Current analysis by CoinWire highlights the dangers of investing in meme cash, particularly these promoted by influencers on X (previously Twitter).

Whereas they promise large earnings, the examine exhibits that almost all of those tokens find yourself inflicting main losses for buyers.

The promise of fast riches is commonly tempting, however most buyers find yourself chasing a mirage. A latest CoinWire report analyzed 1,567 meme cash endorsed by 377 influencers during the last three months. The findings are startling: 76% of influencers promote lifeless meme cash — tokens which have misplaced over 90% of their worth.

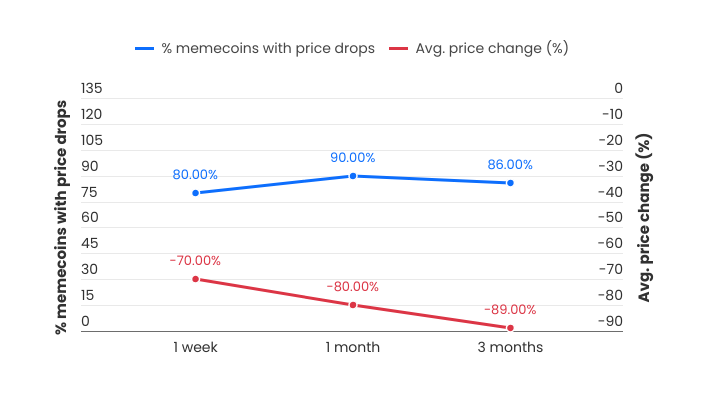

Further findings embody that two-thirds (round 67%) of meme cash promoted by influencers are actually nugatory. The report additionally established that after three months, 86% of influencer-promoted meme cash skilled a 10X drop in worth. Additional, only one% of influencers have efficiently promoted a memecoin that achieved a tenfold acquire.

The short-term efficiency is equally disheartening. After only one week, 80% of promoted meme cash lose 70% of their worth. By the one-month mark, losses escalate to 80%.

Promotions by influencers typically promise exponential positive factors, creating hype that pulls in even inexperienced buyers. But the info signifies that almost all of those campaigns prioritize influencer earnings over the standard of the tasks promoted.

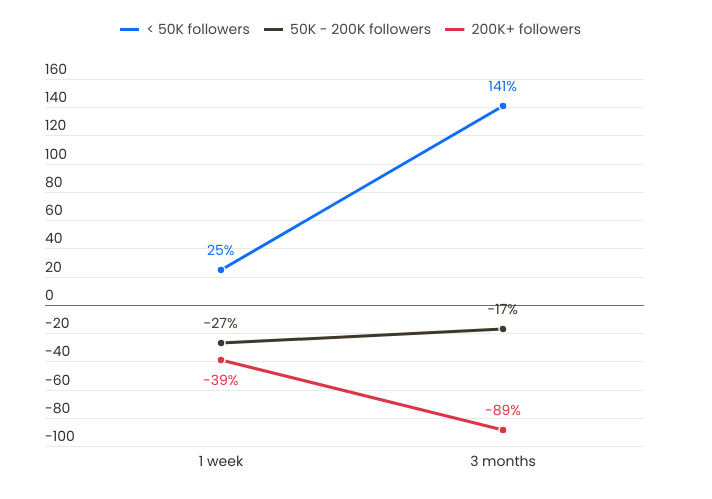

Influencers with over 200,000 followers carry out the worst, with a mean adverse return of 89% after three months. In the meantime, smaller influencers with lower than 50,000 followers supply barely higher outcomes, with some even attaining constructive returns over time.

On common, influencers earn $399 per promotional tweet, incentivizing them to endorse meme cash no matter their viability. This monetary dynamic typically leaves their audiences bearing the brunt of the losses.

The Position of X within the Meme Coin Growth

The challenges with influencer-backed tokens will not be remoted incidents. BeInCrypto lately reported that 97% of all meme cash fail, with solely 15 out of 1.7 million attaining sustained success. The explanations are multifaceted, starting from lack of utility to poor challenge administration.

The meme coin ecosystem can also be rife with controversies. Blockchain investigator ZachXBT lately uncovered 16 influencer accounts on X that coordinated pump-and-dump schemes, leaving their followers to soak up the losses. This has fueled debates in regards to the moral tasks of influencers in crypto markets.

In the meantime, X stays a key platform for selling meme cash amongst influencers. The platform’s skill to amplify hype makes it an efficient car for meme coin promotions but in addition a breeding floor for monetary dangers.

Regardless of the grim statistics, nevertheless, some merchants nonetheless discover alternatives on this risky market. Crypto personalities like Justin Solar, founding father of TRON, counsel evaluating meme cash primarily based on neighborhood measurement, narrative energy, and utility.

In the meantime, crypto influencer Miles Deutscher lately shared a four-step meme coin buying and selling plan: deal with market timing, analyze tokenomics, perceive challenge fundamentals, and handle danger by way of stop-loss methods. Taken collectively, these approaches mirror the significance of warning and due diligence.

Whereas the hype surrounding meme cash is plain, this context highlights the necessity for warning. Influencer endorsements, although attractive, will not be dependable indicators of a token’s potential. Traders ought to scrutinize tasks, contemplating components like utility, neighborhood engagement, and long-term viability.

Disclaimer

In adherence to the Belief Challenge tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nevertheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.