend that this rally could not proceed as XLM has turn into overbought amongst market members. For instance, its Relative Energy Index (RSI) is at an all-time excessive of 92.54 at press time.

RSI measures an asset’s oversold and overbought market situations. It ranges between 0 and 100, with values above 70 indicating that the asset is overbought and due for a correction. Alternatively, values beneath 30 recommend that the asset is oversold and will witness a rebound. XLM’s RSI studying of 92.54 means that it’s considerably overbought and is prone to a pullback.

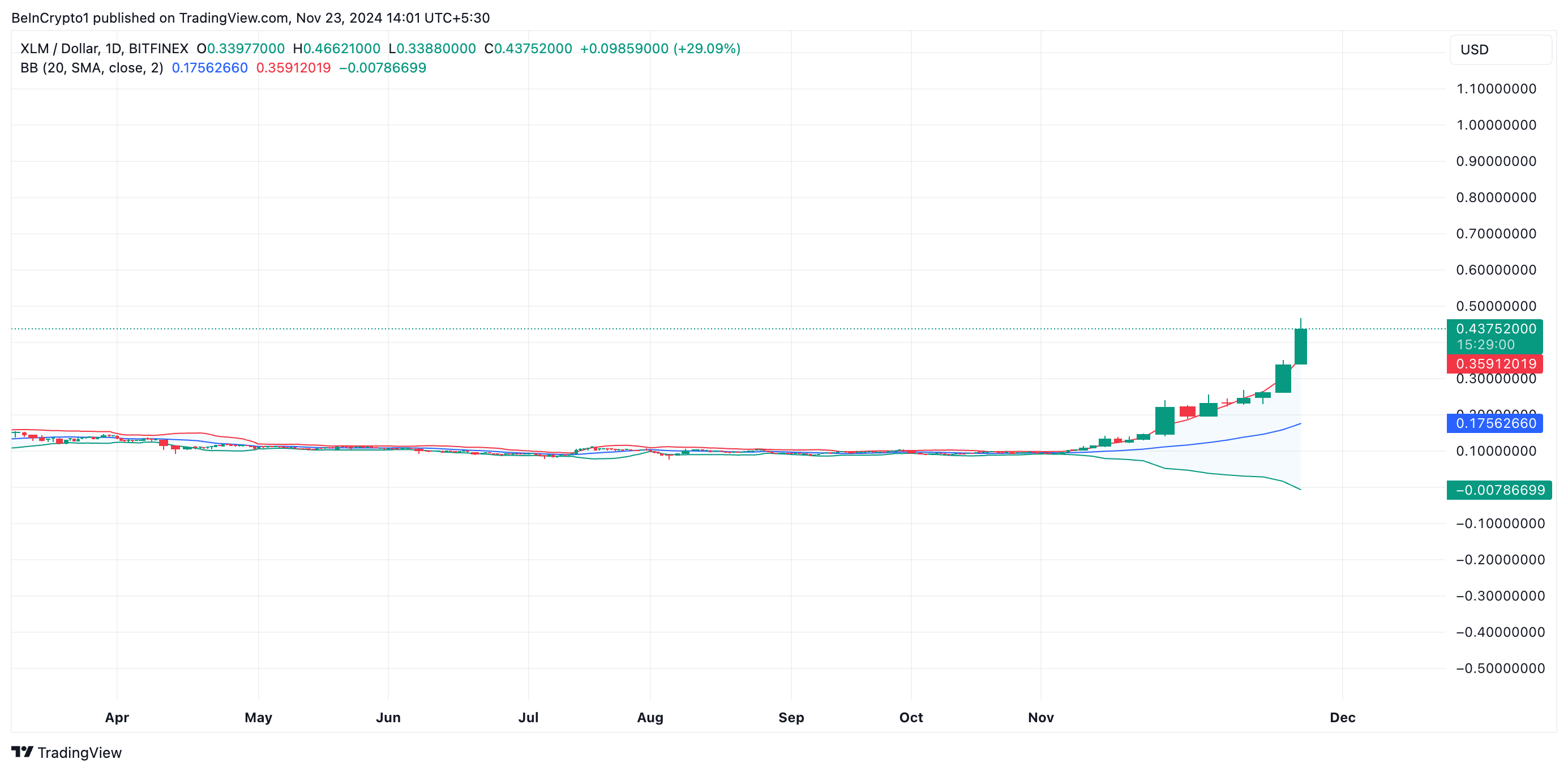

Moreover, XLM’s value trades above the higher line of its Bollinger Bands indicator, confirming the probability of a value correction.

The Bollinger Bands indicator measures market volatility and identifies potential purchase and promote alerts. It consists of three fundamental elements: the center band, the higher band, and the decrease band.

When the value trades above the higher band, it means that the asset is overbought. Which means the asset’s value has moved considerably larger than its common value and is prone to a pullback within the close to time period.

XLM Value Prediction: Token Could Shed Latest Good points

As soon as purchaser exhaustion units in, XLM’s value is prone to shedding a few of its current beneficial properties. In keeping with its Fibonacci Retracement software, if this occurs, its value goal would be the help degree shaped at $0.35. If the bulls fail to defend this degree, the token’s value could drop additional to $0.23.

Alternatively, if shopping for strain intensifies, the XLM token value will proceed its uptrend and try to breach $0.52, a excessive it final reached in Could 2021.

Disclaimer

According to the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. All the time conduct your individual analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.